Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

1/ We worked with the @pendle_fi team to build the risk stack for @boros_fi, the first onchain protocol for trading funding rates.

This required new frameworks, including dynamic margin models, auto-deleveraging mechanics, and real-time risk monitoring.

6.8. klo 11.30

Introducing Boros, Pendle’s new platform for trading funding rates

🔗

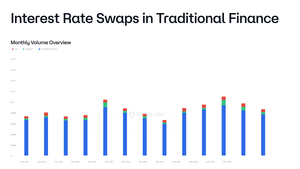

2/ DeFi Gets Interest Rate Swaps

Global markets clear over $1.2 trillion daily in interest rate swaps.

@boros_fi enables a fixed-for-floating structure in DeFi, where users swap fixed yields against floating funding rates from exchanges like @binance.

3/ New Market, New Architecture

We designed the full risk stack, including:

• Dynamic margin formulas

• Auto-deleveraging mechanics

• Oracle manipulation guards

• Capital-efficient margin design

• A custom AMM for fixed–float trades

All tailored for rate volatility and fast-moving markets.

4/ Risk Monitoring

We developed comprehensive monitoring tools and automated bots that continuously track key risk metrics, position health, and market anomalies.

These systems respond to threats in real time, maintaining protocol stability across volatile funding rate environments.

5/ Modeling the Unknown

We ran Monte Carlo simulations to stress-test risk parameters across volatile market conditions. This helped calibrate margin requirements, liquidation bands, and buffers, balancing economic safety with capital efficiency.

6/ New Class of Market

@boros_fi opens access to interest rate trading on any yield stream. Simple structure, baked-in risk controls, and composable design.

This brings DeFi into the trillion-dollar rate derivatives market.

7/ More details on our risk framework, parameters, and monitoring tools will be released soon.

33,31K

Johtavat

Rankkaus

Suosikit