Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

DeFi Warhol

Weekly List of Crypto Things | OG ‘17

5k MMR in Research

10k MMR in Visualization

15k MMR Based Tier List Enjoyer

Why I put @Aptos in the Crab category:

- Strong tech and high TPS

Aptos uses the Move VM and parallel execution, giving it a theoretical throughput of over 100k TPS; it has reached a max TPS of 12,993 already. Infrastructure-wise, it’s top-tier.

- Small ecosystem

Despite the tech, developer, and user activity is lagging. It has a TVL of just ~$1b, and low DEX volume, few transactions, and a conservative stablecoin supply.

- No killer app

Aptos lacks a flagship application, nothing equivalent to a GMX, Uniswap, Pumpfun, Zora, etc. Without a product market fit that retains users daily or defines the chain, it remains a “build-first, hope later” environment.

30,33K

DeFi Warhol kirjasi uudelleen

X is a goldmine if you want to build advanced knowledge and spot opportunities before everyone else.

It’s where information drops first, where analysts share their insights, where networking is easiest, and where you’ll find the richest alpha on upcoming projects.

But to truly make the most of it, you need to follow the right accounts.

Here’s a curated list to get you started:

+ @atoms_res

Shares deep research and good opportunities, whether it’s testnet farming or hidden gems. A great follow to stay ahead of the curve.

+ @el_crypto_prof

Posts daily technical analysis with clear breakdowns. Perfect for active traders looking for reliable, consistent chart insights.

+ @TATrader_Alan

Another strong voice in technical trading. Sharp, frequent updates and a fresh take on market movements.

+ @TheDeFiKenshin

One of the best for DeFi alpha. Explains protocols and strategies in a simple way, making it easy to understand how to take advantage of them. Very active.

+ @Defi_Warhol

I’ve known him for a while, writes across many topics and always brings a personal, thought-provoking perspective. Always worth reading.

+ @stacy_muur

Breaks down complex topics with clarity and elegance. Covers a wide range: DeFi, AI, news… very well-rounded and insightful.

+ @crptst

Don’t judge her by follower count. She’s been in DeFi for years and knows her stuff. Only recently started sharing her knowledge publicly, definitely one to follow.

+ @AmirOrmu

An on-chain analyst at @castle_labs, one of the top Web3 orgs. Shares highly valuable research backed by deep on-chain data. Strongly recommended.

3,2K

I was exploring the weekly top gainers and stumbled across $RHEA, it's up 97% in the last 7 days.

Apparently, @rhea_finance is a top DeFi hub on @NEARProtocol. It just TGE-ed and managed to hold up pretty well in a bloody market.

$RHEA has been listed on top exchanges like @LBank_Exchange, @BitrueOfficial, Binance Alpha, etc.

Pay attention to projects outperfoming when the market is crashing, usually a strong sign.

26,04K

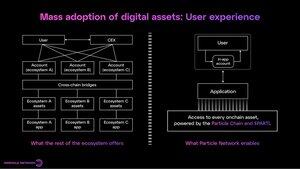

I believe poor UX is still the biggest blocker to retail going onchain.

Top apps win by making the blockchain invisible: seamless and intuitive.

That’s why Universal Accounts by @ParticleNtwrk are such a big deal:

- One account across all dApps

- Unified balance across chains

- No more bridging or wrapping

This isn’t just better UX. It’s the missing link between DeFi and real-world retail adoption.

Particle is the only team truly positioned to capture it with strong infra, a sustainable flywheel with $PARTI in the middle, and an ecosystem of products supporting each other.

Hearing more rumors of a @ParticleNtwrk x @circle partnership that will amplify this vision exponentially.

Trillions are coming, and onboarding is everything that matters.

Particle Network5.8. klo 00.02

TRANSCENDING ONCHAIN: ANNOUNCING THE UNIVERSAL LAYER FOR RWAS, STABLECOINS & DIGITAL ASSETS

The stage is set for Trillions of dollars to come into Web3.

Stablecoins may hit a $3.7T supply by 2030.

Onchain RWAs are projected to be worth $30T by 2034.

Tokenized real‑estate points at a $380T TAM.

The world is ready. Is Web3? Yes, because Universal Accounts exist.

As the only solution making Web3 feel like a single ecosystem, Universal Accounts are here to stay. They’ve already cleared $670 M via @UseUniversalX, and are the only way a multi-chain, multi-Trillion asset ecosystem can find its way to the masses—whether by accelerating Web3 or upgrading Web2.

So today, we’re announcing the culmination of our tech: The Universal Transaction Layer: a retail‑ready settlement rail for RWAs, stablecoins and all other digital assets.

Through the next weeks, we’ll also progressively announce the partners that will aid us in this mission, starting with @Circle. With the integration of Circle Gateway, we’ll be setting the stage for stablecoin settlements to occur across chains for Universal Accounts, unlocking the entire world’s economy for anyone using Universal Accounts.

When every property, dollar, or asset becomes a token, Universal Accounts become the default rails for them.

Crypto is ready. Let’s transcend onchain.

📝 Read the full vision at:

9,56K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin