Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Daniel Sempere Pico

I'll help you turn your business into a monopoly using your personal brand • Sold my offline business for geographic freedom and digital leverage.

This is one of the things that is undoubtedly different about this bitcoin bull cycle.

And the reasons why are fascinating...not sure anyone could have predicted we'd be where we are a few years ago.

Tomas Greif44 minuuttia sitten

One of the most shocking differences in this bitcoin bull market is that mining hardware prices have stayed remarkably flat.

Previous bull runs drove mining equipment prices to extreme premiums, but this cycle has been completely different. Since 2023, prices have remained essentially flat despite bitcoin climbing from $15K to $117K.

Four key factors explain why things are different this time.

1. Consolidated buyer power

The mining industry has matured into a small number of large-scale operations.

Previous bull markets did not see such a concentration of big buyers as we didn't have this concentration of mining companies.

Today's major miners have significant negotiating power and if one manufacturer isn't competitive on pricing, buyers have alternatives.

2. Bitmain finally has real competition

MicroBT has become genuinely competitive with Bitmain.

When you have two major players offering similar performance, neither can increase prices as easily as Bitmain could in the past when there weren't viable alternatives. MicroBT hardware has been deployed at scale by major miners like Riot.

Canaan has also come back with some decent miners, and there are new players like Auradine attempting to enter the space.

There are also rumours that Block will enter the mining hardware game with their own miner as soon as next week. Block subsidiary Proto Mining recently tweeted that they have a big announcement coming up on August 14th. Block is one of the few companies with a big enough brand and capital to compete with the incumbents.

3. Strategic low-margin warfare

Bitmain appears to be running a volume-based strategy, selling new generation miners at sub-$20 per terahash with razor-thin margins.

This could be intentional to maintain market dominance and push out emerging competitors.

It could also be that Bitmain needs to manufacture a certain volume of machines to maintain their position with TSMC, keeping their place on the priority list for chip access and best possible pricing. If they can't sell all the units they must produce to meet required chip buying volumes, self-mining becomes the alternative.

Just look at Cango, a publicly listed company that pivoted from an online car marketplace to a full-fledged Bitmain-backed self-mining operation, going from 0 to 50 EH/s from October 2024 to today.

4. Declining demand from miners themselves

Many miners are diversifying away from pure bitcoin mining.

MARA has openly stated they want to "activate their BTC to generate yield," investing their BTC in ways that will generate yield instead of adding further bitcoin mining hashrate.

Others like Iris and Riot are diversifying to AI/HPC

Some miners now view buying bitcoin directly as more profitable than mining it.

All of these are reducing overall demand for new hardware.

When you combine these factors with the massive capital requirements for new entrants (minimum $20M just to design a viable chip, hundreds of millions more to scale production), established players can afford to keep prices compressed while smaller challengers struggle to gain footing.

The result is that despite bitcoin's massive hashrate increase, mining margins for the large players remain healthy, helped by the increase in bitcoin price and the absence of sky-high hardware prices. This represents a more mature, rational market. but also one increasingly difficult for new mining hardware manufacturers to penetrate.

This structural shift may actually be healthy for bitcoin's long-term security model, as it prevents the boom-bust cycles in mining hardware availability that plagued past bull markets.

1,3K

Daniel Sempere Pico kirjasi uudelleen

One of the most shocking differences in this bitcoin bull market is that mining hardware prices have stayed remarkably flat.

Previous bull runs drove mining equipment prices to extreme premiums, but this cycle has been completely different. Since 2023, prices have remained essentially flat despite bitcoin climbing from $15K to $117K.

Four key factors explain why things are different this time.

1. Consolidated buyer power

The mining industry has matured into a small number of large-scale operations.

Previous bull markets did not see such a concentration of big buyers as we didn't have this concentration of mining companies.

Today's major miners have significant negotiating power and if one manufacturer isn't competitive on pricing, buyers have alternatives.

2. Bitmain finally has real competition

MicroBT has become genuinely competitive with Bitmain.

When you have two major players offering similar performance, neither can increase prices as easily as Bitmain could in the past when there weren't viable alternatives. MicroBT hardware has been deployed at scale by major miners like Riot.

Canaan has also come back with some decent miners, and there are new players like Auradine attempting to enter the space.

There are also rumours that Block will enter the mining hardware game with their own miner as soon as next week. Block subsidiary Proto Mining recently tweeted that they have a big announcement coming up on August 14th. Block is one of the few companies with a big enough brand and capital to compete with the incumbents.

3. Strategic low-margin warfare

Bitmain appears to be running a volume-based strategy, selling new generation miners at sub-$20 per terahash with razor-thin margins.

This could be intentional to maintain market dominance and push out emerging competitors.

It could also be that Bitmain needs to manufacture a certain volume of machines to maintain their position with TSMC, keeping their place on the priority list for chip access and best possible pricing. If they can't sell all the units they must produce to meet required chip buying volumes, self-mining becomes the alternative.

Just look at Cango, a publicly listed company that pivoted from an online car marketplace to a full-fledged Bitmain-backed self-mining operation, going from 0 to 50 EH/s from October 2024 to today.

4. Declining demand from miners themselves

Many miners are diversifying away from pure bitcoin mining.

MARA has openly stated they want to "activate their BTC to generate yield," investing their BTC in ways that will generate yield instead of adding further bitcoin mining hashrate.

Others like Iris and Riot are diversifying to AI/HPC

Some miners now view buying bitcoin directly as more profitable than mining it.

All of these are reducing overall demand for new hardware.

When you combine these factors with the massive capital requirements for new entrants (minimum $20M just to design a viable chip, hundreds of millions more to scale production), established players can afford to keep prices compressed while smaller challengers struggle to gain footing.

The result is that despite bitcoin's massive hashrate increase, mining margins for the large players remain healthy, helped by the increase in bitcoin price and the absence of sky-high hardware prices. This represents a more mature, rational market. but also one increasingly difficult for new mining hardware manufacturers to penetrate.

This structural shift may actually be healthy for bitcoin's long-term security model, as it prevents the boom-bust cycles in mining hardware availability that plagued past bull markets.

2,06K

Daniel Sempere Pico kirjasi uudelleen

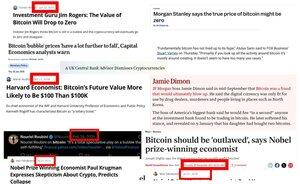

“BITCOIN IS GOING TO ZERO”

For 15 years, the “top” economists, bankers, and investors told you that.

They were all wrong: Nobel laureates, Wall Street CEOs, Ivy League professors.

I hope you didn’t listen.

List:

- Paul Krugman – Nobel Prize–winning Economist; NYT Columnist

- Joseph Stiglitz – Nobel Prize–winning Economist; Columbia University

- Nouriel Roubini – Economist; NYU Stern

- Jamie Dimon – CEO, JPMorgan Chase

- Robert Shiller – Nobel Prize–winning Economist; Yale University

- Warren Buffett – CEO, Berkshire Hathaway

- Jack Bogle – Founder, Vanguard Group

- Kenneth Rogoff – Harvard Economist; ex-IMF Chief Economist

- Atulya Sarin – Finance Professor, Santa Clara University

- Capital Economics – Macroeconomic Research Firm

- James Faucette – Executive Director, Morgan Stanley

- Prince Al-Waleed bin Talal – Chairman, Kingdom Holding Company

- Jim Rogers – Investor; Co-founder, Quantum Fund

- Alan Greenspan – Former Chairman, U.S. Federal Reserve

- Agustín Carstens – GM, BIS; ex-Governor, Bank of Mexico

- Ardo Hansson – Former Governor, Bank of Estonia; ex-ECB Council

- Stephen Poloz – Former Governor, Bank of Canada

- Charlie Munger – Vice Chairman, Berkshire Hathaway

- Peter Schiff – CEO, Euro Pacific Capital

- Sir Jon Cunliffe – Deputy Governor, Bank of England

4,06K

Agreed.

@PEoperator is a great follow.

Anthony Pompliano 🌪22 tuntia sitten

One of the best follows on here is @PEoperator

He constantly shares real-world, applicable leadership lessons related to operating a business.

This type of content is what makes this platform so valuable.

Highly recommend following him at @PEoperator

2,01K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin