Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Jinze 金泽

Here are my reading notes NOT financial advice.

Prev. MuseLabs, LD Research, Binance Research, WallStreetCN, EY.

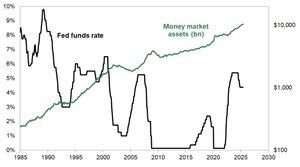

Regarding the claim that a large amount of funds will flow from money market funds into the stock market, Goldman Sachs believes that although the size of money market assets continues to rise, American households have about $20 trillion in cash, which only accounts for about 15% of total household financial assets, consistent with the long-term average level. Historical rate-cutting cycles have not triggered large-scale capital outflows, so one should not overly expect the so-called "money funds" to enter the market.

853

After meeting with Putin, Trump talked with Zelensky for an hour and a half. Following that, Zelensky addressed the EU, and although he mentioned five bottom lines, his attitude was clearly softened, implying he intends to give up the occupied territories to preserve the unoccupied ones. The U.S. stated it would provide Ukraine with security guarantees similar to NATO's Article 5, but it's a downgraded version; in a real conflict, NATO might not directly send troops. The EU mentioned that negotiations for Ukraine's membership would start in 2025, but Ukraine does not meet the criteria in various aspects, which frankly is just a psychological comfort. Therefore, on Monday, Zelensky will meet with European leaders alongside Trump. Although there will be a "battle of wits," the atmosphere is likely to be better than the last time he met with Zelensky alone, increasing the chances of reaching an agreement. After that, Trump will negotiate with Putin to finalize the agreement's bottom line and then organize multilateral talks to sign a ceasefire agreement, followed by Trump winning the Nobel Peace Prize.

3,39K

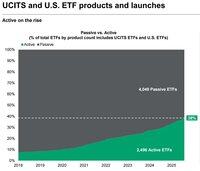

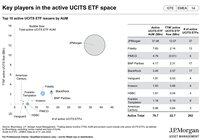

The share of actively managed ETFs is rising rapidly, with a CAGR of 46%. In 2024, global net inflows into active ETFs reached a record $349.2 billion, accounting for 28% of total global ETF flows. The main increment comes from JPMorgan's index-enhanced ETFs, namely JEPQ/JEPG. It is believed that the crypto space will also see more non-index products emerging, bringing the convenience of complex strategies to all ordinary users.

1,53K

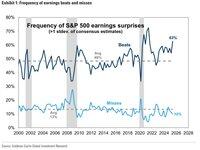

The level of Q2 performance in the US stock market this round is one of the highest historically, aside from the pandemic.

The reason so many companies exceeded expectations is largely that previous analysts were too pessimistic and set their forecasts too low.

As a result, the stock price increases for these companies that exceeded expectations are smaller than usual. Moreover, the penalty for those that missed expectations is the largest in six years.

Additionally, the previous market style overly pursued safety, leading to a 57% premium in price-to-earnings ratios for high-quality stocks (which include high profit margins, strong balance sheets, etc.) compared to low-quality stocks. This level is in the 94th percentile historically since 1995, far exceeding the long-term average premium of 15%.

This extreme premium indicates that the valuations of high-quality stocks have overly reflected their "safety," while low-quality stocks are significantly undervalued. This has created an asymmetric distribution of "limited downside risk and greater upside potential."

If inflation data declines or the Federal Reserve signals a more accommodative monetary policy while economic growth remains resilient, the decrease in real interest rates will lower the financing costs for low-quality stocks and enhance their profit expectations. In this scenario, undervalued low-quality stocks may experience a rapid rebound due to valuation corrections and profit improvements.

In fact, cryptocurrencies also have some low-quality characteristics; aside from Bitcoin, the overall trend has been suppressed against the backdrop of the US stock market hitting new highs.

5,27K

The executive order signed by Trump the day before yesterday broadens the investment scope of the U.S. 401(k) retirement accounts, allowing the inclusion of alternative assets such as cryptocurrencies and private equity funds.

Although the headlines are largely positive for cryptocurrencies, these alternative assets also include precious metals like gold and silver, which were previously classified as "collectibles." So, this is actually a big deal for the gold industry as well.

However, these high-risk assets will not automatically be included in employer plans. Employers and plan administrators need to conduct a selection process. Therefore, it may take at least a few months before we actually see pension funds entering the crypto or gold markets, and the pace of entry may start off quite slow.

This is because investment administrators have a "duty of prudence" in reviewing the assets, and if they incur losses for the pension funds, they may face litigation risks. Thus, it is expected that, apart from companies targeting young IT professionals, most companies will take a considerable amount of time to open up to alternative assets.

Additionally, the 401(k) plan consists of both employer contributions and employee contributions. The latter has always been able to freely purchase cryptocurrencies and gold ETFs, so this portion of funds has already entered the market. However, over 90% of contributions come from the former, and the strategies available here are generally quite limited. Administrators need to actively add options, as they bear the responsibility for users' retirement, and they will certainly be very cautious with assets that have high volatility.

14,89K

The executive order signed by Trump the day before yesterday broadens the investment scope of 401(k) retirement accounts in the U.S., allowing the inclusion of alternative assets such as cryptocurrencies and private equity funds.

Although the headlines are largely positive for cryptocurrencies, these alternative assets also include precious metals like gold and silver, which were previously classified as "collectibles." So, this is actually a big deal for the gold industry as well.

However, these high-risk assets will not automatically be included in employer plans. Employers and plan administrators need to conduct a selection process. Therefore, it may take at least a few months before we actually see pension funds entering the crypto space or gold market, and the pace of entry may start off quite slow.

This is because investment administrators have a "duty of prudence" in their asset reviews, and if they incur losses for pension funds, they may face litigation risks. Thus, it is expected that, apart from companies targeting young IT professionals, most companies will take a considerable amount of time to open up to alternative assets.

3,26K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin