Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

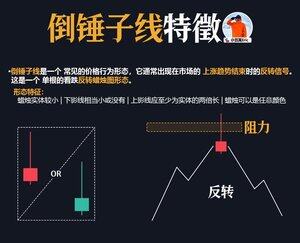

The key to the inverted hammer candlestick is not the length of the shadow itself, but rather the position where it appears.

It represents a situation where, during the price's attempt to break through a resistance level, the buyers are pushed back quickly by the sellers, leaving the close below the body.

There are two conditions for a reliable signal:

1. It must appear in a clear resistance zone, not in the middle of a trend.

2. The next day, if the price breaks below the lowest point of the inverted hammer, it confirms the reversal.

Lastly, and most importantly, but also easily confusing: the inverted hammer is not the cause of a reversal; it is merely a sign that the market has rejected further upward movement. The position and subsequent confirmation are the core factors determining the win rate.

10,73K

Johtavat

Rankkaus

Suosikit