Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

1/ Welcome to the first edition of Arrakis Research – a weekly deep dive into the mechanics driving onchain markets (Data sourced via @Dune).

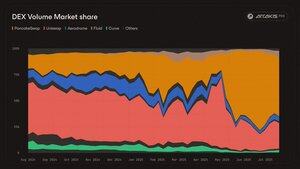

We begin with a major shift in DEX orderflow: How @PancakeSwap flipped Uniswap by leveraging @Binance’s exclusive TGE pipeline.

3/ Binance Alpha has done more than $75B in volume, powering a 539% QoQ volume surge on PancakeSwap.

In just months, it has reshaped onchain token launches:

Projects now tend to default to BNB Chain, drawn by routing depth, speculative flow, and incentive-aligned distribution.

4/ Although it may seem like Binance Alpha should only affect exotic token pairs, it directly drives macro volumes too.

Trades route through deep base pairs like USDC/BNB or USDT/BNB to access TGEs, bootstrapping volume across PancakeSwap’s entire routing graph.

5/ When a GOV/wBNB pair launches, users holding USDC would route:

USDC → wBNB → GOV

This structure bootstraps volume not only on the TGE pair but also across upstream core pools like USDC/wBNB or USDC/USDT, contributing directly to macro pair activity.

6/ While volumes are strong and distribution wide, some challenges still remain:

– Airdrop farming can drive early sell offs

– Few tokens from Alpha reach Binance spot listings (6/153 recorded or <4%)

– Alpha mandates 1 bps pools, yielding negligible fees and poor LP economics

7/ Want more insights like this?

Subscribe to Arrakis Research for weekly, data-driven breakdowns of what’s actually happening in onchain markets.

6,1K

Johtavat

Rankkaus

Suosikit