Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

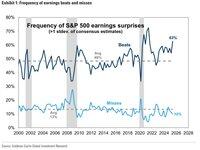

The level of Q2 performance in the US stock market this round is one of the highest historically, aside from the pandemic.

The reason so many companies exceeded expectations is largely that previous analysts were too pessimistic and set their forecasts too low.

As a result, the stock price increases for these companies that exceeded expectations are smaller than usual. Moreover, the penalty for those that missed expectations is the largest in six years.

Additionally, the previous market style overly pursued safety, leading to a 57% premium in price-to-earnings ratios for high-quality stocks (which include high profit margins, strong balance sheets, etc.) compared to low-quality stocks. This level is in the 94th percentile historically since 1995, far exceeding the long-term average premium of 15%.

This extreme premium indicates that the valuations of high-quality stocks have overly reflected their "safety," while low-quality stocks are significantly undervalued. This has created an asymmetric distribution of "limited downside risk and greater upside potential."

If inflation data declines or the Federal Reserve signals a more accommodative monetary policy while economic growth remains resilient, the decrease in real interest rates will lower the financing costs for low-quality stocks and enhance their profit expectations. In this scenario, undervalued low-quality stocks may experience a rapid rebound due to valuation corrections and profit improvements.

In fact, cryptocurrencies also have some low-quality characteristics; aside from Bitcoin, the overall trend has been suppressed against the backdrop of the US stock market hitting new highs.

5,31K

Johtavat

Rankkaus

Suosikit