Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Mr. Lin | Pendle Maxi 🧸

@pendle_fi addictooor | Occasionally whips up some DeFi contents

Mr. Lin | Pendle Maxi 🧸 kirjasi uudelleen

Feel more confident that USDe will become a $50b+ asset in the next 3yrs than if you had asked me if we would get to $10b when we first launched.

To date we have minted & redeemed $18b+ in supply returning $450m+ in cash rewards to (s)USDe users without a single basis point of loss.

Hard to put into words how grateful we are for every single dollar that has helped to bootstrap us to this milestone.

Without you Ethena would be nothing; and I would be no one.

58

Mr. Lin | Pendle Maxi 🧸 kirjasi uudelleen

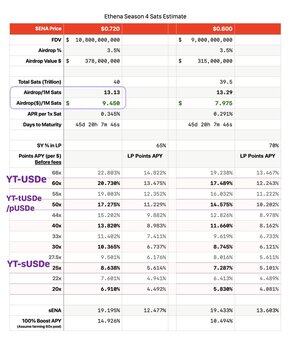

In less than two weeks, $ENA has skyrocketed again…🥹 Immediately updating @ethena_labs Season 4 Sats points exchange rate, points value/annualized calculation table.

From the table, based on the latest points emission rate, every 1M points can ultimately be exchanged for about ~13 coins or approximately ~$9.4 (assuming ENA@$0.72).

For example, in the Pendle market with 60x Sats of $USDe, the annualized points return is about 20.7%, plus a 10% Loyalty bonus makes it 22.8%.

(The calculation sheet does not consider transaction fees and YT cut fees, so you can apply a ~5% discount to the exchange rate.)

~

Current YT quotes in the Ethena system:

*The cost of 60x YT-USDe is 13.2%.

*The cost of 50x YT-tUSDe is 13.4%, and YT-pUSDe is 13.1%.

*The cost of 25x YT-sUSDe is 10.6% (this YT provides about 5-9% base interest, depending on Ethena's funding fee income).

~

❋ How to calculate the expected yield of YT?

On the YT trading page, find the green calculator icon next to the Swap button and click it to bring up the Calculator screen: Enter the Input amount, then enter your expected **future average** cash yield + points yield annualized, and click Calculate to simulate the **current market price** reference profit and loss value for buying YT.

For example, if the expected YT-USDe points yield is 21% (this YT has only points yield with no cash yield), then buying $100 YT at the implied APY of 13.2% at the time of writing would yield a final airdrop return of about ~$162.7, so the Net Profit would be about ~$62.7 or ROI = 62.7% 🔥

Please note that the calculator's results are for reference only. In reality, the final points yield rate can change at any time.

The calculation results provided by the calculator have deducted all fees from the yield.

@pendle_fi @PendleIntern

41,02K

Halfway mark from 14b

But thats just for 2025

@pendle_fi

Mr. Lin | Pendle Maxi 🧸17.1.2025

4. How would Ethena's growth directly impact Pendle V2's TVL?

Currently, 50% of Pendle's TVL is attributable to Ethena-related assets.

⅓ of Ethena's TVL is on Pendle.

Take Ethena's target growth of $25B, and 1/3 of this would be $8.33B.

Ethena's target growth would at least push Pendle's TVL over $10B.

Meaning Ethena alone would EASILY send $PENDLE to > $10.

But with Pendle Boros, we're not stopping at $10.

2,48K

Wrote my @boros_fi prediction + thesis back in January

Glad to see Boros finally taking off as predicted

I'll retweet this one last time when $PENDLE hits $40

JOB'S NOT DONE

Mr. Lin | Pendle Maxi 🧸17.1.2025

What if I told you Pendle Boros will achieve...

👉 Over $40B in TVL,

👉 Consistent annual revenue of at least $246M,

👉 Over $2B in daily trading volume,

👉 and $PENDLE will surpass $40.

w/ aid of Ethena's 2025 roadmap, I'm able to tell you EXACTLY my thesis on Boros.

🧵👇

2,08K

Mr. Lin | Pendle Maxi 🧸 kirjasi uudelleen

How can Ethena leverage delta-neutral through Boros?

Boros, a DeFi primitive product launched 2 days ago, enables financial institutions and delta-neutral products to tailor benefits for strategies.

Simplify this in case @ethena_labs uses @boros_fi to sustain yield in market downturns.👇

5,51K

Mr. Lin | Pendle Maxi 🧸 kirjasi uudelleen

"Boros: The Art of Decentralized Interest Rate Trading"

---Preface---

Boros @boros_fi is a rate derivatives platform developed by the @pendle_fi team over nearly two years, bringing a new yield trading tool to the DeFi ecosystem.

It currently focuses on trading funding rates, with plans to support more types of yields in the future.

📚This article will step by step analyze the core logic of Boros—from the operation principles of funding rates, the core concepts and terminology of Boros, the valuation method of Implied APR, to how to construct efficient arbitrage and hedging strategies.

---Main Text---

1. Breaking Down the Funding Rate Mechanism💡

1. Traditional Futures Contracts: The Game of Time and Expectations📜

Traditional futures contracts have a clear expiration date. Upon expiration, both parties must fulfill their delivery obligations. Due to the existence of time value (the time cost of capital) and market expectations (views on future supply and demand), futures prices often differ from spot prices (basis). For example, if the market generally expects a certain commodity to be in short supply in the future, its futures price will often be higher than the spot price.

Although many contracts now use cash settlement, the "expiration date" mechanism itself provides an anchor for futures prices, causing them to gradually converge towards the spot price as expiration approaches. This price convergence process reflects changes in holding costs and market expectations.

2. The Anchoring Secret of Perpetual Contracts: Funding Rate🔁

Perpetual contracts eliminate the fixed expiration date. To ensure that contract prices do not deviate significantly from spot prices for long periods, a funding rate mechanism is introduced:

➕ Positive funding rate: Long positions need to pay fees to short positions.

➖ Negative funding rate: Short positions need to pay fees to long positions.

Funding rates are typically settled every 8 hours (Hyperliquid settles once per hour), and their level is mainly determined by the degree of deviation between contract prices and spot prices. Simply put, the stronger the market's bullish sentiment, the higher the likelihood that the funding rate will turn positive and increase.

2. Delving into the Boros System🧭

2.1 Core Unit: YU (Yield Unit)🪙

In Boros, 1 YU represents the total funding rate yield stream you can earn by holding 1 unit of the underlying asset (like ETH) on a specific exchange (like Binance).

For example: In the ETHUSDT-Binance market, 1 YU equals all the yields obtainable from holding 1 ETH on Binance.

Based on this basic unit, Boros has created an interest rate swap market that users can utilize for:

🔹🔐 Hedging risk: Converting floating funding rates into fixed rates

🔹📣 Expressing views: Betting on the future trend of funding rates

🔹🧮 Executing arbitrage: Locking in cross-market interest rate differentials

2.2 Two Key Rates💱

🔹Implied APR -> The market's implied fixed annualized yield

🔹Underlying APR -> The actual floating funding rate annualized yield generated by the exchange

From a trading logic perspective:

🟢 Going long on YU (similar to YT):

Pay Implied APR

Receive Underlying APR

Long condition: Expect Underlying APR > Implied APR

🔴 Going short on YU (similar to PT):

Pay Underlying APR

Receive Implied APR

Short condition: Implied APR > Expected Underlying APR

2.3 Practical Example 🎯

Assumption:

The actual average Underlying APR (actual funding rate) for Binance ETHUSDT: 10%

The Implied APR on Boros (market implied fixed rate): 7%

Contract expiration time: 49 days

Your position: 10 YU

Action: Go long on YU.

Result:

Fixed payment: 0.09511 ETH (approximately 361 USD)

Floating gain: 0.1342 ETH

📊 ROI: 41% | 🚀 Annualized yield (APY): 300%

3. Advanced: Implied APR <-> Basis📐

It is recommended to refer to the Basis to price Implied APR (Figure 1 shows the basis, which is the relationship between the Fixed rate and the funding rate). Even in ideal circumstances, the Implied APR will not align with the Underlying APR before the expiration date; the closer it gets to the expiration date, the closer the two will be.

For its pricing, if any friends are interested, I will publish a separate article to discuss it later.

4. Practical Strategies: Arbitrage and Hedging🛠️

👉Strategy One [Speculative Strategy, more volatile than memes]

When there is a significant divergence between Implied APR and expected Underlying APR:

Scenario A [Reversion]: Implied APR (12%) > Underlying APR (8%)

Action: Go short on YU. Lock in this 4% fixed price differential profit.

Scenario B [Natural Leverage]: Implied APR (5%), but a certain meme's expected Underlying APR (40%)

Action: Go long on YU. Capture the increase in funding rates during the meme's rise.

Risk: Note that this strategy is coin-based.

👉Strategy Two [Constructing a Delta Neutral Funding Rate Yield Strategy]

In Boros: Go long on YU (betting on rising funding rates).

In CEX: Go short on an equivalent perpetual contract (which requires paying the funding rate).

Combined effect: If the actual funding rate is higher than the Implied APR on Boros, then this combination can generate net income while hedging against spot price volatility.

Looking forward to Boros launching a U-based market in the future.

👉Strategy Three [Cross-Platform Triangular Arbitrage]

Check funding rates across multiple platforms:

In exchanges with high funding rates (like Binance): Go short on perpetual contracts (receive high funding rates).

In Boros: Go short on the corresponding YU (lock in fixed income, hedging the risk of going short on Binance).

In exchanges with low funding rates (like Bybit): Go long on equivalent perpetual contracts (pay low funding rates, forming a hedge).

Goal: Earn the net profit margin between Binance's high funding rates, Boros's short income, and Bybit's low funding rate payments.

---Conclusion---

Boros! Just do it!

I will continue to update Boros articles and videos in the future~

@ViNc2453 @kevin0x0 @pendle_grandma"

17,12K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin