Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

百萬Eric | Day Trader

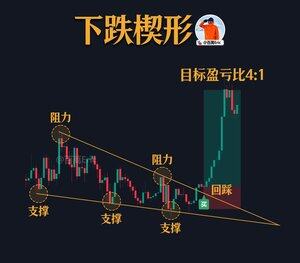

The descending wedge is not bullish because of the pattern itself, but because the price is continuously converging, and the selling pressure is gradually weakening.

When each new low is quickly reclaimed and the resistance line is broken, it indicates that there is a chance for a trend reversal.

The real entry advantage lies in: the first retest of support after the breakout, which can confirm whether the buying momentum is established.

If the retest stabilizes, the risk-reward ratio naturally improves, as the stop-loss point is close to the breakout level, while the profit target is still calculated based on the wedge measurement.

11,28K

The significance of multi-indicator confirmation lies in reducing the misjudgment rate of a single signal or lowering the "subjective" fitting.

In this chart, the double bottom pattern first establishes the possibility of a structural reversal.

Next, the EMA10 and EMA20 form a golden cross, confirming that the short-term trend has shifted from bearish to bullish.

Subsequently, the price continuously receives support in the "buying zone" between the moving averages, indicating that the pace of capital entry is stable and sustained.

The advantage of this combination of signals is that the pattern provides a directional hypothesis, the golden cross of the moving averages gives trend confirmation, and the price's reaction in the support zone provides entry timing.

When all three align, the win rate and confidence in holding positions significantly increase.

14,2K

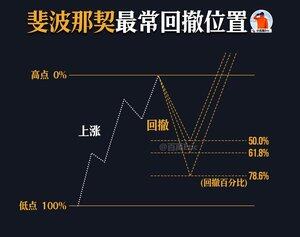

The core value of Fibonacci retracement levels is not to predict that prices will definitely rebound at a certain percentage, but to provide a potential support area that institutions and traders commonly reference.

The significance of the 50%, 61.8%, and 78.6% levels is as follows: the deeper the retracement, the greater the likelihood that the trend is broken, and the higher the psychological pressure on participants.

50% represents a normal correction, indicating a healthy trend; 61.8% is the golden ratio, often a range where significant capital accumulation occurs; 78.6% is considered an extreme retracement, and if the market can stabilize and rebound from here, it indicates strong bottom support.

The real application is to overlay these ratios with structural support, candlestick patterns, and volume signals to pinpoint the most likely reversal zones in the market, rather than simply waiting for the numbers to align.

26,09K

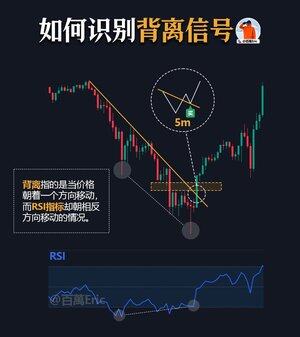

The value of divergence lies not in itself, but in the position it occurs and the accompanying changes in market structure.

The divergence in this chart appears at a low point after a continuous decline, where the price makes a new low while the RSI low point rises, which is a typical signal of selling exhaustion.

The key is that when the divergence occurs, the price just touches the support zone, accompanied by a trendline breakout and a reversal candlestick, which transforms the signal from "possible" to "highly probable."

In actual trading, these types of signals are not entered every time, but rather when the "divergence + structural turning point + confirmation candlestick" coincide, making it an opportunity for a high win-rate "bet."

27,58K

Ethereum #ETH is currently in a previous high pressure zone formed by the peaks in March, May, and December 2024. The intraday trend is strong, with the highs and lows continuously rising above the EMA21.

So, will it definitely break through? I don't know.

Without predicting the market, whether it breaks through is a matter of probability, and finding trading opportunities here relies on fundamental skills.

Even if it breaks through, there are three common paths:

1. Directly break through and rise all the way to 4800.

2. Rise about 10% and then test the breakout area.

3. Test whether the breakout area is a support test or a trap for more buyers, which requires responding to the situation.

If you find this complicated, to be honest, the current market is not your opportunity to make money, and this is an objective fact that must be accepted.

Of course, if you really want to "ride the wave," it’s not impossible; the method is to combine intraday overselling with key EMA for stop-loss, participating in the breakout with clear risks.

So, how do I handle the current market? I bought spot in mid-April and have only made two types of moves since then: small protective take profits (3~5%) and structural increases, executing according to the system without predicting the market.

Now, Ethereum has reached a key position on the weekly chart, and my principle remains unchanged—small take profits of 3~5%, while also raising the stop-loss. Yesterday, I took profits on the 4-hour overbought condition, and today I encountered the previous weekly high. All of these actions are based on the premise of acknowledging that "the market is unpredictable," prioritizing the protection of my own position.

This approach has resulted in one outcome—I now have almost no holding pressure and can patiently wait for the market to develop until the next "high odds" signal appears to take action.

百萬Eric | Day Trader15.4.2025

Ethereum's #ETH weekly bottom divergence + oversold signal has been confirmed.

Sounds like it's finally going to bounce back, but don't worry.

The last time it was similar was in June 2022, when it traded sideways for 21 days, during which it fell nearly 20% before starting to rebound.

Taking a step back, even if it is really the bottom here, it can't be rushed directly, what is really worth doing is to wait for the high odds position after the structure on the right side is confirmed.

There is really a market, not bad for your K.

The signal is to remind you to watch, not to rush in.

74,9K

To truly grow a small capital account, you must pass through several key stages.

Each step is not about advanced technology, but rather decisions based on statistical advantages.

First, strategy comes before waiting: without a system, you won't wait for trading opportunities.

百萬Eric | Day Trader6.8. klo 17.00

Gamble or Learn? — The Life-and-Death Choice for Small Capital

Among all the questions on traders' lists, "How to grow small capital" always ranks first.

Because the capital is small, the pressure is low, and the margin for error is extremely limited, every move feels like dancing on a tightrope. How to grow a small account has become the most concerning and easily misled issue for beginners.

There are only two common answers: gamble or learn.

The former exchanges speed for explosive results, while the latter exchanges time for structure; one relies on intuition to gamble with fate, and the other relies on a system to endure probabilities.

34,22K

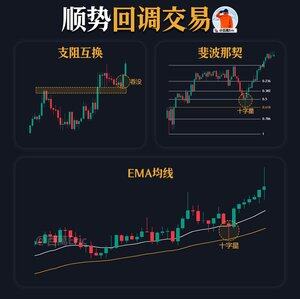

The core of trend retracement trading is to find positions and signals under the premise that a trend has already been established, allowing for smaller entry risks and higher tolerance for errors.

Support and resistance switching occurs when breaking through previous highs and then confirming support on a pullback; a stable footing indicates that buyers are willing to take over at higher levels.

The Fibonacci 0.618 level is the last defensive position for bullish trends; if a doji appears here, it indicates that the bearish test has failed and the bulls regain dominance.

When the EMA moving average retraces, if the price tests and does not break through the key moving average, it becomes one of the conditions for following the trend.

Regardless of the method, the most important thing is to establish the trend and direction first; otherwise, the practical results will be significantly discounted.

36,76K

To determine the strength of a candlestick, it's not about how much it has risen, but rather where it closes, the length of its shadows, and its position relative to the previous candlesticks.

If the closing price is higher than the last two candlesticks and there is no upper shadow, it indicates that the bulls have absolute control during this fluctuation, showing the highest strength.

If the closing price is higher than the previous candlestick but accompanied by a significant upper shadow, it suggests that the bulls made an effort but were partially suppressed by the bears, indicating average strength.

When the closing price is lower than the previous candlestick and there is a long upper shadow, it means that the offensive from both sides has been completely countered by the bears, and the market has shifted to bear control in the short term.

67,08K

I don't want to disturb everyone's trading mood, but I still have to remind you: Ethereum #ETH has triggered an overbought signal on the 4-hour chart.

If you bought in at a high price or your current cost is relatively high, be sure to take some profits here and adjust your stop-loss line accordingly.

This isn't about trying to guess the top; it's about managing your position well, turning this wave of market movement into "more profit" or "less profit," rather than a "loss."

Although the current trend is indeed strong, it still cannot be considered a breakout until it truly breaks through structural resistance, and there's no need to predict a breakout.

156,64K

Real breakthroughs of true value often do not succeed on the first attempt, but rather after the price consolidates repeatedly below a key level, before finally breaking through.

In this chart, the price does not immediately attack the resistance area, but instead continues to consolidate in the lower region. Each test feels like a "knock on the door," while also continuously sending a signal to the market: this resistance level is very critical.

As long as the consolidation is sufficient and the fundamentals and sentiment remain intact—there is no need for a large catalyst; even a small positive news can ignite the market.

Ultimately, the market will indicate with an acceleration move: confirmation completed, direction established.

38,25K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin