Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The last months of Powell as Fed chairman.

His mandate ends in May 2026.

Who will be the chosen one?

Let's see what prediction markets are telling us and explore the main candidates 🧵 👇

✦ Kevin Warsh

• Fiscally conservative, inflation-sensitive Fed voice, often pushing for discipline, restraint, and credibility in central banking.

Experience:

• Member of the Board of Governors of the Federal Reserve (2006–2011)

• Former advisor to President George W. Bush

• Economic advisor to Morgan Stanley before joining the Fed

“We need a Fed that’s forward-looking, not backward-glancing.”

✦ Kevin Hassett

• Opposed to excessive regulations and a strong advocate for tax cuts.

Experience:

• Chairman of the Council of Economic Advisers (CEA) from 2017 to 2019.

• Economist at the Federal Reserve.

• researcher at the American Enterprise Institute (AEI).

"Lowering the corporate tax rate is one of the most pro-worker policies we can pursue."

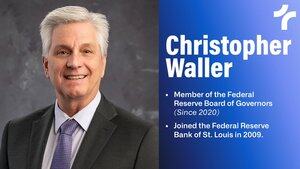

✦ Christopher Waller

• Known for his work on monetary theory, political economy, and central bank independence.

Experience:

• Is a current Member of the Board of Governors of the Federal Reserve, appointed in 2020 by then-President Donald Trump.

• Former Executive VP and Director of Research at the Federal Reserve Bank of St. Louis

“We don’t make policy based on forecasts. We make it based on actual data.”

✦ Scott Bessent

Known for his expertise in global macroeconomics, he seeks to anticipate cycles and benefit from asymmetries

Experience:

• Is currently the Secretary of the Treasury.

• Founder and CIO at Key Square Group

• Worked managing multi-billion dollar portfolios with a macroeconomic focus.

“The bond market is the ultimate vigilante. It tells you when policy is wrong.”

✦ 3 key takeaways

• The choice of the next Fed Chair is crucial for the direction of monetary policy, especially when it comes to the terminal interest rate.

• Data quality is critical for both markets and candidates (it’s time to move on from the BLS and its outdated inflation methodology).

• Prediction markets are gaining traction as a reliable source for establishing event probabilities.

Follow @truflation to stay updated.

6,54K

Johtavat

Rankkaus

Suosikit