Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Kaff 📊

I just found an AI agent that can save 99% of our research time.

@SAG3_ai is an autonomous AI crypto research analyst, delivering deep, verifiable project insights across fundamentals, sentiment, and on-chain data in just a minute.

▫️ Built-in LLMs like #DeepSeek R1 and #Perplexity AI.

▫️ 2,500+ projects indexed.

What you need to do is simply type the name of the tokens on the platform, and instantly, it provides:

– Data sentiment, team activity, charts

– Reports with sources and red flags

– Price analysis, market signals

– And more!

Here’s how I use SAG3 to dive into $CLANKER 👇🏻

9,58K

I’ve been tracking the evolution of #RWAs for a while.

And even though total onchain value has crossed $24.8B, most platforms still stop at just tokenization.

That’s why I think @RtreeFinance stands out.

They’re putting real-world assets onchain as well as engineering a new financial stack around them.

A thread 🧵 👇🏻

10,11K

gOcto!

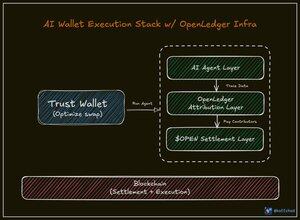

I think we’re about to hit a weird convergence point between wallets, AI, and the economics of data and @OpenledgerHQ is sitting right at the collision zone.

@TrustWallet’s move with #OpenLedger confirmed a few things I’d been suspecting, but also dropped more than a few gems.

We’re watching the "fat protocol" thesis morph into the "fat wallet" thesis. The interface is the distribution.

Trust Wallet's been thinking hard about it, but what’s actually driving the shift is that AI can now mediate how users engage with everything underneath.

So now there’s a new meta testbed for:

– Specialized agents fine-tuned for crypto UX (fraud prevention, swap routing, safety rails)

– Wallets as the identity layer

– Choice-driven custody layered with AI-driven automation

– Guardrails to keep users in control even if the agent goes rogue

OpenLedger slots in with attribution as the core of economic fairness.

Their vision is to let users contribute their expertise, prove it cryptographically, and then route rewards onchain.

Your wallet becomes your face and your paycheck. Whether you're a Solidity dev feeding a model or just someone labeling Web3 scam txs, there’s yield attached.

We’ll go from clicking swap to saying “optimize my ETH yields,” and an agent will do the rest → Fine-tuned on DeFi data, proven onchain, and paying every contributor that made the decision possible.

If OpenLedger gets it right, $OPEN will be how knowledge finally gets paid.

Openledger5.8. klo 14.11

.@TrustWallet is now an @OpenLedgerHQ client, officially building with our tech.

Proud to support one of Web3’s most trusted wallets as it embraces verifiable AI.

Hear @Ramkumartweet and @EowynChen break it down on @therollupco.

11,07K

I think we have been waiting a #Defi summer for a pretty longtime since the last one in 2021.

This time I’ve been feeling the signs that DeFi is coming back are getting clearer every day.

The numbers don’t lie:

✨ TVL across DeFi has surged to $153B (July 2025), the highest since mid‑2022. That’s a massive +57% recovery in just 3 months.

✨ Ethereum dominates with ~$78B locked, and big names like Aave & Lido each sit at ~$33B.

✨ Lending protocols alone crossed $55B TVL, a major bounce from previous lows.

Meanwhile, fresh double‑digit yields are back in platforms like Aave and Compound, making DeFi yields look even better than Treasuries again

✨ DEX/CEX volume ratio hit an all-time high of 29.02% in June, signaling a major shift from centralized to decentralized trading.

✨ Monthly DeFi revenue is booming, $216.3M in July, climbing close to the Jan ATH of $282M. Dominated by PancakeSwap, Ethena, and

✨ Institutional flows are significant, with $1.6B+ from Sharplink and $3B+ from BitMine going directly into DeFi yield strategies through ETH.

And underpinning all of this is progress in infrastructure: Layer‑2, cross‑chain bridges, and AI‑powered liquidity tools are making DeFi smoother and more efficient.

The recent AI-powered liquidity protocol that drew my attention is #INFINIT, one-click agentic defi activated.

Cool product by Infinit where users can create their own DeFi strategy and earn a fee every time someone else uses it.

So, Defi is coming back with something more intelligent, more personal, and way more aligned with users, I believe.

28,55K

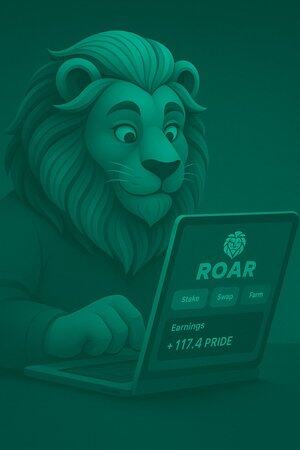

I’ve been messing around with the @th3r0ar Wallet lately, and honestly…

this feels like what mobile-first #DeFi should’ve been from the start.

Most wallets either bombard you with tabs, or lock you out until you connect and by the time you figure it out, you’ve paid $30 in gas and got frontrun twice.

However #R0AR is a different energy entirely.

✅ Self-custodial

✅ You can stake, swap, farm, explore NFTs, and track earnings, all from the same clean screen.

✅ Built on R0ARchain (Optimism-powered) → fast, cheap, and Superchain-ready.

✅ No bridges, no wallet traps, no MEV games.

And here’s the kicker: you don’t even need to connect your wallet to explore the ecosystem.

The Portal is open, quests are live, NFTs are waiting, all without a single signature.

But if you do plug in…

→ Lion’s Share lets you earn triple-digit APYs

→ LP without worrying about MEV sniping

→ ERS NFTs + Pride Points = higher yield multipliers the deeper you go

And this is still the Beta.

UI v2 and real-world asset integrations are already on the roadmap.

Try the wallet:

Explore the platform:

Follow the Pride: @th3r0ar

6,31K

GM! I think On-Chain Treasury is now the biggest trend!

We’re seeing more and more public companies quietly flip the switch on their treasury playbooks.

It started with BTC, shoutout to #MicroStrategy but now the ETH-as-reserve narrative is kicking into gear.

And it’s not stopping there. These companies are diving deeper into $SOL, $BNB, $LTC, $XRP, and beyond.

Feels like we’re watching the next wave: crypto tokens becoming the new standard for strategic reserves.

The treasuries are going onchain 👇🏻

18,1K

📌 What exactly makes @Mira_Network feel different?

I think for most AI projects, the endgame is always the same: solving the training dilemma.

Basically: If you train a model to be more accurate, it often gets more biased.

But if you try to fix the bias by using broader, more diverse data… you usually end up with more hallucinations.

However, @Mira_Network takes a different route.

Instead of obsessing over one perfect model, they get multiple models to verify each other.

And it works-error rates drop from ~30% down to ~5% on real tasks.

They’re even aiming for below 0.1%, which is wild.

You can already see it live:

✨ If you’re using Gigabrain, you’re trading on Mira-verified signals with a 92% win rate

✨ Learnrite builds exam questions with over 90% factual reliability

✨ Klok gives you responses verified by 4+ models every single time

None of those apps require retraining a model from scratch. That’s what $Mira enables.

10,56K

GM!

I think the risk/reward tradeoff around $ETH treasuries is way more nuanced than most people admit.

Sure, staking gives you yield. At 3–5% APY, a $1B treasury can generate $30–50M per year. That looks great on paper.

But in practice, more yield means less liquidity.

I’ve been digging into the real costs: withdrawal queues, smart contract risk, slashing exposure, and now restaking layers introducing even more complexity.

Add #LSDs into the mix, and you’re inheriting a stack of risks just to chase extra yield.

We’ve seen how this plays out.

3AC looped $stETH to lever up on $ETH, and when the peg broke, it all unraveled.

Curve got drained, $stETH started trading at a discount, and the unwind turned systemic.

That was just one player. What happens if three or four public treasuries build similar positions and need to unwind at the same time?

It feels like there’s a systemic risk forming right where DeFi meets public balance sheets.

- #BitMine wants to hold and stake 5% of the entire $ETH supply.

- #SharpLink already has $1.3B. Across the board, public companies are sitting on over 1.3M $ETH and it’s growing.

If even a fraction of that flows into restaking protocols or yield loops, the potential for fragility compounds quickly.

With $BTC, I’ve always seen it as simple: you hold it.

Maybe borrow against it if you’re aggressive. But managing an $ETH treasury is a different beast. There’s no Michael Saylor equivalent here who can just “hodl and chill.”

Every $ETH that’s burned, staked, or restaked becomes harder to sell. That strengthens the price floor but it also raises the stakes.

Because the bear case isn’t just about price, it’s about liquidity risk.

It’s about moments when everyone needs to unwind, but the system isn’t built to let that happen cleanly.

I think we’re entering an era where treasury managers will need to go way beyond balance sheets.

They’ll need to model validator economics, price smart contract risk, and build real-time liquidity buffers.

That’s the only way to keep this from becoming another cautionary tale.

103,75K

#Ethereum didn’t become Ethereum just by being a faster Bitcoin.

It became what it is because it let people build entire economies out of logic.

I’ve always found that idea powerful, the shift from money to programmable value.

What makes $OPEN interesting is it’s building actual infrastructure for how AI should work on-chain where inference isn’t just a black box, but a transaction.

I can see exactly which dataset influenced an output.

And the people behind it: the validators, the curators, the fine-tuners, they all get paid automatically.

To me, this is what real composability looks like in AI:

→ Attribution as a service

→ Royalties for data

→ Programmable agent execution

→ Inference as a monetizable event

@OpenledgerHQ is for the incentives that’ll shape how agents learn, adapt, and collaborate across networks.

Openledger Foundation1.8. klo 22.09

OPEN is the Ethereum of AI

12,38K

I’ve been watching what happens to projects after they go live on #Kaito.

And honestly, most of them disappear just as fast as they rose.

But a few, They didn’t escape the post-TGE dump, But they didn’t surrender to it either.

1/ $NEWT

Pumped +144% in 4 days with massive volume

→ $500M–$1.7B trading on the surge day

→ Now rebuilding momentum with point loops and micro-engagements

2/ $SOPH

Bounced from $60M to $102M MC within 2 weeks

→ Volume is climbing again

→ Product evolution + staking flywheel = signals of a second wave

3/ $IP

Climbed +135% from bottom (June 25)

→ Now pushing near its ATH

→ Holding narrative with meme energy, quests, and active staking rewards

They understood something most miss:

Kaito gives you borrowed energy. But to sustain it, you need systems of return, reasons for users to stay, act, and believe after the leaderboard fades.

And it’s what separates a one-time flash from a long-term flywheel.

So here’s what I’ve come to believe:

→ Getting users is easy if you’re willing to pay.

→ Keeping them? That requires design. Loops. Culture. Patience.

Maybe the new meta isn’t how loud your launch is. But how quiet your comeback can be and still hold attention.

48,31K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin