Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

2Q25 GDP came in hotter than expected (3% vs 2.6% consensus).

But don’t be fooled by the headline...

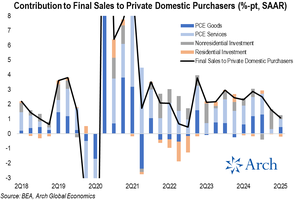

Final sales to private domestic purchasers - the cleanest read of underlying demand - rose just 1.07% in Q2.

That’s the weakest since 4Q22 and a notable downshift from ~2.5% growth in 2024.

Let's dig in🧵

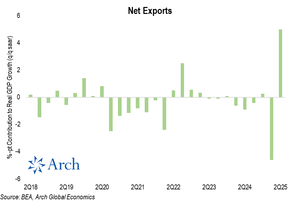

Headline GDP was flattered by a snap back in net exports as frontloading of imports to get ahead of tariffs in Q1 left a void in Q2.

The trade war is likely to cause continued distortions, to a lesser degree, over the remainder of 2025.

So, stripping out the noise, the domestic demand engine is clearly losing steam.

Isolating net exports, you can see the wild swing the past two quarters, which exceeds even the pandemic-era distortions.

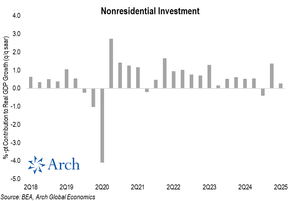

However, we even see some distortions from this angle as the front-loading to get ahead of tariffs didn’t just show up in the trade data.

It also flattered business investment activity, which surged in Q1 – contributing 1.4%-pts to headline GDP growth – but fell back to below the 2024 pace as hangover from frontloading set in.

With a more typical quarter for business investment, Q1 final sales to private domestic purchasers would’ve been even weaker – likely below 1%.

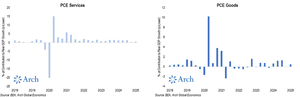

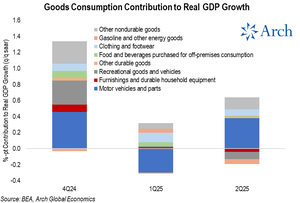

Looking closer at the consumer, the downshift has been fairly broad-based, with spending on both goods and services taking a step down.

Goods consumption has clearly taken a hit as consumers brace for tariff impacts, with autos spending being the biggest swing factor - down big in Q1 but snapping back in Q2.

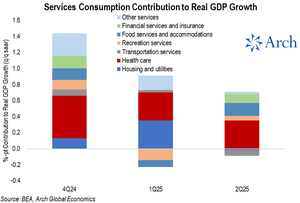

Services consumption has also cooled as general anxiety about the outlook has created a drag on growth, but the underlying driver remains a tailwind for growth: healthcare.

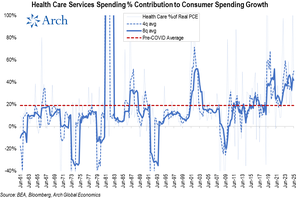

I've highlighted healthcare as the key driver of recent economic growth previously, but it's worth revisiting.

Pre-COVID, healthcare typically contributed ~25bps to headline real GDP growth.

Over the last couple years, it's contribution has roughly doubled.

That means healthcare has been accounting for roughly half of real consumer spending growth in recent years.

Wrapping it all up: while the economy may still be expanding, momentum has clearly faded under the surface.

With tariffs disrupting trade, consumption, and business investment, it’s getting harder to sustain solid private sector growth.

With tariffs also throwing a wrench into the disinflation narrative, it's clear why most FOMC participants will be sitting on their hands at today's meeting.

45,17K

Johtavat

Rankkaus

Suosikit