Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Stacy Muur

Most multi-VM chains run VMs side-by-side.

@fluentxyz blends them.

Why it matters:

• One state → atomic composability

• One proof → cheaper zk-verification

• One wallet → zero user friction

This design is probably one of the greatest breakthroughs since the times of ZK.

– Write in Rust, Solidity, or Move — no compromises

– Compose across VMs like they’re one

– Inherit liquidity & network effects instantly

This isn’t EVM-compatible. It’s all-VM native.

Fluent testnet is now live.

First app live: @PumpPals.

More ↓

Fluent8 tuntia sitten

Testnet is live

Built and optimized for app feedback

3,92K

Sale opportunity report: @PublicAI_ | @CoinList

+ promo code ↓

Most AI is built by scraping the internet and underpaying anonymous crowdworkers.

@PublicAI_ flips that model: a decentralized platform where real people earn income for contributing, verifying, and curating high-quality data that powers enterprise-grade AI.

And now, the $PUBLIC token sale is live on @CoinList.

What PublicAI is:

→ A global human data engine for AI training & inference

→ 2.5M+ contributors in 200+ countries

→ 9M+ verified data samples

→ $14M+ in revenue from clients like Adobe &

→ Backed by Solana Foundation, NEAR, Stanford, and Saudi government (via MIT’s “Beyond Borders AI”)

Why it matters:

→ Synthetic data is polluting AI systems

→ Jobs are being displaced across industries

→ PublicAI keeps humans in the loop, verifiably and scalably

How it works:

→ Contributors earn $PUBLIC for uploading & validating data

→ Reputation stakers earn 8% AAR, with slashing for low-quality work

→ Token issuance is tied to real revenue: 1 $PUBLIC minted = $1 earned

→ Governance via PublicDAO to decide rewards, upgrades, allocation

$PUBLIC Token Sale (CoinList):

• $70M FDV, 100% unlocked at TGE (Aug 15)

• 2.85% of supply for sale at $0.07/token (~30% discount from last round)

• Min/max: $100 – $250K

• Accepted: USDT/USDC (ERC-20)

• Filling from the bottom (smaller buyers prioritized)

• Region locks: US, CA, UK, CN, etc.

What $PUBLIC enables:

→ Real-world earning opportunities for humans in the AI economy

→ Verifiable, permissionless contribution to model training pipelines

→ A decentralized, revenue-aligned foundation for ethical AI

AI shouldn’t be built by scraping or by excluding the people it affects.

PublicAI is a new layer of infrastructure: not just AI for people, but AI with people.

⚠️ Use code STACYMUUR for queue priority

DYOR. NFA.

9,96K

RHEA is rolling out a new staking model designed for sustainability:

→ Stake $RHEA

→ Earn xRHEA / oRHEA, backed by real protocol revenue.

Why @rhea_finance is different from 95% of DeFi staking models ↓

Advantages:

• Aligns with long-term holders → real yield

• No artificial emissions = lower sell pressure

• Encourages usage → more fees = higher yield

• Creates a sustainable flywheel if protocol usage scales

Tradeoffs / Risks:

• Yield is directly tied to activity: no usage = low rewards

• Requires product-market fit & adoption

It’s a fundamentally sound model, but not a quick pump-and-dump.

Community-first tokenomics since team burned prior holdings and holds 0% at launch, with unlocks only after 6 months.

A must-explore, if you're bullish on the @NEARProtocol eco.

Rhea Finance4.8. klo 22.17

xRHEA is now live!

You can now stake $RHEA & receive xRHEA, earning up to 65% APY!

Best part? Compound your yield strategies with xRHEA👇

1️⃣ Lock xRHEA for Lending boost → Boost APY on lending Positions

2️⃣ Supply xRHEA on RHEA Lending → earn oRHEA rewards

$RHEA / xRHEA / oRHEA trilogy. DeFi, leveled up.

21,36K

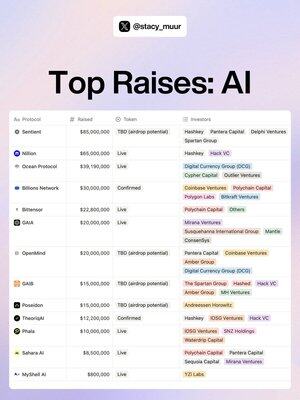

The biggest VC rounds: AI in focus.

Watchlist ↓

1. Infrastructure-first (Deep Tech Plays)

These projects are building rails, compute layers, privacy-preserving tooling, or data marketplaces. They aim to become part of the protocol stack, not the app layer.

Examples:

• @nillionaire98 (privacy-preserving computation)

• @oceanprotocol (data liquidity layer)

• @SentientAGI (decentralized AI compute)

• @PhalaNetwork (confidential smart contracts & compute)

These are high-capex, high-mojo bets often with long time horizons and complex regulatory overlays.

2. Agent-first (Consumer UX plays)

This group is focused on making AI usable in Web3 contexts: identity, wallets, task automation, even social UX.

Examples:

• @billions_ntwk (human verification layer)

• @Gaianet_AI / @openmind_agi (AI agents, DeFi interfaces)

• @SaharaLabsAI (on-chain assistants & chat UX)

• @TheoriqAI (autonomous trading + treasury AI)

They solve immediate UX bottlenecks and have faster feedback loops, hence quicker adoption and possibly faster token velocity.

3. Missing Middle Layer = Opportunity

What’s not being funded:

• Tooling for training on-chain

• Model versioning and reproducibility layers

• AI security (anti-sybil, adversarial defense)

These gaps may define the next AI crypto cohort especially as inference becomes commoditized and the infra race saturates.

Crypto found consensus.

AI brings cognition.

The frontier is what happens when both are native.

24,5K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin