Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

"REAL" meta where people have spent over 50m and none of these platform have launched a token yet

TCG ( pokemon ) are new onchain generating over $100m in volume in less then a year.

I covered

📍 What it is

📍 How it works

📍 Important statistics

📍 Revenue model

📍 Actionable

and token speculation

🧵open for a deep dive

@collector_crypt @phygitals @TCG_Emporium

🔹 Quick explainer?

First TCG mean ( Trading card game) so we're talking about tokenization of physical trading cards (like Pokémon TCG) into digital assets on Solana.

where users can:

• Own: Each card is a verifiable, tokenized asset.

• Trade: Use marketplaces or gacha (blind box) systems.

• Financialize: Collateralize cards for loans or use instant buybacks.

🔹 What's the TCG landscape like?

first of, there are 3 major highlighted TCG platforms live and actively generating revenue

📍 @collector_crypt- first mover, The clear market leader in tokenized TCG on Solana. CC has captured the community’s attention with its gacha-first experience, instant buybacks that keep users engaged, and an expanding marketplace.

📍 @phygitals - Phygitals leans on its accessible gacha model, also,

Each graded card is fully insured, securely stored in a facility physically.

📍 @TCG_Emporium - Emporium positions itself as a premium destination for high-value collectibles. While still building its user base, it blends gacha mechanics with a growing marketplace that caters to serious collectors chasing rare, top-tier cards,

🔹 Statistics

In comparison, Collector crypt takes about 90% of the marketshare, Phygitals following the same protocol model falls behind, while emporium is the latest platform wiith a slightly different model...

• Collector crypt- $104m, 3k users

• Phygitals- $1.5m, 6.7k users

• Emporium- $500k, 89 users

you might be wondering how CC has more volume with less users, its in the quality of the users spending on CC with their no 1 wallet peaking over $3m on gacha spending...

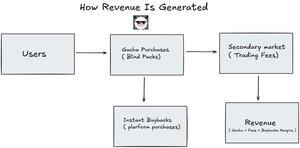

🔹 Revenue model

• How do they generate revenue?

( if you already read how it works)

• Users

This starts with collectors or players who want to engage with TCG assets (like Pokémon cards)

• Gacha Purchases (Blind Boxes)

Users spend money (often in $SOL) to open gacha (blind boxes).

• Instant Buybacks

After opening, users can instantly sell cards back to the platform at a set percentage (often 80–85% of market value)

• Secondary Market (Trading Fees)

Users who don’t sell back can list cards on the marketplace to trade with others. ( fees are charged for each successful trade)

TLDR

The platform earns revenue from:

• Gacha spending (blind box sales)

• Trading fees (on secondary sales)

• Buyback margins (difference between buyback price and resale price)

This should be clear yeah?

4,66K

Johtavat

Rankkaus

Suosikit