Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

1inch Labs is starting to look like a really awkward family reunion - successful business at the table, broke tokenholders on the couch

And now they’re arguing over who should pay for dinner.

For real though, @1inch is crushing it as a DEX aggregator.

Top-tier execution, integrations everywhere, solid volume.

But somehow... tokenholders ( @1inchDAO ) are getting absolutely nothing out of that.

Like, zero. Nada. Not even exposure to revenues.

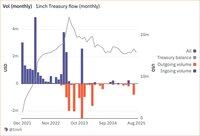

⚠️ Here’s what’s been happening:

– In Q2 2023, the DAO stopped collecting Fusion surplus fees (its main income)

– Since then, Treasury's just... draining

– No new inflows, no revenue, and yeah, it’s not a huge Treasury to begin with

– At current pace, it runs dry in about ~2 years

🪙 Meanwhile, team asks the DAO to fund their business trips:

$1.8M requested for “sponsored events” over the next 6 months.

Sounds fun… but tokenholders are expected to foot the bill.

And the business? Still not sharing profits.

That vote’s currently losing — by a mile.

This isn’t the first time a funding request gets shot down — it’s becoming a pattern.

But then something interesting popped up 👀

A new proposal suggests routing 100% of Fusion surplus fees + limit order taker fees back to the DAO Treasury.

That’s right — the very thing that used to fund the DAO... could come back.

📊 If it passes?

→ Over $5.3M/year in revenue

→ A treasury that actually grows

→ Tokenholders finally get exposure to real cash flows

→ $1INCH becomes a real rev-backed token

Meanwhile, CowSwap - 1inch's biggest competitor - is printing record volumes and collecting fees like it’s nobody’s business.

So yeah, 1inch DAO could finally wake up.

But for now? It’s still in denial.

You can either fund team vacations...

...or fix the damn incentives.

4,22K

Johtavat

Rankkaus

Suosikit