Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

ElonMoney

defi research // onchain & perps trading

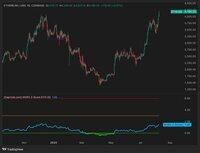

Looking back, yeah, it’s obvious it would’ve been smart to load up on $BTC, $ETH, or $HYPE at the April lows. But that ship’s sailed… Don’t sweat it though, there’ll be plenty more shots like that. In this post, I want to walk you through the kind of indicators that can flag an amazing buy zone.

Let’s use ETH as the example:

1. Sentiment

Crowd sentiment is one of the most important signals in trading. If it’s been extreme bullish for a long time, start selling. If it’s been extreme bearish, start looking to buy.

Of course, you never base a decision on one metric alone. Combine it with others.

On @KaitoAI charts, you can see sentiment was negative in Feb and April 2025. Looking back, those were the moments to buy, nobody believed in ETH then, everyone was calling it dead.

2. Open Interest RSI by @TRDR_io

This is a killer metric for spotting tops and bottoms on higher timeframes.

In April, OI RSI dropped to 29 when ETH was $1,500. Even earlier, in Feb 2025, it hit 23 with ETH at $2,500.

3. RSI & MACD

On April 8th, 1D RSI printed 24, the lowest since Aug 2024. Even in Feb 2025 it didn’t go below 30.

MACD bottomed a bit earlier in March, with ETH at $1,860.

4. MVRV Z-Score

@capriole_fund's MVRV Z-Score sank to critical lows from March to May 2025, with ETH trading between $1,800–$1,500.

These five indicators won’t always nail the exact bottom, but they’ll get you pretty damn close.

11,5K

Why I’m leaning toward more BTC upside right now

Market Profile:

- BTC is pinned between pMonth VWAP (115965) and 30D RVWAP (117200). A break and hold above 117200 - looking for 120K.

- Drop to 115965 and hold below opens 114–112K, but that’s low-probability, IMO, with CB Premium positive and BTC ETF inflows back.

Orderflow:

- OI RSI / ODB not overheated. When ODB RSI >60 + net ODB >0 and OI RSI sits in 50–65 range - historically, we see grindy upside, eating ask walls and stair-stepping into new highs.

- When net ODB ≤0 with OI RSI >70 - upside bursts fizzle in 3–7 candles, price pulls back into lower bid clusters.

Trading plan:

- Base case: grind toward 119–120K, dip buys get absorbed.

As long as net ODB stays >0 and ODB RSI ≥60, market’s being pulled higher.

- Bear alt: pullback into lower bids.

Trigger = flip net ODB ≤ –0.3–0.5B + ODB RSI drops <55 while OI RSI climbs (fresh shorts coming in). Path: 115.9–114.8k, weak bounce = magnet at 113k.

5,11K

As you already know, in this cycle $ETH has drawn institutional attention. ETFs are buying, but what’s even more interesting is that companies are also adding ETH to their balance sheets.

The most important metric for gauging growth potential is mNAV. As you can see in the screenshot, $BMNR has a high mNAV, which corresponds to significant ETH purchases for its treasury.

If mNAV falls below 1, it means the company is forced to sell ETH and buy back its own shares, clearly a negative for ETH’s price. That’s why it’s crucial to track this metric and use it to assess the positioning of these companies.

h/t: @Delphi_Digital

8,11K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin