Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

miles jennings

miles jennings kirjasi uudelleen

unfortunately this is pure race to the bottom stuff that makes no sense from a policy perspective

the fewer rights people have, the less regulated something is?

it should be the opposite--if they have more rights, they are more protected under general contract law and there is less need for regulation. . .

this is how you get pure memecoin mania forever, equity/token conflict of interest forever, etc.. . .

the House approach is far superior

8,33K

miles jennings kirjasi uudelleen

for years crypto vcs have been pushing for legal clarity on security status for tokens

now they are saying what they actually want: for tokens to be blanket-defined as not securities, even those with the structural properties of investment contracts but no legal binding

12,8K

miles jennings kirjasi uudelleen

Today’s guilty verdict against Roman Storm for unlicensed money transmission is an unfortunate outcome. Like many in the industry have raised, we agree that non-custodial software through which people engage in self-directed, P2P transactions is not money transmission, and the government erred in charging this count in the first place.

This decision could have a wide-ranging and unintended impact on the blockchain ecosystem as a whole. The lack of regulatory clarity that has long plagued the crypto industry not only impedes innovation, it’s dangerous. Now, developers may fear their projects could run afoul of the law. This result is misaligned with the goals of the current administration and jeopardizes its push to place the United States at the forefront of crypto innovation.

The sole count of conviction (18 U.S.C. § 1960) was driven by the court’s pre-trial legal interpretation, not jury fact-finding. We believe the court erred in discounting FinCEN’s guidance and so broadly defining money transmission. Unfortunately, this may have tied the hands of the jury and dictated the outcome.

But, the fight is not over. Storm has multiple grounds for appeal. And we will continue to support the fight to protect developers—in legislation, regulatory rulemaking, and the courts.

1,05K

miles jennings kirjasi uudelleen

1/ Throughout tech history, it has often been the sequels that became the greatest hits.

Underrated strategy for founding the next breakout crypto company:

Think about the big, bold ideas from the last era of crypto that didn’t quite work as planned, but still have the potential to be world changing.

5,16K

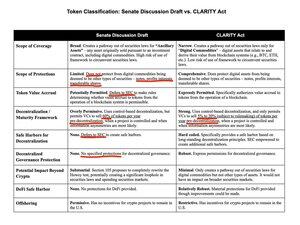

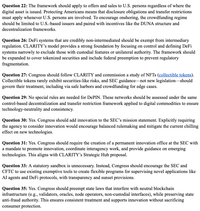

Here's a quick summary of our feedback on the Senate Banking Committee's draft market structure legislation.

In two words: More CLARITY.

miles jennings1.8. klo 03.46

1/ Progress on crypto policy continues! The White House just released an excellent report and the SEC launched “Project Crypto”.

The next critical step is feedback on the Senate’s market structure legislation.

We just submitted our recommendations👇

7,87K

miles jennings kirjasi uudelleen

the below thread is vital feedback from @milesjennings and @a16zcrypto on the Senate's risky departure from regulatory framework established in the House's bipartisan CLARITY bill.

In particular, there are two extremely hard-fought 'wins' in CLARITY without which I would not have endorsed it & which are essential if token markets are to have a healthy future, but which are lacking in the Senate approach:

(1) CLARITY makes very clear that tokens can have intrinsic economic value flows etc. as long as these economic flows derive from their use within a decentralized/autonomous system--they can look a bit like securities, as long as their trust properties are unlike those of securities; in contrast, the Senate framework resorts to an antiquated and gray-area test around whether tokens are associated with 'rights' to determine the securities dividing line...this is completely different from current securities law and would place any value accrual mechanism that appears rights-like into serious jeopardy, creating more and more incentive and 'moral hazard' for 'valueless memecoins' as a pure regulatory arbitrage . . .CLARITY also makes this point clear not just for 'investment contract' analysis but for every other type of 'security' that a token could be regulated as ('notes' etc.), the Senate bill only deals with investment contracts. . .

(2) the entire point of a *market structure* bill should be to do just that--improve *structure*, improve *capital formation* for the projects that are worthy of capitalizing... but if project insiders and VCs can dump with complete impunity without delivering a single one of their promises, market structure will get *worse*. . .this will be particularly bad if combined with point #1..taken together, we will have a market with strong incentives toward creating valueless tokens that are pumped-and-dumped fast, and high-quality tokens and projects will be *punished* with greater regulatory ambiguity & risk

10,26K

miles jennings kirjasi uudelleen

the below thread is vital feedback from @milesjennings and @a16zcrypto on the Senate's risky departure from regulatory framework established in the House's bipartisan CLARITY bill.

In particular, there are two extremely hard-fought 'wins' in CLARITY without which I would not have endorsed it & which are essential if token markets are to have a healthy future, but which are lacking in the Senate approach:

(1) CLARITY makes very clear that tokens can be 'securities-like' (have intrinsic economic value flows etc.) as long as the economic flows derive from their use within a decentralized/autonomous system--in contrast, the Senate framework resorts to an antiquated and gray-area test around whether tokens are associated with 'rights' to determine the securities dividing line...this is completely different from current securities law and would place any value accrual mechanism that appears rights-like into serious jeopardy, creating more and more incentive and 'moral hazard' for 'valueless memecoins' as a pure regulatory arbitrage . . .CLARITY also makes this point clear not just for 'investment contract' analysis but for every other type of 'security' that a token could be regulated as ('notes' etc.), the Senate bill only deals with investment contracts. . .

(2) the entire point of a *market structure* bill should be to do just that--improve *structure*, improve *capital formation* for the projects that are worthy of capitalizing... but if project insiders and VCs can dump with complete impunity without delivering a single one of their promises, market structure will get *worse*. . .this will be particularly bad if combined with point #1..taken together, we will have a market with strong incentives toward creating valueless tokens that are pumped-and-dumped fast, and high-quality tokens and projects will be *punished* with greater regulatory ambiguity & risk

2,56K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin