Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

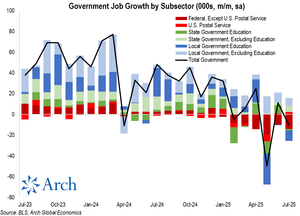

One of the big surprises in today's jobs report was the contraction in government payrolls.

Consensus expected total job growth of 104k, of which 100k would be private jobs - implying growth of 4k for government payrolls.

Instead, the government sector lost -10k jobs, thanks to a -14k decline in Federal workers (non-USPS).

This shouldn't have been a big surprise...

I'll explain quickly in the 🧵

There has been a clear rebound in initial claims by federal employees for unemployment insurance, which surged higher in July.

This coincides with the reference week for the jobs report, so economists should have been forecasting a notable drag from federal layoffs this month.

Why the renewed spike?

On July 8, 2025, the Supreme Court lifted a lower court’s injunction that had blocked Trump's February Executive Order directing agencies to prepare for reductions-in-force (RIFs) under the DOGE initiative.

The Court did not rule on the underlying legality of the executive order—only that the administration was “likely to succeed” in defending it.

Some agencies are opting for voluntary resignations, buyouts, and early retirements instead of forced RIFs, often ahead of schedule to reduce legal exposure.

Others, including the State Department and VA, are moving forward with planned terminations, sending Notices of Proposed Removal and triggering appeal windows at the Merit Systems Protection Board.

The Supreme Court ruling removed a key legal hurdle, paving the way for a new wave of layoffs or RIF implementations.

That delay earlier this year seemed to hold layoffs in limbo, but with the legal green light now in hand, initial claims are beginning to reflect renewed activity, which maps onto the recent spike I noted above in UI filings.

Layoffs at the federal level are now procedurally safe and likely to accelerate, contributing directly to the uptick in federal employee initial unemployment claims and a continued drag on total job growth.

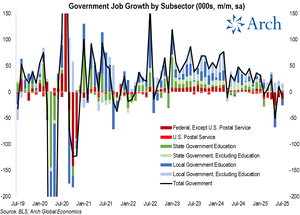

Looking at a longer chart of government employment, it's clear this sector has shifted from previously supporting growth to a small but notable drag.

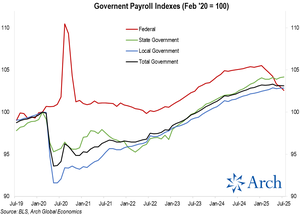

Here's a look at the government payrolls by segment, indexed to Feb '20 = 100.

While the growth has cooled, the sharp shift down in Federal payrolls is clear.

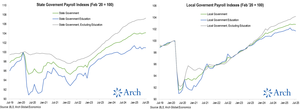

At the state and local level, any remaining growth is now due to non-education government jobs.

Education jobs have leveled off or even turned lower at the state and local level.

Going forward, there is little reason to expect these trends to reverse in the near-term.

Thus, the government sector is likely to remain an increasing drag on overall job growth.

43,2K

Johtavat

Rankkaus

Suosikit