Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Marc, the Degen CEO of Polygon Labs (💜,⚔️, ※)

CEO at @0xPolygon Labs. Advisor @variantfund. Board @fund_defi. Formerly CLO @dYdX. Opinions are my own.

Marc, the Degen CEO of Polygon Labs (💜,⚔️, ※) kirjasi uudelleen

Katana is getting a lot of attention lately and I can see exactly why.

Yes, it's backed by giants like Polygon and GSR, but what really excites me is the way it’s built from the ground up

With the powerful idea of deep + usable liquidity.

I’ve used enough chains to know how frustrating it is when capital feels out of reach split across too many DEXs or protocols.

Katana flips that completely.

Instead of spreading liquidity thin, it brings everything together. And that changes the game.

It means that when I need access to capital, it's actually there.

Trades become smoother.

Protocols feel stronger.

And that kind of design gives me real confidence.

And honestly I think this is just the beginning.

Katana is building a great future , gkatana

1,2K

it is great to see Vitalik focusing on the user experience of L2s. it is clearly a better user experience to be able to to withdraw assets from a chain in under an hour rather than days. the key to making this happen is using zk proofs. this is one of the architectural decisions made on @katana that makes it better for defi than any other L2 since there is no need to wait days to withdraw assets.

this is all made possible because of the plonky3 proof system that we developed at @0xPolygon along with great work done by other teams like @StarkWareLtd and @RiscZero.

vitalik.eth7.8. klo 00.29

Amazing to see so many major L2s now at stage 1.

The next goal we should shoot for is, in my view, fast (<1h) withdrawal times, enabled by validity (aka ZK) proof systems.

I consider this even more important than stage 2.

Fast withdrawal times are important because waiting a week to withdraw is simply far too long for people, and even for intent-based bridging (eg. ERC-7683), the cost of capital becomes too high if the liquidity provider has to wait a week. This creates large incentives to instead use solutions with unacceptable trust assumptions (eg. multisigs/MPC) that undermine the whole point of having L2s instead of fully independent L1s.

If we can reduce native withdrawal times to under 1h short term, and 12s medium term, then we can further cement the Ethereum L1 as the default place to issue assets, and the economic center of the Ethereum ecosystem.

To do this, we need to move away from optimistic proof systems, which inherently require waiting multiple days to withdraw.

Historically, ZK proof tech has been immature and expensive, which made optimistic proofs the smart and safe choice. But recently, this is changing rapidly. is an excellent place to track the progress of ZK-EVM proofs, which have been improving rapidly. Formal verification on ZK proofs is also advancing.

Earlier this year, I proposed a 2-of-3 ZK + OP + TEE proof system strategy that threads the needle between security, speed and maturity:

* 2 of 3 systems (ZK, OP) are trustless, so no single actor (incl TEE manufacturer or side channel attacker) can break the proof system by violating a trust assumption

* 2 of 3 systems (ZK, TEE) are instant, so you get fast withdrawals in the normal case

* 2 of 3 systems (TEE, OP) have been in production in various contexts for years

This is one approach; perhaps people will opt to instead do ZK + ZK + OP tiebreak, or ZK + ZK + security council tiebreak. I have no strong opinions here, I care about the underlying goal, which is to be fast (in the normal case) and secure.

With such proof systems, the only remaining bottleneck to fast settlement becomes the gas cost of submitting proofs onchain. This is why short term I say once per hour: if you try to submit a 500k+ gas ZK proof (or a 5m gas STARK) much more often, it adds a high additional cost.

In the longer term, we can solve this with aggregation: N proofs from N rollups (plus txs from privacy-protocol users) can be replaced by a single proof that proves the validity of the N proofs. This becomes economical to submit once per slot, enabling the endgame: near-instant native cross-L2 asset movement through the L1.

Let's work together to make this happen.

16,5K

Marc, the Degen CEO of Polygon Labs (💜,⚔️, ※) kirjasi uudelleen

I hope you are ready for the $POL bullish reversal. After few months of accumulation it looks absolutely ready to smash the next targets.

I'm sure the OG followers will remember @0xPolygon , one of the fastest blockchains ever. Will play a key role among stablecoins 👌

32,44K

Marc, the Degen CEO of Polygon Labs (💜,⚔️, ※) kirjasi uudelleen

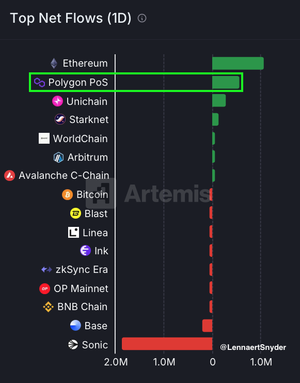

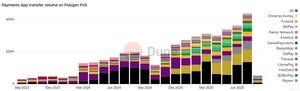

Some mind blowing stablecoin metrics on @0xPolygon

This is just the beginning, image the volumes once all the chains are unified leveraging @Agglayer interoperability.

Below is the growth of multiple payment apps transfers on @0xPolygon

Payment apps and card issuers

Moonpay, Transak, Ramp Network, Assetux, Revolut, Paytrie, Robinhood, Coinbase: Transfer, Zero Hash, RedotPay, Cypher, Holyheld, BasedApp, Lemon Cash, DePay, Wirex, BitPay, Nexo, Bitpanda, BlindPay, Bitso, Paxos, B2BinPay, OpolisPay, GamePayments, LlamaPay, Coinbase Commerce, Request Network, Bank Frick, Bybit Brazil, Topper(Uphold), Coinflow, Ripio Payments, Payeer, Cryptomus Payments, CryptoPay, Cobo, Ceffu Payments, IDRX, Fonbnk, Mercuryo, Avenia Pay, Buenbit and more will join.

Source: @obchakevich_ dune dashboards.

1,28K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin