Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

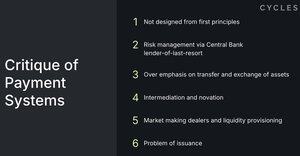

There’s a number of deep structural issues in modern payment systems.

Cycles addresses all of them. Lets break it down

1. Modern banking wasn’t designed from first principles. It was cobbled together in response to recurring liquidity and political crises, and has a highly fragile relationship to debt.

Instead, Cycles proceeds from 1st principles of accounting, observes all payments are cycles in a graph, and liquidity is a network property.

How do we find & create more cycles in the graph?

How do we clear the most debt for the most people with the least money?

2. Much risk management is focused around central banks as lenders/dealers of last resort. While useful for backstopping certain kinds of liquidity crises, this leads them to be captured by systemic risk and to compound moral hazard

Instead, Cycles focuses on risk-reduction mechanisms made possible by the graph and accessible to the general public, enabling them to use a wider variety of assets, credit, and clearing protocols to make liquidity-saving payments and reduce risk.

3. Much payments innovation is focused on asset transfer and exchange by individuals. A limited, bilateral, transactional view.

But the payment system has a network structure arising out of the web of obligations formed in the course of trade and finance.

Instead, Cycles takes an expansive, multilateral, network view. It optimizes over the graph to maximize flow, with results not otherwise possible.

It's about the network of liabilities, not the aggregate of assets.

Quality Theory over Quantity Theory of Money

4. Modern payments and finance often invoke intermediaries, counterparty substitution, and contract novation, which are associated with a higher regulatory burden and opaque transmutation of risk.

Think securitization, factoring, etc.

Instead, Cycles can reduce intermediaries and financial complexity by taking advantage of the existing network graph (e.g. trade credit obligations) and leveraging the more permissible legal structure of set-off notices under international private obligation law.

5. Liquidity in modern banking & blockchains is organized around market-making dealer intermediaries enriching themselves through liquidity provisioning.

Liquidity provisioning is a short volatility position associated with systemic risk.

Instead, Cycles is designed to optimize liquidity without such intermediaries, and is focused on liquidity saving via set-off notices.

Liquidity saving is a way to reduce systemic risk, and open new economic growth opportunities.

6. Payment systems must reckon with the problem of issuance, which arises when there is not enough liquidity in the system.

There is much to lament about modern issuance through commercial and central banks, no matter your school of economics, from Bagehot to Mises to Minsky.

Instead, Cycles leverages the obligation network as endogenous network liquidity to enable new forms of distributed issuance that improve the system’s overall liquidity.

Cycles is thus a platform for “network-aware” credit & issuance protocols

Cycles completely changes whats possible for capital-efficiency, risk management, and sustainable growth

Learn more in the paper:

2,49K

Johtavat

Rankkaus

Suosikit