Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Heather Long

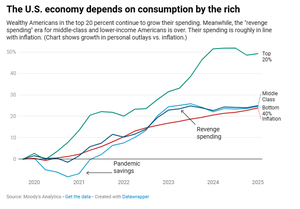

The "K-shape" economy is back.

To me, this is one of the most important charts to understand the 2025 economy...

The wealthy are still spending (though there has been some moderation).

Meanwhile the bottom 80% are tapped out. Their spending is basically in line w/inflation.

***Whether we go into a recession will depend almost entirely on whether the top 10 to 20% of earners keep spending***

#economy

224,37K

The US labor market is weakening.

Is that due to lower supply or lower demand?

Smart piece from @Claudia_Sahm who concludes:

"Currently, the data suggest that reduced labor supply is likely the key driver though reduced demand is playing a role and the risk of cyclical weakening in the labor market have risen."

#jobs #economy

7,66K

Heather Long kirjasi uudelleen

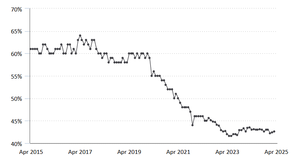

The Bureau of Labor Statistics Monthly Job Report: it’s based on two surveys the establishment & household. The survey in question is the former. It’s based on a 121K survey from non-farm private employers & government agencies comprising 631K worksites.

The response rate has recently slipped below 60% down from pre pandemic rate of 70% and well below the 80% rate typical over a decade ago. The survey has a +/- of 100K each month.

Typically with a three month window the response rate for a single monthly survey time improves to 90% which is why there are ongoing rolling revisions that are rarely as large as the downward 258K revision in June.

The numbers are not rigged and they are the gold standard internationally.

63,87K

Heather Long kirjasi uudelleen

Federal Reserve governor Adriana Kugler is unexpectedly stepping down early from the central bank’s powerful board of governors, creating an early vacancy that will give President Donald Trump an early opportunity to shape the Fed’s leadership.

Her term was slated to expire in January.

Kugler missed this week's Fed meeting for personal reasons.

19,74K

President Trump says he is firing the head of the Bureau of Labor Statistics after the weak jobs data.

BLS puts out the jobs reports, CPI inflation, productivity and employment cost index, among other key statistics.

This is basically unprecedented and will raise concerns about US data integrity going forward.

426,14K

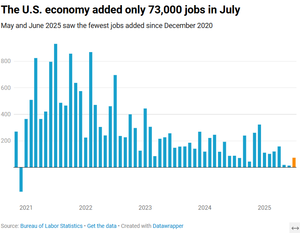

I've been calling this a "Frozen" job market for awhile.

Now I would call it a red flag.

The economy is barely adding any jobs.

July: 73,000

June: 14,000 --> The weakest since Dec 2020

May: 19,000

Healthcare makes up almost all the jobs added in the past 3 months.

Many sectors -- manufacturing, professional biz, warehouse, retail, government -- have LOST jobs in the past three months.

The big preliminary annual revision coming out on Sept. 9 may even show job losses. (Or certainly an even weaker labor market so far in 2025).

-->Companies do not want to hire or invest with this much uncertainty about tariffs, inflation, etc.

157,21K

This labor market is in trouble.

Healthcare are social assistance are pretty much the only sectors hiring. This is NOT healthy.

**Just +73,000 job gains in July**

Healthcare +55,000

Social assistance +18,000

Retail +16,000

Finance +15,000

Hospitality +5,000

State gov't +5,000

Transport/warehouse +4,000

Construction +2,000

Professional and biz services -14,000

Federal gov't -12,000 (down -84,000 since January)

Manufacturing -11,000

Local gov't -3,000

Information -2,000

215,94K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin