Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Katherine Minarik

Tech lawyer. Crypto advocate. DeFi fanatic. All views my own.

Katherine Minarik kirjasi uudelleen

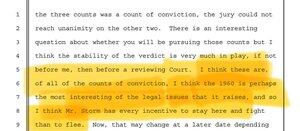

Here is Judge Failla in the Storm case this afternoon:

"I think the stability of the verdict is very much in play... I think the 1960 [charge] is perhaps the most interesting of the legal issues..."

This is absolutely NOT over - the government's overreach here will not stand.

25,6K

Katherine Minarik kirjasi uudelleen

Coin Center’s Seven Takeaways from the Storm Verdict:

▪️ 1. The sole conviction—unlicensed money transmission (18 U.S.C. § 1960)—turns mainly on legal/regulatory interpretation (“does this count as money transmission?”), not jury fact-finding.

▪️ 2. The court, at the motion-to-dismiss stage, discounted FinCEN’s stated guidance on what counts as “money transmission” in crypto and treated the category as broader than “control of customer funds.”

▪️ 3. With “money transmission” defined that broadly, the jury’s room to decide facts was narrow; the court’s interpretation largely dictated the outcome.

▪️ 4. DOJ’s prior “end regulation by prosecution” memo didn’t fully resolve §1960 issues left things open for continued prosecution; the DOJ dropped the failure-to-register theory but not the “knowingly transmitting criminal funds” theory. Coin Center’s view: both hinge on “transmitting” and are improper against developers excluded by FinCEN guidance.

▪️ 5. The BRCA (Blockchain Regulatory Certainty Act), now attached to CLARITY and passed by the House, would confirm that non-controlling developers aren’t money transmitters. It can’t help Roman retroactively, but the Senate should pass it in upcoming market-structure debates.

▪️ 6. Coin Center fellow Michael Lewellen is suing DOJ for a declaration that publishing/maintaining his software isn’t unlicensed money transmission. Coin Center will continue supporting this effort to correct the legal interpretation.

▪️ 7. Coin Center is sorry Roman faces sentencing on a theory that contradicts the regulator’s guidance. He should appeal the denial of his motion to dismiss; Coin Center will assist however possible.

94,94K

Katherine Minarik kirjasi uudelleen

I can’t think of another regulator who has been as engaged and hands-on as Commissioner Peirce. Her willingness to meet builders where they are—literally and figuratively—is a model for democratic policymaking and thoughtful regulation. I interviewed her last year at the @BlockchainAssn policy summit and asked what she wanted her legacy to be; she demurred. Crypto aside, I think this will be her legacy.

3,45K

Yessssssss to this!!!!

Peter Van Valkenburgh5.8. klo 09.15

Commissioner Peirce just gave a must-read speech offering one of the clearest defenses of financial privacy in the context of crypto and new technologies yet articulated. As she says:

We should take concrete steps to protect people’s ability not only to communicate privately, but to transfer value privately, as they could have done with physical coins in the days in which the Fourth Amendment was crafted.

Most fears of financial privacy and the technology that enables it flow from a genuine desire to protect this nation from enemies and criminals. Safeguarding our families, communities, and country from harm is extremely important, but curtailing financial privacy and impeding disintermediating technologies are the wrong approach. Denying people financial privacy—whether through sweeping surveillance programs or restrictions on privacy-protecting technologies—undermines the fabric and freedoms of our families, communities, and nation. The American people and their government should guard zealously people’s right to live private lives and to use technologies that enable them to do so.

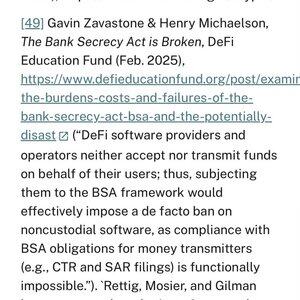

In the written speech there are pointers to deep analysis of the overbreadth of US financial surveillance laws, including a citation to a paper Coin Center published last year on dangerous ambiguities in the Bank Secrecy Act and how they could be abused to “mandate that every American who pays or is paid [] register with the Treasury Department and regularly report the details of her monetary transactions as if she were a bank or other financial institution.” Commissioner Peirce also cites two other federal laws, 6050I and Patriot Act Section 311, that are—in Coin Center’s opinion— already being abused to harm the legitimate privacy expectations of law-abiding Americans.

Read the whole thing! Link in the next post.

380

Katherine Minarik kirjasi uudelleen

Thank you @HesterPeirce for correctly recognizing the nature of DeFi technology, and for your relentless advocacy for creating a more open financial system.

The BSA is broken. And, noncustodial DeFi technology is fundamentally incompatible with the CeFi-suited regime. DeFi software providers that do not exercise control or custody over user funds should not be improperly classified as intermediaries.

Thank you for your efforts. Read more in Commissioner Peirce's speech here:

5,73K

Agreed. The BSA is not fit for modern purposes. There are better tools to verify identity when that is truly needed. And there are better ways to stop bad guys than tracking the everyday financial activity of everyday people. Let’s do better.

paulgrewal.eth4.8. klo 18.14

The Bank Secrecy Act was built entirely for a paper-based world. But money is now a creature of the internet and we need our laws to respect that. A prime example: we should look to Zero-Knowledge Proofs to eliminate the data dragnet that the BSA forces on every consumer. 1/3

939

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin