Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Funding rates are a continuous source of return (or cost) for every perp trader.

They're dynamic, market-driven, and affect every perp position.

Until now, there was no way to isolate or hedge that exposure directly in crypto.

How @boros_fi by @pendle_fi makes it possible 🧠🧵

2/ If you've ever used Pendle, you must have been familiar with PT and YT.

In Boros, get to know YU (Yield Unit)

Each YU represents the funding yield from 1 unit of collateral (for eg.: 1 ETH or 1 BTC) on a perp market, until a set maturity.

You can go Long YU (betting funding goes up) or Short YU (betting it drops).

3/ Quick breakdown of terms in Boros:

- Floating Rate = raw funding rate from the perp (e.g. 0.01% every 8h on Binance)

- Underlying APR = the annual Floating Rate by oracle

- Implied APR = the market "price" YU, set by supply/demand on Boros

- Fixed Rate = A payable/receivable Implied APR at maturity

4/ When you open a position, the Implied APR becomes your Fixed Rate.

- Long YU → you pay this Fixed Rate, and receive the actual funding (Underlying APR)

- Short YU → you receive the Fixed Rate, and pay the Underlying APR

Your goal is to profit from the spread.

5/ Funding is settled on Boros at the same frequency as the source market:

- Binance = every 8h

- Hyperliquid = every hour

At each settlement, Boros compares your Fixed Rate to the Underlying APR, and adjusts your collateral accordingly.

6/ The longer you hold, the more of your YU gets “realized” into your collateral. At maturity, all yield is settled and your position value → 0.

But you can close at any time by entering the opposite trade, which cancels out remaining position value and unlocks collateral.

7/ Your position’s value depends on 2 factors:

- The difference between Underlying and Fixed APR, settled every period

- Changes in Implied APR. This affects the mark-to-market value of the YU.

This also means timing your entry matters. Lower Implied APR at entry can improve your profit even if funding is flat.

8/ The same mechanism applies to protocols, too.

Take Ethena, their delta-neutral yield depends on receiving positive funding from short perps. When funding rates turn negative, their margins shrink.

To hedge that, Ethena could Long YU, paying a fixed low Implied APR now, while gaining the higher Underlying APR later if funding flips back positive.

This applies to any strategy that is structurally exposed to funding.

9/ What happens when you open a position on Boros:

- You select a market (e.g., ETHUSDT on Binance)

- Choose long or short YU (whether you expect the funding rate of this pair on Binance will increase or decrease in the next 8 hours)

- Deposit collateral (in the base asset)

- Boros calculates your position size and fixed APR

- Every funding settlement (in this case, every 8 hours for Binance), your position receives or pays based on the difference between the fixed and floating rate.

- At maturity, total position value is zero, you'll receive your collateral.

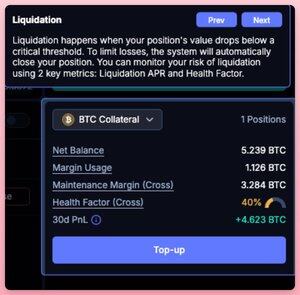

10/ Is a liquidation possible on Boros?

Boros is like a perp DEX for funding rates. So yes, there is a purpose-built margin and liquidation system on Boros.

Liquidations happen when your Net Balance falls below Maintenance Margin.

Net Balance = Collateral + Unrealized PnL

11/ In which:

- Collateral adjusts every settlement (based on Underlying APR vs Fixed Rate)

- Unrealized PnL is based on the mark Implied APR

Short YU gets liquidated if Underlying APR stays too high (you keep paying more than you earn).

Long YU gets liquidated if marked Implied APR drops sharply (your unrealized PnL is down).

12/ What if you don't want to be a trader?

To support execution and liquidity, each YU market is paired with a Vault - a passive LP pool that acts as a counterparty for market orders.

As a Vault LP, you'll earn swap fees, $PENDLE, and potentially upside if Implied APR rises.

But it's not risk-free. Vaults are long-YU biased. Falling Implied APR creates IL for LPs.

13/ Boros now supports trading for BTCUSDT and ETHUSDT on Binance. All filled in 24 hours.

Caps were currently conservative: $15M notional OI per market, 1.2x leverage.

Boros has seen $36M in notional trading volume. The traction is real.

7.8. klo 12.33

In 24 hours since launch, @boros_fi has achieved:

• $15M in Open Interest

• $36M in Notional Trading Volume

• BTCUSDT-Binance market at full capacity (with OI cap recently being raised $10M → $15M)

• ETHUSDT-Binance reached 52%

• Both BTCUSDT and ETHUSDT Liquidity Vaults are fully filled

All trades and settlements are functioning exactly as intended.

We're actively monitoring the system and appreciate the patience of our users as we build a new DeFi primitive from the ground up together.

Job's not done.

14/ Perp markets already carry billions daily, but the concept of trading funding rates directly is a new primitive in DeFi playbook.

Boros might be a 0-to-1 that further reinforces Pendle as one of the most innovative DeFi protocols today.

First crypto. Then the world.

3,38K

Johtavat

Rankkaus

Suosikit