Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Eugene Bulltime

Head of Analytics & Partner @ContributionCap | Blockchain and Crypto researcher | DeFi Advisor | Fulltime in crypto since 2017 | My Research Hub ↓

LBTC by Lombard: The Gen III Standard for Wrapped Bitcoin

LBTC by Lombard represents a new generation of wrapped Bitcoin — one that solves the major flaws of its predecessors. I call it Gen III, because historically, the 3rd generation of products tends to be the most refined, having learned from the mistakes of earlier versions.

The Flaws of Gen I: Multisig Wrappers

Take WBTC, for example. It relies on a multisig wallet. While this setup spreads responsibility across multiple signers, it comes with a critical weakness: if a sufficient number of signers collude, they can seize all the underlying BTC. In practice, the only safeguard is the reputation of the signers — hardly a foolproof defense.

What’s more, the number of WBTC signers hasn’t been stable. Initially, there were 11 signers, later expanded to 18, and eventually reduced to 13.

Notably, some of those excluded included Alameda/FTX — the very entities behind the 2022 bear market — and other firms that reportedly lost their management keys.

These events alone highlighted the fragility of the model and sparked demand for a better solution.

Moreover, let's look at other major signatories:

- Compound — repeatedly hacked, raising doubts about its reliability despite being a top lending protocol.

- BadgerDAO — suffered a $125M exploit while promising BTC yield, despite being one of leaders in its sector.

- Multichain — shut down due to regulatory pressure in China, despite being the largest bridge.

- Ren — lost significant collateral in FTX, operated with opaque liquidity management, and ultimately disappeared, althoug it was one of most famous projects in BTC eco at that moment.

The lesson is clear: multisig wrappers are inherently risky.

Projects, no matter how reputable they appear, can collapse, mismanage keys, or even act maliciously. The core issue is that custody and security are not their primary business.

The Compromise of Gen II: Centralized Wrappers

To address these weaknesses, major exchanges like Binance and Coinbase introduced their own wrapped BTC products — what I call Gen II.

These shift full responsibility to a single, highly reputable custodian such as a leading CEX.

While this reduces the risks of multisig mismanagement, it creates a new problem: centralization. Tokens like cbBTC and BTCB are not censorship-resistant. Their issuers can block or freeze assets at any time, undermining the trustless ethos of Bitcoin.

Additionally, issuance is restricted to a limited number of entities that must undergo strict KYC/KYB procedures. For many, especially institutional players in TradFi, this raises red flags around accessibility, censorship, and counterparty risk.

Enter Gen III: LBTC by Lombard

This is where Lombard changes the game:

1. Decentralization — LBTC minting/burning/bridging operates via a PoA consensus, with plans to move toward full permissionlessness.

2. Open Issuance — Anyone can issue LBTC, with no paperwork or gatekeeping.

3. Non-Custodial Security — Using Cubist technology, BTC is stored non-custodially, meaning no third party — not even Lombard — can access user funds.

With these innovations, Lombard has effectively removed the risks that plagued earlier wrapped BTC models. It’s no surprise that LBTC has gained significant traction over the past six months.

Last point:

- Real TradFi will not go where there are risks of blocking and depegs like WBTC, cbBTC, BTCB.

So, LBTC will be the main option for them.

And yield will be a nice additional feature that increases the retention rate.

And follow on strong visioners and analysts:

@0xBreadguy

@alpha_pls

@poopmandefi

@TheDeFISaint

@DoggfatherCrew

@0xSalazar

@DefiIgnas

@Defi_Warhol

@hmalviya9

@Mars_DeFi

@rektdiomedes

@eli5_defi

@JayLovesPotato

@Steve_4P

@TheDeFinvestor

@arndxt_xo

@0xCheeezzyyyy

@Moomsxxx

@0xAndrewMoh

2,33K

I think $21M is a direct hint from team to the max supply of 21M BTC

Follow-on rounds among crypto VCs are a huge rarity

This suggests that VCs not only see the growth of the BOB, they understand well what is happening inside and know new triggers for growth

Congratulations!

BOB7.8. klo 16.14

0/ BOB has raised an additional $9.5M in strategic rounds between December 2024 and July 2025.

A total of $21M has now been raised to build the Gateway to Bitcoin DeFi.

4,43K

This is a major step for the BTC eco.

The launch of the first BitVM bridge signals that Bitcoin is no longer just a store of value but is becoming modular.

@AlpacaYovela, @cyimonio and Fiamma's team have done excellent work to accelerate the BTC ecosystem's progress.

Best wishes for continued growth!

𝗙𝗶𝗮𝗺𝗺𝗮 🦙🔥 | 𝗠𝗮𝗶𝗻𝗻𝗲𝘁 𝗟𝗜𝗩𝗘6.8. klo 21.37

𝗙𝗶𝗮𝗺𝗺𝗮 𝗕𝗿𝗶𝗱𝗴𝗲 𝗠𝗮𝗶𝗻𝗻𝗲𝘁 𝗶𝘀 𝗟𝗜𝗩𝗘!

The 𝗳𝗶𝗿𝘀𝘁 𝘁𝗿𝘂𝘀𝘁-𝗺𝗶𝗻𝗶𝗺𝗶𝘇𝗲𝗱 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 bridge, powered by 𝗕𝗶𝘁𝗩𝗠𝟮, is now live across 11 chains.

Unchain Bitcoin now: 🦙🔥

1,52K

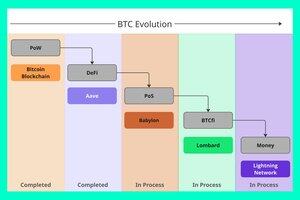

Bitcoin’s Journey: From Concept to Global Money

Bitcoin has come a long way since its inception — evolving from a niche idea into an asset embraced by ETFs, institutions, and corporate treasuries. Yet, this journey is far from over.

At its core, Bitcoin strives for a single goal: to become money.

Skeptics usually raise three objections:

- Bitcoin is too slow

- The network isn’t scalable

- Bitcoin is too volatile

Let’s break each down.

1. “Bitcoin is too slow”

Bitcoin’s mission is not to be the fastest, but the safest. If BTC is to become a universal money, its security must surpass even that of traditional banks.

That security comes from energy consumption — the foundation of Bitcoin’s proof-of-work model. I believe the @Bitcoin network will eventually consume no less energy than all global AI data centers combined. And that’s perfectly logical: a single world currency requires world-class security.

2. “The Bitcoin network isn’t scalable”

Security comes first. Because Bitcoin blocks are nearly impossible to roll back, not all transactions need to happen onchain. Instead, they can be handled offchain, with proofs recorded on the Bitcoin blockchain.

That’s why I expect scalability to come from L2 networks for financial transactions and the Lightning Network for payments.

Bitcoin, in fact, is even more suited to modularity than Ethereum. The challenge has always been infrastructure — but progress is accelerating. I anticipate major contributions from projects like

@Lombard_Finance

@babylonlabs_io

@nubit_org

@lightning

@fiamma_labs and others,

in building the ecosystem that will power Bitcoin’s scalability.

3. “Bitcoin is too volatile”

Bitcoin’s volatility has already decreased dramatically over the years. As its price grows, volatility naturally declines. When BTC reaches $1M, its volatility will likely match that of gold — stable enough for adoption by individuals, corporations, and even nation-states.

_______________________________

The truth is simple: if you don’t believe in Bitcoin as money, it’s because you lack long-term vision.

1,91K

Glad to be on your list, Mars!

It's amazing to see myself among CT legends, many of whom I've been following for years.

"Add value" - is what makes each of these guys stand out

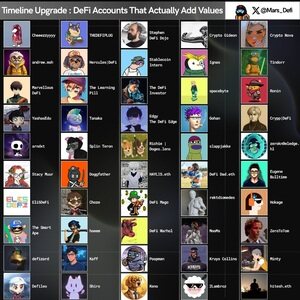

Mars_DeFi6.8. klo 13.06

In crypto, what you know matters but who you follow might matter even more.

It's easy for one’s timeline to have too much information. But if you follow the right accounts, you start curating a feed that’s not just signal over noise, but insight over hype.

• You could hear about drops before they trend.

• You catch alpha early, not when it’s already priced in.

• You learn from people actually building, not just tweeting for engagement.

Over time, this shapes how you think, how you invest, and the opportunities that come your way.

Because it’s true what they say:

Your network really is your net worth.

Looking to stay ahead of the curve? Here’s a list of 50 DeFi content creators that can help with just that.

---------------

@eli5_defi ➝ Weekly project spotlights, DeFi project research and yield strategies. Uses good visual aids to explain content.

@TheDeFinvestor ➝ Weekly crypto watchlists, defi developments, and in depth Ethereum and stablecoins research.

@0xCheeezzyyyy ➝ One of the top DeFi gurus out there, simplifying DeFi with both tweets and cool infographics.

@stacy_muur ➝ Robust DeFi and crypto research - Projects, VCs, DeFi strategies, you name it. Runs a research hub.

@0xAndrewMoh ➝ Educational content on projects, narratives, and on-chain data.

@phtevenstrong ➝ Banger yield strategies. Looking to dive fully into yield farming? Here’s your guy.

@arndxt_xo ➝ In-depth market insights and yield strategies. You can’t go wrong with his Substack.

@belizardd ➝ DeFi protocols and yield research. A “Pendled” guy.

@0xDefiLeo ➝ Quality DeFi insights and educational content.

@YashasEdu ➝ Need a deep dive into DeFi and AI? Here’s the right place for that.

@CryptoGirlNova ➝ One of the best in the game. Well thought-out crypto content backed by pro research.

@TheDeFiPlug ➝ Based crypto researcher. Drops insightful weekly crypto roundups.

@zerototom ➝ Core DeFi research and one of the best accounts for good yield strategies and tricks.

@defi_mago ➝ DeFi research. Simplifies yield farming strategies using clean visual guides. Check out his Dune dashboard.

@splinter0n ➝ Go-to guy for DeFi and AI content.

@Slappjakke ➝ All things DeFi, DeFAI and L2 related. Yield researcher.

@Defi_Warhol ➝ DeFi protocols and airdrop research.

@zerokn0wledge_ ➝ DeAI maxi and DeFi protocols researcher.

@DefiIgnas ➝ Smart market insights and DeFi research. You sure don’t want to miss his DeFi blog.

@thelearningpill ➝ Solid yield strategies and beginner-friendly guides.

@Tanaka_L2 ➝ Real alpha hunter. Good DeFi strategies and project breakdowns.

@DeFiMinty ➝ In-depth market analysis. Researcher at Delphi Digital.

@hmalviya9 ➝ Pro on-chain and narrative tracking.

@the_smart_ape ➝ Good market insights and analysis.

@Moomsxxx ➝ On-chain analysis and RWA research.

4,3K

Something cooking

Congrats!

Willem Schroe5.8. klo 21.02

Botanix just hit $10 million TVL.

On beta mainnet. Just getting started 💪

1,11K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin