Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

ViNc | Pendle Sensei 🌸

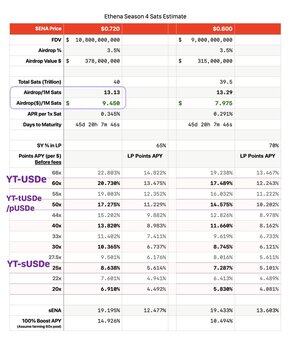

In less than two weeks, $ENA has skyrocketed again…🥹 Immediately updating @ethena_labs Season 4 Sats points exchange rate, points value/annualized calculation table.

From the table, based on the latest points emission rate, every 1M points can ultimately be exchanged for about ~13 coins or approximately ~$9.4 (assuming ENA@$0.72).

For example, in the Pendle market with 60x Sats of $USDe, the annualized points return is about 20.7%, plus a 10% Loyalty bonus makes it 22.8%.

(The calculation sheet does not consider transaction fees and YT cut fees, so you can apply a ~5% discount to the exchange rate.)

~

Current YT quotes in the Ethena system:

*The cost of 60x YT-USDe is 13.2%.

*The cost of 50x YT-tUSDe is 13.4%, and YT-pUSDe is 13.1%.

*The cost of 25x YT-sUSDe is 10.6% (this YT provides about 5-9% base interest, depending on Ethena's funding fee income).

~

❋ How to calculate the expected yield of YT?

On the YT trading page, find the green calculator icon next to the Swap button and click it to bring up the Calculator screen: Enter the Input amount, then enter your expected **future average** cash yield + points yield annualized, and click Calculate to simulate the **current market price** reference profit and loss value for buying YT.

For example, if the expected YT-USDe points yield is 21% (this YT has only points yield with no cash yield), then buying $100 YT at the implied APY of 13.2% at the time of writing would yield a final airdrop return of about ~$162.7, so the Net Profit would be about ~$62.7 or ROI = 62.7% 🔥

Please note that the calculator's results are for reference only. In reality, the final points yield rate can change at any time.

The calculation results provided by the calculator have deducted all fees from the yield.

@pendle_fi @PendleIntern

ViNc | Pendle Sensei 🌸25.7.2025

Zero nonsense, direct bookmarking

It's $ENA's the turn of the explosion again

Update the @ethena_labs Q4 Points Value/Annualized Statement now

The following is a trial calculation of $ENA = $0.55 / $0.45

Every 1M cent can be exchanged for about 15 coins or equal to ~$8 (ENA@$0.55)

The $USDe market for 60x Sats on Pendle is about 17.8% annualized

46,89K

ViNc | Pendle Sensei 🌸 kirjasi uudelleen

🧐 Can the funding rate also be used to speculate? Pendle Boros Measured Guide: Unlock New Ways to Engage in Interest Rate Trading!

For a long time, the funding rate has only been a supporting role, and it has always been market regulation and passive acceptance.

I never expected that one day the funding rate would also be split and turned into an independent asset that could be traded separately - this thing was really made by Pendle.

@pendle_fi The latest lab project, Boros @boros_fi, a platform focused on funding rate trading, has just been launched.

After spending most of my days researching, I found that it is a real "interest rate DEX". With a good play, this thing has a lot of potential.

Below I will try to explain the meaning of Boros in a popular way and how to play it -

1️⃣Boros Core Mechanism: How to Tokenize Funding Rates?

Anyone who has played contracts knows that the funding rate is the core mechanism for adjusting the long-short balance in perpetual contracts:

Positive rate → Long pays short positions

Negative Rates → Shorts pay longs

The problem is that it has been floating, like the rain that farmers rely on to eat, sometimes more and less, making the cost of the position full of uncertainty.

Boros' approach is to cast this "floating rainwater" into tradable "income assets".

The core unit of Boros is called Yield Units (YU).

You can think of it as: holding 1 BTC perpetual contract, the funding rate cash flow receivable over a certain period of time. Like what:

Holding 1 YU-BTC (1 month) is equivalent to the funding rate income generated by buying 1 BTC perpetual contract in the next 1 month.

Long YU = Pay a fixed APR (Implied APR) to obtain the floating funding rate income of the underlying asset. The actual rate is higher than the fixed rate → profitable; Otherwise, it will be a loss.

Short YU: Charges a fixed APR that pays the cost of the underlying asset's floating funding rate. If the actual rate is lower than the fixed rate→ profit; Otherwise, it will be a loss.

The settlement frequency is synchronized with the exchange, and the value of YU is reset to zero after expiration, and profits and losses are automatically settled.

For example, it's more intuitive:

Assuming the current $BTC price is $100,000 and the Binance funding rate is 6% annualized, you have long 10 YU-BTC on Boros with a 6% YU-APR.

After 8 hours, the funding rate rises to 8%;

Your earnings = Notional value × (actual APR - fixed APR) × time = 10 × 100,000 × (8%-6%) / 365 / 3 = 18 USDT

You will find that the profit and loss here have nothing to do with the price of the underlying asset itself, but are completely a game of interest rates.

2️⃣Why Boros? Where is its market?

You may ask: If you speculate in currency, why should someone speculate on the funding rate? This thing sounds like there is no market!

Miss by a mile. The answer is simple: fluctuations in funding rates are far more violent than you might think, and they are the norm.

🔸The BTC/ETH perpetual contract funding rate often fluctuates between -3% → +6%

🔸 In a high-leverage structure, a 3% spread can be magnified to 50%+ returns

🔸 For stablecoin protocols (such as Ethena), high-frequency arbitrageurs, and pegged asset minters, the funding rate is the core source of profit.

In the past, the way to deal with funding fee fluctuations was either hard eating or using complex multi-legged hedging (spot + perpetual + delta neutral + OTC settlement) - the threshold was too high for ordinary people to play at all.

And Boros is "securitizing" the funding rate for the first time, much like the expected trend you are trading U.S. Treasury yields:

You think the funding rate will rise in the future → long YU, locking in the low APR you want to spend now

You feel that the market sentiment will turn bearish, and the funding rate will drop → short YU, locking in the high APR you want to charge now

3️⃣Who is suitable for Boros?

In fact, it can be understood from the mechanism of Boros that this is not a platform for speculative novices, but it should be very attractive to the following types of people:

1) Spot + Futures Traders: Hedging funding rate costs/benefits

For example, if you open a long position in 100 BTC perpetuals on Binance, and see the funding rate rise from 0.1% to 0.3%, you want to lock in interest expenses.

→ Then you can go long on Boros and YU-BTC and lock in a fixed APR to hedge against this cost fluctuation.

On the other hand, if you want to short BTC and want to take advantage of the funding rate, but are afraid that the market will pick up tomorrow and the funding rate will fall, you can short YU-BTC to lock up your gains.

The essence of this approach is to turn the floating risk of funding rates into predictable costs.

2) Spread trader / DeFi structured player

Boros can also do delta-neutral strategies, such as:

You hold Lido's ETH (get 4% APY) while shorting ETH perpetuals on Binance (hedging price risk), then short YU-ETH on Boros, locking in funding rate income.

This combination operation can generate a stable high-interest note: pledge interest + funding rate arbitrage, not relying on ETH price, only eating structural spreads.

This is a pure positive for an income-generating stablecoin issuer like Ethena, and there are too many things that can be done with Boros.

A few other points to note when using Boros -

(1) You can open a position with a margin of 1-2%, it is recommended not to add leverage in the early stage, and then enlarge it after you are familiar with the net balance mechanism.

(2) Liquidation will be triggered when the margin ratio is lower than the maintenance margin.

(3) It is best to close or roll over the position a few days before expiration to avoid the expansion of capital-intensive slippage / stepping on the liquidity pit.

(4) Remember to keep an eye on the Implied APR, which is actually YU's price expectation.

(5) In addition to direct trading, users can deposit funds into the Boros vault to provide liquidity for the market, earn trading fee shares, PENDLE token rewards, and increase in the value of the vault, with the current LP interest rate up to 460%. However, the risk characteristics of vault positions are similar to long YU, and if the implied APR decreases, it may face higher impermanent losses, so it is only recommended to study DeFi old birds and try it!

4️⃣ Conclusion -

In the past, we traded coins to make fluctuating money;

Now we trade interest rates to hedge structural risks and make more stable money.

Pendle originally split the yield right into PT/YT, opening the prologue to the on-chain interest rate market.

Now, Boros has further structured the black box variable of the funding rate into an independent asset that can be priced, traded, and derived.

The future imagination behind this lies in -

📍 May support funding rates on more exchanges: OKX, Bybit, Hyperliquid

📍 Cover more cross-chain assets: long-tail coins such as SOL, ARB, OP, etc

📍 Introducing real-world RWA interest rate products to become an interest rate bridge for TradFi-DeFi

At that time, stablecoins, yield notes, hedge funds, and even interest rate strategies of traditional institutions may directly call Boros' YU as an anchor, which is quite interesting to think about!

Finally, I would like to offer a more practical suggestion for all those who are new to Pendle Boros and want to know about Pendle Boros -

If you don't dare to open a position directly, you might as well try shadow hedging first:

Open a small perpetual long order on CEX, such as 0.001 BTC, and then go long on YU-BTC on Boros 1:1 (or both open short at the same time) to observe the changes in capital flow on both sides and familiarize yourself with the UI and settlement mechanism.

In this way, even if you lose very little, you can quickly get started with the logic of the entire funding rate transaction.

You can learn the relevant operations of Boros first:

The Pendle community has also opened a new Boros communication channel, you can ask any questions:

23,92K

ViNc | Pendle Sensei 🌸 kirjasi uudelleen

$PENDLE just hit ATH in TVL & the PA has been following it. There's a reason why👇

While others chase quick gains, @pendle_fi built the infra for yield trading. They turned complex DeFi mechanics into something that actually works.

The result?

➠ 1600%+ fee growth in 30 days

➠ Launched the most anticipated @boros_fi

➠ Became the go to platform for institutional yield strategies

Currently I’m farming @pendle_fi LPs across 3 solid protocols to get yields + points before a potential airdrop.

1/ @FalconStable LP USDf (173 days left)

On LP USDf I’m getting 12.5% APY + 60x point multiplier compared to 6x from holding USDf directly

2/ @Terminal_fi LP tUSDe (47 days left)

➠ Terminal doesn't offer yield on tUSDe deposits. Only 30x Terminal points + 30x Ethena points

➠ LP tUSDe gives 7.6% APY + 60x Terminal points + 30x Ethena points

3/ @strata_money pUSDe LP (68 days left)

➠ Strata has no native yield. Only 30x Strata points + 30x Ethena points

➠ LP pUSDe provides 6.52% APY + 60x Strata points + 50x Ethena points

@pendle_fi made the boring tech win by providing yields!

15,56K

Friendship forwarding, @sigmadotmoney is a friendly fork of F(x) @protocol_fx. F(x) started with the method of separating the volatility of volatile coins to create stablecoins, and now it has come to the BNB ecosystem.

Its $bnbUSD stability pool has been packaged and listed on @pendle_fi. Currently, the fixed interest rate for PT is over 17%, while YT is mining Sigma points.

Sigma has been audited by Slow Mist, and you can find a detailed project introduction in @CryptoCharming1's post:

Sigma.Money6.8. klo 20.17

We're excited for a new era of composability!

$bnbUSD & $USDT on @BNBCHAIN are now live for yield trading on Pendle!

We're excited to share how @sigmadotmoney leverages @pendle_fi and what this means for $BNB holders and stablecoin yield chasers!

Let's dive in 👇

8,97K

ViNc | Pendle Sensei 🌸 kirjasi uudelleen

The price performance of $PENDLE has been lagging, and there are three reasons supporting the surge of Pendle:

1. The ETH exchange rate has hit bottom, creating a demand for recovery;

2. ETH is performing strongly, with good funding rates ➡️ $ENA is performing well, attracting funds to USDe-related assets ➡️ Pendle's TVL and trading volume are rising;

3. Currently, while Boros is not yet perfect, the foundation has been laid, and the team will continue to deliver, with a high ceiling, waiting for the right timing and conditions.

22,21K

ViNc | Pendle Sensei 🌸 kirjasi uudelleen

"Boros: The Art of Decentralized Interest Rate Trading"

---Preface---

Boros @boros_fi is a rate derivatives platform developed by the @pendle_fi team over nearly two years, bringing a new yield trading tool to the DeFi ecosystem.

It currently focuses on trading funding rates, with plans to support more types of yields in the future.

📚This article will step by step analyze the core logic of Boros—from the operation principles of funding rates, the core concepts and terminology of Boros, the valuation method of Implied APR, to how to construct efficient arbitrage and hedging strategies.

---Main Text---

1. Breaking Down the Funding Rate Mechanism💡

1. Traditional Futures Contracts: The Game of Time and Expectations📜

Traditional futures contracts have a clear expiration date. Upon expiration, both parties must fulfill their delivery obligations. Due to the existence of time value (the time cost of capital) and market expectations (views on future supply and demand), futures prices often differ from spot prices (basis). For example, if the market generally expects a certain commodity to be in short supply in the future, its futures price will often be higher than the spot price.

Although many contracts now use cash settlement, the "expiration date" mechanism itself provides an anchor for futures prices, causing them to gradually converge towards the spot price as expiration approaches. This price convergence process reflects changes in holding costs and market expectations.

2. The Anchoring Secret of Perpetual Contracts: Funding Rate🔁

Perpetual contracts eliminate the fixed expiration date. To ensure that contract prices do not deviate significantly from spot prices for long periods, a funding rate mechanism is introduced:

➕ Positive funding rate: Long positions need to pay fees to short positions.

➖ Negative funding rate: Short positions need to pay fees to long positions.

Funding rates are typically settled every 8 hours (Hyperliquid settles once per hour), and their level is mainly determined by the degree of deviation between contract prices and spot prices. Simply put, the stronger the market's bullish sentiment, the higher the likelihood that the funding rate will turn positive and increase.

2. Delving into the Boros System🧭

2.1 Core Unit: YU (Yield Unit)🪙

In Boros, 1 YU represents the total funding rate yield stream you can earn by holding 1 unit of the underlying asset (like ETH) on a specific exchange (like Binance).

For example: In the ETHUSDT-Binance market, 1 YU equals all the yields obtainable from holding 1 ETH on Binance.

Based on this basic unit, Boros has created an interest rate swap market that users can utilize for:

🔹🔐 Hedging risk: Converting floating funding rates into fixed rates

🔹📣 Expressing views: Betting on the future trend of funding rates

🔹🧮 Executing arbitrage: Locking in cross-market interest rate differentials

2.2 Two Key Rates💱

🔹Implied APR -> The market's implied fixed annualized yield

🔹Underlying APR -> The actual floating funding rate annualized yield generated by the exchange

From a trading logic perspective:

🟢 Going long on YU (similar to YT):

Pay Implied APR

Receive Underlying APR

Long condition: Expect Underlying APR > Implied APR

🔴 Going short on YU (similar to PT):

Pay Underlying APR

Receive Implied APR

Short condition: Implied APR > Expected Underlying APR

2.3 Practical Example 🎯

Assumption:

The actual average Underlying APR (actual funding rate) for Binance ETHUSDT: 10%

The Implied APR on Boros (market implied fixed rate): 7%

Contract expiration time: 49 days

Your position: 10 YU

Action: Go long on YU.

Result:

Fixed payment: 0.09511 ETH (approximately 361 USD)

Floating gain: 0.1342 ETH

📊 ROI: 41% | 🚀 Annualized yield (APY): 300%

3. Advanced: Implied APR <-> Basis📐

It is recommended to refer to the Basis to price Implied APR (Figure 1 shows the basis, which is the relationship between the Fixed rate and the funding rate). Even in ideal circumstances, the Implied APR will not align with the Underlying APR before the expiration date; the closer it gets to the expiration date, the closer the two will be.

For its pricing, if any friends are interested, I will publish a separate article to discuss it later.

4. Practical Strategies: Arbitrage and Hedging🛠️

👉Strategy One [Speculative Strategy, more volatile than memes]

When there is a significant divergence between Implied APR and expected Underlying APR:

Scenario A [Reversion]: Implied APR (12%) > Underlying APR (8%)

Action: Go short on YU. Lock in this 4% fixed price differential profit.

Scenario B [Natural Leverage]: Implied APR (5%), but a certain meme's expected Underlying APR (40%)

Action: Go long on YU. Capture the increase in funding rates during the meme's rise.

Risk: Note that this strategy is coin-based.

👉Strategy Two [Constructing a Delta Neutral Funding Rate Yield Strategy]

In Boros: Go long on YU (betting on rising funding rates).

In CEX: Go short on an equivalent perpetual contract (which requires paying the funding rate).

Combined effect: If the actual funding rate is higher than the Implied APR on Boros, then this combination can generate net income while hedging against spot price volatility.

Looking forward to Boros launching a U-based market in the future.

👉Strategy Three [Cross-Platform Triangular Arbitrage]

Check funding rates across multiple platforms:

In exchanges with high funding rates (like Binance): Go short on perpetual contracts (receive high funding rates).

In Boros: Go short on the corresponding YU (lock in fixed income, hedging the risk of going short on Binance).

In exchanges with low funding rates (like Bybit): Go long on equivalent perpetual contracts (pay low funding rates, forming a hedge).

Goal: Earn the net profit margin between Binance's high funding rates, Boros's short income, and Bybit's low funding rate payments.

---Conclusion---

Boros! Just do it!

I will continue to update Boros articles and videos in the future~

@ViNc2453 @kevin0x0 @pendle_grandma"

17,46K

ViNc | Pendle Sensei 🌸 kirjasi uudelleen

Pendle's new product Boros, which took nearly two years to refine, finally launched yesterday. Twitter was buzzing, and TG messages were overflowing. Grandma knows that the community members have been waiting for a long time, and she is incredibly grateful for the enthusiasm of the DeFi community.

Yesterday, some friends asked Grandma some questions about Boros PMF, so here’s a summary to share with everyone (Chinese is not my first language, please be kind to Grandma ❤️):

The user profile of Boros is more diverse compared to Pendle V2, and the operation and structure of Boros are simpler and easier to understand.

From a macro perspective, Boros can cover both DeFi and CeFi players, providing a new trading method for both sides while simultaneously unlocking funding rates as a new stable and reliable source of income. In addition to opening positions on Boros, users can also open positions on exchanges to implement more advanced composite strategies.

💡 Why are funding rates a high-quality and reliable source of income?

📍 No need for "narratives," no need to worry about TGE, no need to calculate points, it's straightforward and simple. There is no dependency on the platform or a single party, and it has good sustainability.

📍 Suitable for various capital sizes, whether small retail investors or large whales, everyone can find a way to participate that suits them.

📍 You can go long on bullish positions and short on bearish positions, with no absolute dependency on market sentiment; it works for both bull and bear markets, allowing for flexible strategy adjustments.

📍 Funding rates are usually updated every 8 hours, and they are publicly transparent parameters on major exchanges, monitored in real-time, fair and reliable.

💡 For professional traders and institutions:

Derivatives issuers, especially those at the short end, typically hedge their positions by going long on perpetual contracts. For example, options sellers will hedge on the long side of perpetual contracts, and these positions need to pay funding rates. Boros can help them hedge these funding rate payments.

Many funds hold long positions on perpetual contracts for a longer term, and these positions also face funding rates. These are usually hedged elsewhere through OTC or brokers, which is clearly less efficient.

Regarding projects like Ethena / Resolv and basis trading, Boros aims to provide them with an additional, more efficient, and reliable operational pathway to hedge their basis trading positions when needed. They are all actively testing Boros and adapting mechanisms that can be implemented in their protocols.

Currently, due to the extremely strict risk control measures for the new product launch, there is a very low OI cap. As the OI cap increases and liquidity improves, more large funds will enter the market.

For example, when perpetual contracts were first launched, funding rates weren't even a concept; they were just a tool for the operation of perpetual contracts. But now, they have become a source of income for many funds and basis trading positions.

Therefore, from various DeFi and CeFi retail players to institutions holding different strategies, and to protocols with related needs, Boros will definitely become an important tool, laying a solid foundation for future rates beyond funding rates, and even for off-chain yield trading pairs.

💡 The data from Boros's first 24 hours is also impressive, having already surpassed:

• $15 million in open contracts (increased from the initial $10 million)

• $36 million in nominal trading volume

• The LP vaults for BTC/USDT and ETH/USDT have been completely filled

Everything is running smoothly, and the risk control team will gradually consider increasing the limits.

There’s really so much to discuss about Boros, Grandma looks forward to the community members wishing each other prosperity and sharing more!

🔥 We also have a dedicated channel for Boros discussions in Pendle's Chinese community:

📍 Telegram group address: @PendleFinance_CN

45,72K

ViNc | Pendle Sensei 🌸 kirjasi uudelleen

In 24 hours since launch, @boros_fi has achieved:

• $15M in Open Interest

• $36M in Notional Trading Volume

• BTCUSDT-Binance market at full capacity (with OI cap recently being raised $10M → $15M)

• ETHUSDT-Binance reached 52%

• Both BTCUSDT and ETHUSDT Liquidity Vaults are fully filled

All trades and settlements are functioning exactly as intended.

We're actively monitoring the system and appreciate the patience of our users as we build a new DeFi primitive from the ground up together.

Job's not done.

42,08K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin