Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

DeFi Voyager

🔍 DeFi Researcher & Investor

💡 Sharing my investment strategies, knowledge and hands-on expertise

Every token you buy is a vote and a trade-off

You’re not just clicking buttons. You’re saying yes to one thing and no to everything else.

That’s the part people forget.

They see a “cheap” token, or a project “early in its cycle,” and think they’re being smart.

But if your whole decision ends at “it’s undervalued” — then, yeah, you’re probably missing the point.

━━━━━━━━━━━━━━━

📌 The part most folks skip? → Alternatives

Buying Token A isn’t just about liking Token A.

It should also mean: “I looked at Tokens B, C, D… and A still felt like the strongest bet.”

But most people never get that far.

They stop thinking once they’re excited.

And then what happens?

They buy A… and literally the next day realize Token B was the better choice all along.

That’s not rare. That’s normal.

━━━━━━━━━━━━━━━

🔍 What real conviction actually looks like:

Before putting your money into anything, ask:

1. Is this token worth what I’m paying for it?

2. Do I believe, right now, that this is the best use of my capital compared to everything else I know?

If you can’t answer both with “hell yes”?

You’re not investing — you’re just guessing with confidence.

━━━━━━━━━━━━━━━

💡 Final thought and this one sticks:

It doesn’t really matter why you picked a token.

If there’s a clearly better option out there, your reasons don’t matter.

You made the wrong choice anyway.

So yeah — it’s always about the alternative.

That’s the part that separates the curious from the killers.

Choose like your capital has a cost. Because it absolutely does.

226

Looks like x(3,3) on @ShadowOnSonic just hit a wall.

The original game theory is gone. No more xSHADOW rewards, locks are still there, but now they’re pointless, no PvP rebases

What’s left? A generic DEX living off emissions, slowly diluting its own token.

From a unique long-term model to the same farm-and-dump cycle as everyone else.

That's sad.

403

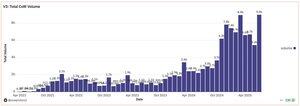

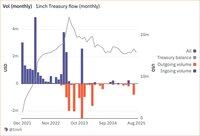

1inch Labs is starting to look like a really awkward family reunion - successful business at the table, broke tokenholders on the couch

And now they’re arguing over who should pay for dinner.

For real though, @1inch is crushing it as a DEX aggregator.

Top-tier execution, integrations everywhere, solid volume.

But somehow... tokenholders ( @1inchDAO ) are getting absolutely nothing out of that.

Like, zero. Nada. Not even exposure to revenues.

⚠️ Here’s what’s been happening:

– In Q2 2023, the DAO stopped collecting Fusion surplus fees (its main income)

– Since then, Treasury's just... draining

– No new inflows, no revenue, and yeah, it’s not a huge Treasury to begin with

– At current pace, it runs dry in about ~2 years

🪙 Meanwhile, team asks the DAO to fund their business trips:

$1.8M requested for “sponsored events” over the next 6 months.

Sounds fun… but tokenholders are expected to foot the bill.

And the business? Still not sharing profits.

That vote’s currently losing — by a mile.

This isn’t the first time a funding request gets shot down — it’s becoming a pattern.

But then something interesting popped up 👀

A new proposal suggests routing 100% of Fusion surplus fees + limit order taker fees back to the DAO Treasury.

That’s right — the very thing that used to fund the DAO... could come back.

📊 If it passes?

→ Over $5.3M/year in revenue

→ A treasury that actually grows

→ Tokenholders finally get exposure to real cash flows

→ $1INCH becomes a real rev-backed token

Meanwhile, CowSwap - 1inch's biggest competitor - is printing record volumes and collecting fees like it’s nobody’s business.

So yeah, 1inch DAO could finally wake up.

But for now? It’s still in denial.

You can either fund team vacations...

...or fix the damn incentives.

4,19K

It’s funny to watch the founders of @0xfluid & @AerodromeFi measuring d*cks.

I guess the best move for users would be to have both tokens in their portfolio?

Actually, no, the best move would be to have $HYPE & $PENDLE.

Samyak Jain 🦇🔊🌊5.8. klo 01.33

So Aerodrome which counts "ALL THE FEES" generated by LPs as revenue and send that fees to buyback AERO tokens to give those AERO tokens back to LP holders. Creating a confusing ponzinomics with tokens and tells that they earn the most revenue in the DEX space.

Pretty stupid comparison imo.

The only DEX (outside of Fluid) that I have huge respect for is Uniswap because it's a pure LP play, no ponzi tokenomics to keep the liquidity hooked to protocol. Liquidity is there because it's earning real fees out of it.

6,45K

2018 — the year I found ETH.

I had no clue what I was doing, but I kept mining anyway.

That mining rig?

Loud as a hairdryer, hot as an oven.

The room felt like 40°C. I’m serious — it was hard to breathe in there.

I’d leave it running all day and night.

While I was asleep.

While I was at work.

That thing could’ve burned my place down.

But I didn’t stop.

I was mining ETH and selling it for $300.

Didn’t know what a wallet really was.

Didn’t know what ETH was even used for.

Just saw coins coming in and thought, “Cool.”

Looking back, it was wild.

But honestly? That’s how I really got into crypto.

5,45K

I want to invest in $ENA, but I’m terrified of the massive unlocks and token emissions.

There’s a smoother, less stressful way to ride the wave. 👇

The smarter option: $PENDLE

Why?

@ethena_labs generates yield.

Pendle? It splits, packages, and sells that yield.

-> The better Ethena performs, the more activity Pendle gets.

And guess what? That activity = fees.

Real fees that go back to vePENDLE holders.

No unlock cliffs.

No inflation spiral.

No whales dumping on your head.

Just real, streaming rewards.

⚖️ Why @pendle_fi makes more sense (in terms of risk):

$ENA has over 3 years of unlocks ahead.

You’ll constantly be fighting sell pressure.

$PENDLE? Tokenomics are basically complete.

Tight supply, mostly already distributed.

Ethena is great, but ENA as an investment doesn't make sense now.

Pendle operates across chains, assets, and protocols.

More income streams = lower risk.

vePENDLE holders?

You don’t wait. You earn weekly.

So yeah, you’re already earning from Ethena by holding PENDLE.

But what if you still want ENA?

You’re not locked out of $ENA just because you’re not holding it.

If you’ve got vePENDLE, you can vote for @ethena_labs pools.

And guess what they do in return?

-> Airdrop $ENA tokens. Every epoch.

You vote → they pay → you stack $ENA without ever buying it directly.

TL;DR

- Ethena performs well → Pendle volume grows

- Pendle volume = more fees → vePENDLE holders earn

- No unlock stress

- You still get $ENA via voting rewards

- Oh, and Boros is coming 👀

So yeah… Ethena is great.

But Pendle?

Pendle is where you farm the farmer.

15,36K

DeFi Voyager kirjasi uudelleen

(1/11) Hyperliquid Valuation Framework: Update 🧵

It has been about 6 months since I initially posted my valuation framework for $HYPE. A lot has changed since then, but also much has remained true

I am as bullish on $HYPE as I have ever been

Let's walk through some numbers👇

195,37K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin