Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

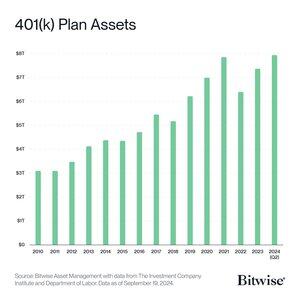

1/ A short story on crypto, 401k plans, and the U.S. Department of Labor's efforts to block crypto from 401k plans.

📜👇

14 tuntia sitten

If crypto captures X% of the $8 trillion 401k market:

1% … $80 billion

2% … $160 billion

3% … $240 billion

4% … $320 billion

5% … $400 billion

6% … $480 billion

7% … $560 billion

8% … $640 billion

9% … $720 billion

10% … $800 billion

2/ In 2022, the U.S. Department of Labor issued an unprecedented warning to retirement plan providers:

Exercise extreme caution before offering crypto in 401(k) plans.

It was the first—and only—time the DOL singled out an asset class like this. Not even junk bonds or ESG funds.

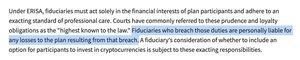

3/ The DOL even took it step further.

They said adding crypto to 401(k) plans could be seen as a failure to meet the required standard of professional care.

They threatened that any 401(k) providers who fail to meet this standard are personally liable for any losses.

4/ 401(k) providers had to decide if adding crypto to plans was worth the risk of DOL scrutiny.

Most didn't.

The DOL's threat had major ripple effects.

- 401(k) plan sponsors backed off

- Firms paused crypto retirement offerings

- Investors missed out on life-changing returns

5/ Then something happened.

Legal pressure mounted, 401(k) firms pushed back, and Members of Congress raised alarm over regulatory overreach.

Alas, crypto's regulatory renaissance began.

By May 2025, the DOL quietly rescinded the "extreme caution" guidance in full.

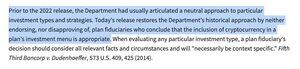

6/ Remarkably, the DOL even admitted that its 2022 guidance was a deviation from the neutral approach to particular investment types and strategies the agency had previously taken.

Once again, the U.S. government admitted it had singled out crypto.

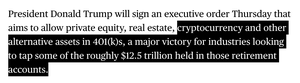

7/ That brings us to today's news: President Trump will reportedly sign an executive order to allow private equity, real estate, and other alternative assets in 401(k)s.

Crypto included.

8/ So, back to my original post and why this matters.

As of Sep-24, 401(k) plans in the U.S. hold $8 trillion in assets. Every week, more capital funnels into these funds.

If crypto captures 1%, that's $80 billion of new capital entering the space, and a steady flow thereafter.

9/ Bloomberg reports the 401(k) market at $12.5 trillion. At that level:

1% ... $125 billion

2% ... $250 billion

3% ... $375 billion

4% ... $500 billion

5% ... $625 billion

6% ... $750 billion

7% ... $875 billion

8% ... $1.0 trillion

9% ... $1.13 trillion

10% ... $1.25 trillion

10/ Naturally, investors ask: "Which assets will benefit the most?"

In my opinion, crypto assets that already have an ETF will be the easiest funds for 401(k) plans to adopt.

- Bitcoin

- Ethereum

- Solana*

But, as JFK famously put it, "a rising tide lifts all boats."

11/ And, of course, I'd be remiss to ignore that our @BitwiseInvest team predicted this in our 10 Crypto Predictions for 2025 last December.

I'm happy to chalk this win on the board.

You can see the full list of our 2025 predictions here

11.12.2024

In 2025… Bitcoin will hit $200,000, Coinbase will enter the S&P 500, stablecoin AUM will double, and more…

Here are 10 Crypto Predictions for 2025 by the team at @BitwiseInvest

🧵👇

12/ The End.

14,63K

Johtavat

Rankkaus

Suosikit