Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Nick van Eck

Bringing the world’s money on-chain 💸 | CEO and Co-Founder @withAUSD | prev General Catalyst

.@ethena_labs kicked off a new era for what I think is going to be one of the continued largest and fastest growing segments of crypto native businesses.

I’m still tinkering with the best way to articulate this segment…yieldcoins, onchain asset management…don’t love any of them yet, but the product is primarily YIELD

Ethena did several things incredibly well:

- bring yield onchain in a yield starved era

- opening up access to a popular, profitable TradFi strategy in a crypto-driven manner (BTC/ETH basis)

- superior form and function. The $1 denomination was key, instead of doing it on a NAV/PPS basis like typical funds

- risk management + building trust

Think there is a tremendous opportunity to build hundreds of product strategies here and at least a dozen very valuable businesses. TAM in 10-15 years is probably $500B-$1T at least. Most traditional asset managers will struggle with this (even the crypto friendly ones) because:

- unfamiliarity with DeFi/crypto market structure

- compliance risk/reward

@maplefinance is another great firm I put in this category. @upshift_fi and @MidasRWA also come to mind.

60,77K

@ethena_labs kicked off a new era for what I think is going to be one of the continued largest and fastest growing segments of crypto native businesses.

I’m still tinkering with the best way to articulate this segment…yieldcoins, onchain asset management…don’t love any of them yet, but the product is primarily YIELD

Ethena did several things incredibly well:

- bring yield onchain in a yield starved era

- opening up access to a popular, profitable TradFi strategy in a crypto-driven manner (BTC/ETH basis)

- superior form and function. The $1 denomination was key, instead of doing it on a NAV/PPS basis like typical funds

- risk management + building trust

Think there is a tremendous opportunity to build hundreds of product strategies here and at least a dozen very valuable businesses. TAM in 10-15 years is probably $500B-$1T at least. Most traditional asset managers will struggle with this (even the crypto friendly ones) because:

- unfamiliarity with DeFi/crypto market structure

- compliance risk/reward

@maplefinance is another great firm I put in this category. @upshift_fi and @MidasRWA also come to mind.

9,85K

Nick van Eck kirjasi uudelleen

i'm relieved this update is out re @katana yield. it has been weighing on me so much. it is borderline embarrassing that these APYs were not available on day 1.

i'll share the story here. most people will respond with the meme thanking me and letting me know that they won't read. for those who read, you'll get useful info.

a couple days before launching, we realized that our planned transition to mainnet from turtle vaults would result in no deposits being available anywhere for a few days. so we decided to keep them open during the weekend and then execute the transition from ethereum to mainnet on the same day with some risk on delaying the launch. although there were some delays, we got the chain launched and transitioned vault shares to users.

there was a problem. the underlying markets with sushi and morpho, which we had planned to seed over the weekend, now hadn't been seeded so there was no yield to be earned and we couldn't show any APYs because we pull our APYs from yearn but there was no APY to earn. so, we set the APYs "to come," which was the right decision since they weren't 0 but we didn't know what they were.

we expected to be able to show APYs quickly but yearn was limited in making its APYs available by other infrastructure providers and so we had nothing to pull from. after a couple weeks, yearn got APYs up but they couldn't be relied on. this isn't yearn's fault (they've been phenomenal). it is just that yearn needs to receive the yield from underlying pools and reward distributors to be able to show APYs that properly reflect the yield earned, so there is a delay.

eventually that delay was solved but there was another problem, a standard one for setting up an entirely new financial market. in our case the problem was as follows: yearn works by providing liquidity to both sushi and morpho. to generate the highest yield, yearn needs borrowers on morpho. for borrowers to come to morpho, the amount that is borrowable needs to be high enough. for amounts to be high enough to borrow, you need enough liquidity in sushi to liquidate positions when needed. to get enough liquidity in sushi, you need enough assets to create liquidity, including diversity of assets.

so we set out on finding borrowers and liquidity providers to sushi. this has been going well because we made good choices around assets to onboard and have concentrated the liquidity. but it takes time nonetheless. the good part is that things have been progressing well.

but the bad is that native yields were very low on katana in july. as the flywheel described above and the katana native flywheel that everyone knows well started kicking in, yields started to increase. we've seen it most on eth and started a little on stables and btc. this month we'll start seeing it increase quite a bit, and it should be stable in september.

turtle (working with us) had shown a ~5% APY on katana yield. technically, it was an estimate and anyone who knows crypto well knows that starting a new defi ecosystem is hard and the risk of lower yields in early days was real, which is the case, even though we hoped it wouldn't be.

so trying to figure out what we would do, we decided to do right by users who would have expected ~5% APY by ensuring at least 3% yield (instead of basically 0) using KAT if the stables APY did not hit at least 3% (different %s for other assets).

in addition to ensure users have a good experience on katana, we decided to offer the yield shown on the turtle app to everyone on the katana app. this means that that we are fixing the yields at specified amounts for now on the app.

as the ecosystem develops and real yields get to where we'd want them to be (and higher than on other chains as katana is designed to do), we will replace KAT yield with more of that real yield that everyone loves.

against the wish of some people who think i'm a lunatic for sharing too much, i'm attaching screenshots from a document we shared with liquidity providers who we know personally as an update on the ecosystem. this providers a complete picture of things.

i'm so excited that katana is picking up the steam it deserves and soon will have the fundamentals in place for the fun to begin. the katana team is absolutely amazing for grinding on this non-stop.

enjoy it samurais ⚔️

48,57K

There is a lot of OG DeFi/Stablecoin blood in the @withAUSD team courtesy of @samkazemian and @Frax, who always seem to be ahead of the curve on many elements in DeFi/Crypto.

This was one of the most fun and deep discussions I've had on a pod 👇

SOCKET1.8. klo 01.21

📺 SOCKET TV. Episode 5

We sat down with stablecoin experts @Nick_van_Eck (@withAUSD) and @samkazemian (@fraxfinance) to chat:

→ Hype around stablecoins

→ Key use cases and types

→ Stablecoins = the OG chain abstracted applications

Full convo with @0xrishabhai here:

5,45K

@withAUSD is bringing the cost of stablecoin infrastructure down dramatically.

Say goodbye to 8 figure up front costs just to have digital dollars on your chain.

Mikko Ohtamaa28.7.2025

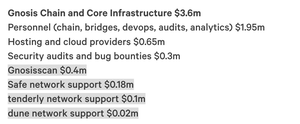

The cost of running the EVM chain, in terms of the external services cost needed, from Gnosis Chain:

- Etherscan $400k/year (other chains quote $1M/year)

- Tenderly $100/year

- Dune $20/year

- Server costs: $600k/year

From Gnosis DAO $35M budget allocation

422

As John says, every fintech (and more!) will launch branded stablecoins.

Agora is here to serve them @withAUSD out of the box!

John Wang19.7.2025

The GENIUS Act for stablecoins passed today. Two predictions:

1. Major banks will launch stablecoins surpassing the float of USDC/USDT (JPMD, Citi)

2. Every FinTech will launch branded stablecoins to capture treasury yield revenue (bullish @withAUSD for white-labeled stables)

13,06K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin