Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

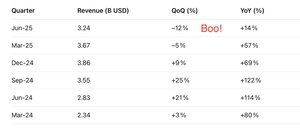

$AMD It comes down to this: Data Centre revenue being down -12% on last quarter (down second Q in a row), and only up +14% y/y is just brutally bad.

We’re literally in the strongest data centre demand cycle in human history… and people don’t want what these guys are selling.

Remember: The stock is trading at a huge premium to $NVDA and most other semiconductor stocks at 78x ‘25E and 49x ‘26E P/E (!).

It would require absolute insane growth acceleration to start to catch up, but it’s doing the opposite.

So lower growth, higher valuation? Not good!

142,96K

Johtavat

Rankkaus

Suosikit