Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The Smart Ape 🔥

Father | Building @BasePumpFUN and experimenting with ideas | I do technical stuff hard to explain | Love you Mom | Nothing is financial advice | DM open 📩 |

In Act 1 @campnetworkxyz pitched the tents.

In Act 2 they lit the fire.

In Act 3 everyone is coming.

This is the real turning point, where technical infra turns into cultural momentum.

Camp spent a year building the foundation:

→ a dedicated L1

→ onchain primitives for remixing & monetizing IP

→ a clean, creator-focused UX

But let’s be honest, that was still mostly for builders.

Now, with Act 3, we’re seeing apps made for everyday users, not just devs.

Like @JukebloxDapp, a music platform where you can drop tracks with built-in onchain rules.

Or @KorProtocol, the largest onchain IP economies

Most Web3 projects never make it past infra.

They get stuck between building and actual adoption.

Between code and culture.

Camp didn’t.

Act 3 shows it was all part of the plan. Every move, intentional.

3,56K

X is a goldmine if you want to build advanced knowledge and spot opportunities before everyone else.

It’s where information drops first, where analysts share their insights, where networking is easiest, and where you’ll find the richest alpha on upcoming projects.

But to truly make the most of it, you need to follow the right accounts.

Here’s a curated list to get you started:

+ @atoms_res

Shares deep research and good opportunities, whether it’s testnet farming or hidden gems. A great follow to stay ahead of the curve.

+ @el_crypto_prof

Posts daily technical analysis with clear breakdowns. Perfect for active traders looking for reliable, consistent chart insights.

+ @TATrader_Alan

Another strong voice in technical trading. Sharp, frequent updates and a fresh take on market movements.

+ @TheDeFiKenshin

One of the best for DeFi alpha. Explains protocols and strategies in a simple way, making it easy to understand how to take advantage of them. Very active.

+ @Defi_Warhol

I’ve known him for a while, writes across many topics and always brings a personal, thought-provoking perspective. Always worth reading.

+ @stacy_muur

Breaks down complex topics with clarity and elegance. Covers a wide range: DeFi, AI, news… very well-rounded and insightful.

+ @crptst

Don’t judge her by follower count. She’s been in DeFi for years and knows her stuff. Only recently started sharing her knowledge publicly, definitely one to follow.

+ @AmirOrmu

An on-chain analyst at @castle_labs, one of the top Web3 orgs. Shares highly valuable research backed by deep on-chain data. Strongly recommended.

3,5K

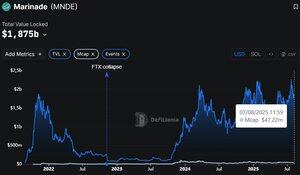

One of the first protocols I ever used on Solana was @MarinadeFinance, and that was over 4 years ago.

It’s a great example of a project where the Mcap is completely disconnected from the TVL. $2B in TVL, but only $47M in Mcap.

Now, they’re finally making moves to bring valuation closer to fundamentals:

+ 50% of all revenue will be used for token buybacks starting in September

+ A proposal to burn 10% of the total supply is coming

+ First staking provider ever to be included in a US ETF S-1 filing

The gap between value and price might not last much longer.

4,25K

Glad to see real innovation in LP.

@KyberNetwork just launched FairFlow, which lets you earn way more than just swap fees.

It combines rewards from trading fees, a share of arbitrage profits, token incentives, and even external yield since your LP tokens stay liquid and usable elsewhere.

Liquidity mining is also live, running from Aug 06 to Aug 12, with extra $KNC rewards for selected FairFlow pools.

Definitely worth checking out.

Kyber Network6.8. klo 17.55

🔥 FairFlow is Live!

LPs now earn more than just fees:

- Equilibrium Gain (EG): Reclaim a share of arbitrage profits.

- Liquidity Mining (LM) Rewards: Extra token incentives.

- Additional Yields: No LP staking - earn elsewhere while collecting EG Sharing and LM Rewards.

LP Rewards = Fees + EG + LM Rewards + Additional Yields ⚡️

Running on @Uniswap V4 for unmatched security and reliability.

🚀 Become FairFlow LPs today:

🔍 How it works:

Higher APR. Sustainable yields. Designed for security.

7,77K

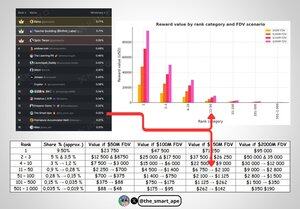

In just one week, I went from 40th to 13th on the @Infinit_Labs leaderboard.

It only took 2–3 tweets, instead of focusing on quantity, I focused on delivering real value and covering important topics no one else was talking about.

TGE is tomorrow. Based on my estimates, I should get between $2K and $3K for Season 1.

If I keep my rank in future seasons, that could mean $5K to $6K, assuming a $150M market cap, which feels like the most realistic target for now.

Once all products are live, it’ll likely go much higher.

5,31K

To truly understand a project, you need to understand what it brings compared to its competitors.

For years, institutions like SACEM (France), BMI (USA), and YouTube CMS have dominated copyright and royalty management.

But their systems are outdated, full of high fees, lack of transparency, and slow processes.

@campnetworkxyz introduces a whole new paradigm, every piece of content becomes a programmable onchain asset, with attribution, licensing, and royalties built in from the start.

Many of you asked me what’s the real difference, in plain terms? No technical jargon.

So here it is, I scored each feature out of 5 and compared Camp to SACEM, BMI, and YouTube CMS.

The closest one is YouTube CMS, but even that only scored 18/35, barely half of Camp’s perfect 35/35.

Camp outperforms them all, across IP registration, attribution & splits, royalty transparency, payment automation, fees, global access, and AI compatibility.

You just need to see this breakdown once to realize that this is what the future of IP looks like.

2,22K

If $IN had launched back in January 2025, it would’ve started at a $1B FDV.

The market is less favorable now, but we can still estimate @Infinit_Labs future FDV with a model.

So far, Infinit has already onboarded 174K+ users, and that’s before all its core features were live.

So it’s reasonable to project a future range of 100K to 1M monthly active users (MAUs).

So we can consider 3 scenarios:

+ 100K MAUs

+ 500K MAUs

+ 1M MAUs

We can assume:

+ $100 avg. volume per transaction

+ 10 transactions per user per month (this is a conservative estimate)

Infinit charges fees between 0.2% and 0.5% depending on strategy complexity, so we’ll use an average fee of 0.3%.

From this, we can calculate protocol-level revenue.

This is total revenue captured by Infinit, not necessarily what's distributed to $IN holders.

We don’t yet know the exact percentage of fees that will be shared with $IN holders.

To stay conservative, let’s assume 50% of the protocol revenue will go to token holders.

(In reality, it may be closer to 100%, but 50% is a safer base case.)

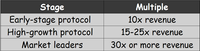

In DeFi, it’s common to value tokens based on a multiple of annualized revenue.

Early-stage projects usually trade at 10x revenue. More mature or hyped protocols can go up to 30x.

Since the AI sector is highly speculative, a 15x multiple seems like a reasonable middle ground. With that in mind, we can estimate the FDV range between $27M and $270M FDV.

A mid scenario of 500K MAUs with a 15x multiple gives us a projected FDV of $135M, which seems realistic for launch.

Even the most conservative scenario, with cautious estimates at every step, still gives us an FDV of $18M.

This worst-case is unlikely but it sets a clear floor.

A conservative but realistic scenario would be 500K monthly users and a 15x revenue multiple → $135M FDV.

That’s a reasonable expectation for a protocol just launching.

Now that you have an estimate of the FDV, you can use this post to calculate the potential reward value for top 1,000 Yappers:

8,59K

The FairFlow concept by @KyberNetwork is worth a closer look.

It’s a Uniswap V4 (and similar protocols) hook that lets LPs earn more, without doing anything extra.

The idea is to redirect arbitrage value that would normally be captured by external arbitrageurs back to the LPs.

1/ It blocks external arbitrageurs

2/ Absorbs Captures arbitrage value

3/ Redistributes them to LPs

4/ LP tokens remain usable elsewhere (like in liquid staking)

7,56K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin