Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

An important battle is happening rn between American VCs and regulators for how tokens are to be legalized globally

We gathered our views below for teams and investors affected (practically everyone) ahead of also dropping a paper on token design that aims to mitigate the risks

So,why everyone?

US legal treatment of tokens is going to inform most of regulations from other countries, best to view it as a general framework for the world

Yes, some big economies aren't rushing atm (EU, China), but it can all change if US proves it works - as was w/TradFi

Both documents are aligned in most important topics - like treatment of diff. types of crypto and market participants, including issuers

But the actual procedures by which those principles will be governed are still a subject to pending legislation or rule-making by SEC and CFTC

So, a big fight right now is about the definitions:

-what is a crypto Security, vs

-a crypto Commodity, vs

-an Ancillary Asset (a term defining tokens as assets w/o legal rights for holders - as opposed to securities)

With everyone agreeing that Commodity = "decentralized"

There's a push atm, lobbied by a bunch of big name investors (@paradigm,@RibbitCapital, @galaxyhq among others) to introduce a law through Senate that defines tokens as Ancillary Assets - those that derive value solely from code, not rights to holders, even if offering yield

On the other side is @a16zcrypto that advocate for clear Security/Commodity distinction

The issue is - can a single team behind a [centralized] crypto project avoid securities laws

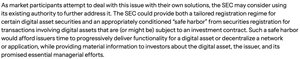

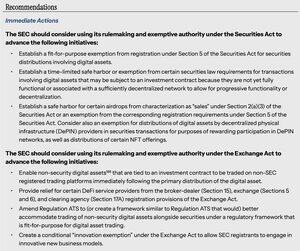

A16Z says "not before they decentralize" and WH Working Group seems to agree, but w/carveouts(📸)

The Chair of the @SECGov already made it clear that his agency plans to implement suggestions from the WH Working Group ()

Which leads us to believe that the industry probably lands on some light "Crypto Securities" legal regime despite countering efforts

Which isn't necessarily a bad thing for teams that have revshare/buybacks

As most likely all of them fall under this upcoming regime if even one of their token holders is from the U.S. (good luck geo-fencing that)

Maybe flag some wallets, post regular updates, get a US entity

But it is a path towards broader market that pumps the right tokens HARD (can't blame @a16z)

The lean DeFi teams that may fall under upcoming regulation will have best revenue-per-employee in all of Financials if the fee switch is turned on

Why own bank stocks instead?!

Yet, this is also a path towards further centralization and government control over the industry, which in a world like today means picking sides at the end of the day - e.g. "if you are registered as a crypto US Security, you can't serve Chinese/EU customers"

That's why some are advocating for the Ancillary Asset regime for tokens

But even if signed into law, it may fail in courts, in our view - the nature of the arrangement doesn't change

We get the frustration @danrobinson, but there's a third path

The tokens can and should be designed in a way that truly captures value while still keeping the builders behind it safely in the "code contributor" bracket

The blockchain money is programmable after all

Stay tuned.

1,94K

Johtavat

Rankkaus

Suosikit