Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

barnabe.eth

Shipping Protocol::Improve UX @ethereumfndn — research in public

barnabe.eth kirjasi uudelleen

Amazing to see so many major L2s now at stage 1.

The next goal we should shoot for is, in my view, fast (<1h) withdrawal times, enabled by validity (aka ZK) proof systems.

I consider this even more important than stage 2.

Fast withdrawal times are important because waiting a week to withdraw is simply far too long for people, and even for intent-based bridging (eg. ERC-7683), the cost of capital becomes too high if the liquidity provider has to wait a week. This creates large incentives to instead use solutions with unacceptable trust assumptions (eg. multisigs/MPC) that undermine the whole point of having L2s instead of fully independent L1s.

If we can reduce native withdrawal times to under 1h short term, and 12s medium term, then we can further cement the Ethereum L1 as the default place to issue assets, and the economic center of the Ethereum ecosystem.

To do this, we need to move away from optimistic proof systems, which inherently require waiting multiple days to withdraw.

Historically, ZK proof tech has been immature and expensive, which made optimistic proofs the smart and safe choice. But recently, this is changing rapidly. is an excellent place to track the progress of ZK-EVM proofs, which have been improving rapidly. Formal verification on ZK proofs is also advancing.

Earlier this year, I proposed a 2-of-3 ZK + OP + TEE proof system strategy that threads the needle between security, speed and maturity:

* 2 of 3 systems (ZK, OP) are trustless, so no single actor (incl TEE manufacturer or side channel attacker) can break the proof system by violating a trust assumption

* 2 of 3 systems (ZK, TEE) are instant, so you get fast withdrawals in the normal case

* 2 of 3 systems (TEE, OP) have been in production in various contexts for years

This is one approach; perhaps people will opt to instead do ZK + ZK + OP tiebreak, or ZK + ZK + security council tiebreak. I have no strong opinions here, I care about the underlying goal, which is to be fast (in the normal case) and secure.

With such proof systems, the only remaining bottleneck to fast settlement becomes the gas cost of submitting proofs onchain. This is why short term I say once per hour: if you try to submit a 500k+ gas ZK proof (or a 5m gas STARK) much more often, it adds a high additional cost.

In the longer term, we can solve this with aggregation: N proofs from N rollups (plus txs from privacy-protocol users) can be replaced by a single proof that proves the validity of the N proofs. This becomes economical to submit once per slot, enabling the endgame: near-instant native cross-L2 asset movement through the L1.

Let's work together to make this happen.

712,08K

barnabe.eth kirjasi uudelleen

🤖 New EIP: 0000

By:

- Anders Elowsson (@anderselowsson)

-Vitalik Buterin (@vbuterin)

🔗

EIP-0000 proposes a unified multidimensional fee market for Ethereum transactions, allowing users to specify a single aggregate `max_fee` for multiple resources. This aims to enhance capital efficiency by treating the `max_fee` as fungible across different resource types, thereby simplifying user experience and improving economic efficiency. The proposal also seeks to unify existing fee mechanisms and facilitate future expansions into additional resources.

94,47K

barnabe.eth kirjasi uudelleen

One month in at @ethereumfndn leading the new EF Enterprise team.

One thing is clear: Ethereum is the Liquidity Layer for the internet of value. It is the backbone of the onchain economy and the data speaks for itself:

→ 90% of RWAs live on Ethereum & L2s

→ DeFi TVL is 9x the next largest ecosystem

→ $170B in DEX volume (last 30 days on mainnet & L2)

→ $140B+ stablecoin TVL on mainnet

→ 60%+ of stablecoins are on Ethereum & L2s

Why are FIs, fintechs, etc choosing Ethereum?

→ 10 years of uninterrupted uptime

→ No single point of failure / no vendor lock-in (+ L2 optionality)

→ $130B+ in economic security

→ 1.1M+ validators, multi-client, genuine decentralization

→ Deepest onchain liquidity

→ Zero pay-to-play

Believe in somETHing.

54,92K

barnabe.eth kirjasi uudelleen

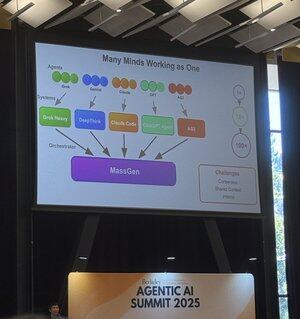

The 3 key challenges for multi-agent system design according to @Chi_Wang_ of Google DeepMind:

- Consensus

- Shared state

- Interop

Protocol designers and devs anything sounds familiar?!

The frontier of AI requires solving problems we’ve been facing for years in Ethereum. Lots of upcoming problems at the intersection of distributed systems and AI with huge impact.

5,57K

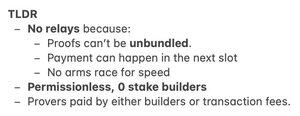

While the cryptography and engineering move at breakneck speed towards our zk future, so do the economics and protocol design to support wide and open markets

Julian29.7.2025

How should Ethereum pay provers?

A trustless in-protocol market is the most robust way.

In this new post, we show how to create such a market! See link below!

3,77K

barnabe.eth kirjasi uudelleen

While everybody's always got thoughts on Ethereum, not everyone's as informed about where we're actually headed. So let's change that.

We're bringing you an exciting session with our friends at @ProtocolGuild (aka core Ethereum devs + researchers) about the Glamsterdam forks.

We've got @trent_vanepps and @arlery to lead the convo with:

@barnabemonnot repping reducing block latency (to reduce Ethereum's slot time from 12 seconds to 6 seconds)

@soispoke repping FOCIL (to improve censorship resistance)

@nero_eth repping delayed execution and block-level access lists

@tbenr repping ePBS. decoupling of the consensus block from the execution payload)

Which path should the Glamsterdam upgrade take?

The technical roadmap determines everything. Join us to learn more about it.

Wednesday (tomorrow) @ 2 pm UTC / 10 am EDT

5,43K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin