Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Simon

Research @Delphi_Digital | @USC Alum | Sharing my best ideas daily | NFA

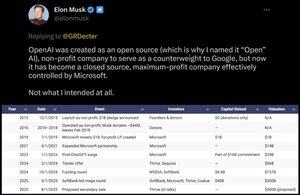

In 2015, Elon Musk gave ~$44M to help start OpenAI as a non-profit. No equity, just a donation.

Fast forward to today, OpenAI is now a for-profit worth $300B to $500B.

If that $44M had been treated as seed equity when OpenAI went for-profit, it could be worth $100B+ (even after dilution, maybe $10B to $50B).

Actual value to Musk today: $0.

From founding a non-profit to stop Big Tech… to $0 while it became Big Tech.

1,3K

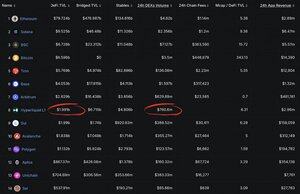

Hyperliquid's L1 - which isn't even their main product - is crushing the "premium L1s" that consumed years of development and massive VC rounds:

HyperEVM: $1.99b DeFi TVL, $760m DEX volume

- $SUI: Same TVL, half the volume, $35b FDV

- $AVAX: $1.83b TVL, $355m volume, $15.4b FDV

- $APT: $867m TVL, $160m volume, $4.95b FDV

Hyperliquid's main business, Hypercore, makes ~$3.5m in daily revenue with 93% flowing back to $HYPE buybacks on the open market.

These other chains?

No meaningful revenue, let alone any passed back to token holders.

Still trading on stale "L1 premium" narratives while getting outperformed by what's essentially Hyperliquid's side project.

With native USDC coming to HyperEVM, Arbitrum's "Hyperliquid bridge" utility evaporates overnight.

Flippening incoming there too.

hyperliquid.

52,61K

How have $PUMP public sale buyers positioned since the sale?

Of 10,145 buyers who purchased 150B tokens at $0.004 (15% of supply):

1,692 (16.7%) still holding

5,156 (50.8%) transferred

2,995 (29.5%) sold on DEX

302 (3.0%) acquired more

Most transfers likely went to exchanges for selling. Combined with DEX sales, ~80% have exited or are positioned to exit.

Taking 65% gains at $0.0065 was rational given unlimited ICO size without lockups.

Key question: does $0.004 act as natural support from new buyers, or psychological resistance as remaining holders capitulate below their entry?

*Data excludes 18% institutional allocation

24,89K

Did you know SBF got the rights to 888 million $SUI tokens for just $1 million?

It was a side-deal to a larger $101M investment, all confirmed in court docs.

Fast forward to today: $SUI is trading at ~$4.04 per token. That side position alone would be worth $3.59 BILLION.

But it gets crazier.

FTX's total $SUI haul with incentives from its larger $101M investment was reportedly ~1.6 BILLION tokens, a stash worth $6.46 BILLION.

Plot twist: The estate sold the entire potential position back to Sui's founders for just $96M

90,56K

"Companies are the only entities in the world other than the U.S. government that can print money."

When people talk about selling BTC or supply overhang from certain majors, it kind of makes me wonder where they are planning to allocate once they sell/how good the alternatives really are.

For example:

- You don't want to park your assets in USD (long term, the denominator is worthless)

- Stocks are tricky because it's very hard to accurately pick and outperform the index

(even if you are a great stock picker, doesn't mean you'll be able to have conviction through drawdowns or be able to allocate a meaningful % of your net worth like you could with BTC, which has outperformed 99% of stocks over the past 5 years)

- Furthermore, like the quote mentions, companies (unlike BTC's fixed supply) can issue new shares, diluting shareholders as they see fit (S&P 500 actually net reducing ~1% per year from buybacks, but smaller caps and tech/growth companies average about 1-3% net dilution annually).

So where exactly are you all planning to rotate to?

1,56K

ICYMI the Pump team just started buying back $PUMP on the open market

With 33% of supply circulating, $PUMP holders are receiving daily buybacks of $538k (assuming 25% revenue share) based on 180-day trailing numbers.

That's $196.6M annually flowing directly to token holders.

Current valuation: $6B FDV / $2.12B market cap

- Market Cap/Earnings: 10.78x (180D)

- FDV/Earnings: 30.51x (180D)

Peer comparison shows Pump trading at a discount:

- $JUP: 14.17x MC/E, 32.33x FDV/E

- $RAY: 13.09x MC/E, 27.08x FDV/E

- $HYPE: 26.78x MC/E, 80.24x FDV/E

146,53K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin