Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Alexander Grieve

VP of Government Affairs @paradigm | fmr. @the_DTCC @SpeakerBoehner | the revolution will be tokenized 🇺🇸

Alexander Grieve kirjasi uudelleen

A major force behind the market structure bill is fear of "Gensler 2.0" if the SEC changes hands. Legislation now can protect the industry later.

But it's pointless if it doesn't address DOJ. Without full developer protections and a Section 1960 fix, "Garland 2.0" will be fatal.

5,45K

Alexander Grieve kirjasi uudelleen

President Trump signed two important Executive Orders relevant to the crypto community today:

“Guaranteeing Fair Banking for All Americans” prevents the denial of banking services based on political beliefs, religious beliefs, or lawful business practices. This means unfair censorship campaigns, like the debanking of conservatives or Operation Chokepoint 2.0, can never happen again.

“Democratizing Access to Alternative Assets for 401(k) Investors” will allow more than 90 million American workers, whose retirement accounts are currently limited, to access the same range of alternative assets (including digital assets) that are available to government workers, for better returns and diversification.

Thank you, President Trump, for guaranteeing greater fairness and freedom in our financial system!

552,96K

Alexander Grieve kirjasi uudelleen

1/ Earlier this week, we submitted a letter on Senate Banking's Market Structure RFI. We're proud to work with our friends @danrobinson, @JBSDC & @AlexanderGrieve at @Paradigm, as well as our co-signatories at @Chainlink, @ElectricCapital, @GalaxyHQ, @RibbitCapital & @TribeCap.

9,01K

Alexander Grieve kirjasi uudelleen

What @danrobinson said.

If regulatory clarity just involves replacing the current inscrutable regime that no one can register under or operate in with another complex regime that requires a phalanx of lawyers & millions of dollars to comprehend, this exercise will have failed.

2,3K

When crafting a durable regulatory regime for crypto, details matter and simplicity for founders is paramount. This week, @paradigm and our friends at @multicoincap, @RibbitCapital, @galaxyhq, @chainlink, @ElectricCapital, and @tribecap filed a joint letter underscoring this. 👇🏼

Dan Robinson7.8. klo 23.38

We sent a letter this week to the Senate Banking Committee, in response to their draft of crypto market structure legislation.

On the critical question of which tokens should be regulated as securities, the Senate's draft takes a very different approach from the CLARITY Act that was already passed in the House.

We think the Senate's approach—"ancillary assets"—is better for crypto.

While both bills are an improvement on the Howey-based regime—which is notoriously difficult to apply and creates toxic perverse incentives for issuers—the Senate draft is significantly simpler, and avoids forcing decentralized tokens and protocols to fit themselves into an inflexible legislative framework.

Instead, it protects against abuse with a simple exclusion—assets that come with legal rights to specified financial interests do not qualify as ancillary assets.

As we explain in the letter, we think this is the cleanest test that protects decentralized crypto assets while preventing traditional securities issuers from improperly taking advantage of this framework.

2,65K

Alexander Grieve kirjasi uudelleen

We sent a letter this week to the Senate Banking Committee, in response to their draft of crypto market structure legislation.

On the critical question of which tokens should be regulated as securities, the Senate's draft takes a very different approach from the CLARITY Act that was already passed in the House.

We think the Senate's approach—"ancillary assets"—is better for crypto.

While both bills are an improvement on the Howey-based regime—which is notoriously difficult to apply and creates toxic perverse incentives for issuers—the Senate draft is significantly simpler, and avoids forcing decentralized tokens and protocols to fit themselves into an inflexible legislative framework.

Instead, it protects against abuse with a simple exclusion—assets that come with legal rights to specified financial interests do not qualify as ancillary assets.

As we explain in the letter, we think this is the cleanest test that protects decentralized crypto assets while preventing traditional securities issuers from improperly taking advantage of this framework.

93,97K

Alexander Grieve kirjasi uudelleen

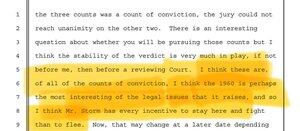

Here is Judge Failla in the Storm case this afternoon:

"I think the stability of the verdict is very much in play... I think the 1960 [charge] is perhaps the most interesting of the legal issues..."

This is absolutely NOT over - the government's overreach here will not stand.

25,99K

Alexander Grieve kirjasi uudelleen

The Biden-Garland DOJ went after Roman for writing neutral code that criminals used for their own criminal purposes - true of literally every product from cars to phones. This case is a serious threat to innovation.

Time to shut down the Biden-Garland war on crypto.

7,6K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin