Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

TN | Pendle

Housekeeping @pendle_fi

TN | Pendle kirjasi uudelleen

You can learn a lot from @pendle_fi

They brute forced their success.

Now it looks easy but they had to deal with a lot of issues in the past.

- TVL halved after points meta ended

- $PENDLE dropping from $1,7 to $0,05

- Constant outflows of TVL

They always found a way to attract new capital, new partners and create new products. This was only possible because they are close to the community.

Yield Trading is one of the biggest things in TradFi but when Pendle started in 2021 it was not clear if that model would work in crypto. Many people overlooked the opportunity back then since it is difficult to fully grasp the concept of PT/YT and why it’s useful.

Explain your Product

Pendle did a great job creating educational resources which is key if you want to onboard users to a rather complex product.

Once someone is onboarded they stick.

Solve rich people's problems: They pay better

Average User Net Worth > User Numbers

Pendle achieved $7,7 Billion in TVL with 22k monthly active users.

Theory: The average Pendle User deploys $350k.

Reality: 20% of Wallets account for $6,1 Billion TVL

Go where the puck is going

Pendle always had a great sense for what will drive the next liquidity wave. From early partnerships with @LidoFinance and @ether_fi to now @ethena_labs and @kinetiq_xyz. Always think ahead and be prepared.

This is the reason why Pendle has 90% Marketshare in their Niche.

The distribution of Pendles TVL changed a lot over the years. From being 50% in stETH to now being 80% Stablecoins, mostly forms of USDE.

This is big since it reduces the volatility of the TVL.

Don't just focus on TVL growth but find ways to make that TVL stick and less volatile. One of the reasons why I also like @maplefinance so much.

Pendle Token Design

Pendle has a vePENDLE Token design. While this is not ideal for most projects it was crucial for Pendle. The average vePENDLE holder locks their tokens for 1,37 years to earn fees which are paid in $ETH.

Since the $Pendle Token itself is rather useless people are motivated to lock their Pendle for vePendle.

Having Token Holders that can't panic sell when the token is down is crucial for any project.

It also led to : The Pendle Wars of liquid Wrappers.

If you create a situation where people lock vePendle they will find a way to make it more liquid.

@Penpiexyz_io and @Equilibriafi hold about 20 Million vePendle.

Both of their liquid Wrappers depegged so be careful with those.

While I am not the biggest fan of the 2 Token Design it was important for Pendle's success.

Influencers & KOLs

Accounts like @crypto_linn and @defi_mochi played a big role in pushing Pendle and the community. It is important to do partnerships the right way. Look for accounts that align with your vision and focus on the long term outcome.

If your token price goes up you will gain way more attention from real accounts that want to support instead of trying to do a KOL campaign.

Conclusion

> Brute force your way to the top

> Adapt to new circumstances

> Focus on building with and for the community

> Think in years > months

Pendle Chads

@Rightsideonly

@crypto_linn

@tn_pendle

@defi_mochi

@poopmandefi

8,89K

TN | Pendle kirjasi uudelleen

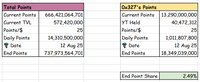

If you think you've seen a zero-to-hero trade, let me introduce you to 0x327.

This user:

- Started farming @sparkdotfi 2 weeks ago (69% into the program)

- Has 13.3b Spark Points (#7 on the leaderboard)

Zero or hero?

Let's break things down.

👇

___________________________________

0x327 has ~$40.5m in USDS exposure on a $174k spend.

Something to note - he/she is a CLINICAL trader and their entire position is filled using limit orders.

That means they've filled their entire $40.5m position with ZERO price impact and EXACT Implied APY pricing 💅

___________________________________

Since we're close to 🪂, its preeeeeeeeety easy for us to predict how many points there'll be in total.

It's also easy to predict how many points 0x327 will have based on his current position.

Intern's guess?

About 2.49% of the final $SPK 🪂.

___________________________________

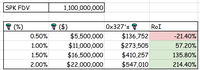

Based on $SPK's FDV of $1.1b, we can project our good lad's RoI depending on different 🪂 allocations.

0.5%? zero

1.0%? hero

1.5%? Hero

2.0%? HERO

My personal thoughts? I'm thinking something starting with 'h' +/- a capital letter.

NFA NLA NMA MDMA

Pendle

51,69K

TN | Pendle kirjasi uudelleen

Pendle's new product Boros, which took nearly two years to refine, finally launched yesterday. Twitter was buzzing, and TG messages were overflowing. Grandma knows that the community members have been waiting for a long time, and she is incredibly grateful for the enthusiasm of the DeFi community.

Yesterday, some friends asked Grandma some questions about Boros PMF, so here’s a summary to share with everyone (Chinese is not my first language, please be kind to Grandma ❤️):

The user profile of Boros is more diverse compared to Pendle V2, and the operation and structure of Boros are simpler and easier to understand.

From a macro perspective, Boros can cover both DeFi and CeFi players, providing a new trading method for both sides while simultaneously unlocking funding rates as a new stable and reliable source of income. In addition to opening positions on Boros, users can also open positions on exchanges to implement more advanced composite strategies.

💡 Why are funding rates a high-quality and reliable source of income?

📍 No need for "narratives," no need to worry about TGE, no need to calculate points, it's straightforward and simple. There is no dependency on the platform or a single party, and it has good sustainability.

📍 Suitable for various capital sizes, whether small retail investors or large whales, everyone can find a way to participate that suits them.

📍 You can go long on bullish positions and short on bearish positions, with no absolute dependency on market sentiment; it works for both bull and bear markets, allowing for flexible strategy adjustments.

📍 Funding rates are usually updated every 8 hours, and they are publicly transparent parameters on major exchanges, monitored in real-time, fair and reliable.

💡 For professional traders and institutions:

Derivatives issuers, especially those at the short end, typically hedge their positions by going long on perpetual contracts. For example, options sellers will hedge on the long side of perpetual contracts, and these positions need to pay funding rates. Boros can help them hedge these funding rate payments.

Many funds hold long positions on perpetual contracts for a longer term, and these positions also face funding rates. These are usually hedged elsewhere through OTC or brokers, which is clearly less efficient.

Regarding projects like Ethena / Resolv and basis trading, Boros aims to provide them with an additional, more efficient, and reliable operational pathway to hedge their basis trading positions when needed. They are all actively testing Boros and adapting mechanisms that can be implemented in their protocols.

Currently, due to the extremely strict risk control measures for the new product launch, there is a very low OI cap. As the OI cap increases and liquidity improves, more large funds will enter the market.

For example, when perpetual contracts were first launched, funding rates weren't even a concept; they were just a tool for the operation of perpetual contracts. But now, they have become a source of income for many funds and basis trading positions.

Therefore, from various DeFi and CeFi retail players to institutions holding different strategies, and to protocols with related needs, Boros will definitely become an important tool, laying a solid foundation for future rates beyond funding rates, and even for off-chain yield trading pairs.

💡 The data from Boros's first 24 hours is also impressive, having already surpassed:

• $15 million in open contracts (increased from the initial $10 million)

• $36 million in nominal trading volume

• The LP vaults for BTC/USDT and ETH/USDT have been completely filled

Everything is running smoothly, and the risk control team will gradually consider increasing the limits.

There’s really so much to discuss about Boros, Grandma looks forward to the community members wishing each other prosperity and sharing more!

🔥 We also have a dedicated channel for Boros discussions in Pendle's Chinese community:

📍 Telegram group address: @PendleFinance_CN

37,77K

In 24 hours since launch, @boros_fi has achieved:

• $15M in Open Interest

• $36M in Notional Trading Volume

• BTCUSDT-Binance market at full capacity (with OI cap recently being raised $10M → $15M)

• ETHUSDT-Binance reached 52%

• Both BTCUSDT and ETHUSDT Liquidity Vaults are fully filled

All trades and settlements are functioning exactly as intended.

We're actively monitoring the system and appreciate the patience of our users as we build a new DeFi primitive from the ground up together.

Job's not done.

37,53K

TN | Pendle kirjasi uudelleen

1.7 years in the making.

Yet another DeFi primitive is born (yes, the Pendle team is always in the business of creating new primitives).

The fundamental fabrics of the whole crypto financial system will forever change, with an efficient interest rate swap layer.

Mark my words, this is a point to remember in the history of DeFi and even AnythingFi.

Rejoice anon. You are witnessing history.

#pendle #boros

10,3K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin