Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The Learning Pill 💊

Curating crypto alfa, insights and new projects so you can make it //

Nothing here is financial advice.

Another accomplishment for RWA on @Aptos as TVL crosses the $700M mark!

This is exactly what we love to see - real capital flowing onchain and serious players doubling down on Aptos' infrastructure

Biggest contributor→ @pactconsortium bulking up their private credit loan portfolio once again

Pill believes one day (soon) Aptos will cross the $1B mark in RWA TVL. The infra is here, the confidence is building, and moves like this from Pact are just the beginning.

Would you place your confidence in the $APT eco?

Aptos6.8. klo 08.00

Surpassing 700M in RWAs

Sitting in the Top 3 Chains in RWAs

Supported by @pactconsortium, @OndoFinance, @BlackRock, @Securitize, @apolloglobal, @FTDA_US, @KAIO_xyz

Sensational.

Aptos.

49,52K

Most people use USDT to farm, swap, and bridge.

But when it comes to real-world access? Minimal.

@KaiaChain is making it work by allowing Kaia-native USDT withdrawal from a Digital ATM (DTM) in South Korea via a partnership with DaWinKS and will soon be supported on @biptapofficial for card usage

DTMs are live in a few major tourist hotspots like N Seoul Tower!

If you’re visiting Korea, you can:

• Withdraw local currency from USDT

• Load prepaid transport cards

• Passport-based KYC + face scan directly on the machine

Why this matters?

• $KAIA is building a real bridge between crypto <> physical world

• It’s a sandbox for stablecoin utility in regulated markets

• It gives USDT actual spending power, not just number-go-up speculation

This would be a step to rolling-out wider scale KRW stablecoin adoption, awareness and participation on @KaiaChain

4,39K

KRW stablecoins might unlock Korea’s trillion-dollar securities market and @KaiaChain could play a role in it

here’s the big idea:

everyone’s focused on cross-border payments or DeFi yield when they hear “stablecoins.”

but in Korea, there’s a far more overlooked (and massive) opportunity - tokenised securities.

let’s break it down 👇

Korea is moving fast on security token infrastructure.

however, there’s friction as settlement still happens off-chain via bank transfers, batch processing, and custodians.

now add a KRW stablecoin into the mix and you'll have:

➪ onchain, real-time settlement

➪ automatic dividends and coupon payouts

➪ tokenised bonds, stocks, REITs (but composable)

KRW stablecoins become the native money for a programmable capital market, and this is where @KaiaChain enters the frame

Kaia isn’t just talking about stablecoins but they’re building the infrastructure to support them

if tokenised securities are the endgame, then KRW stablecoins are the fuel, and $Kaia could be the chain that makes it all run

these kind of developments are what Pill has set eyes on in the past few years - going to continue keeping watch on this

what do you think about $KAIA's role and tokenised markets?

6,91K

Will the $IN attention-fuelled flywheel go BRRRR?

Pill thinks...very possibly.

If you’ve been following @Infinit_Labs, you’ll know V2 is coming.

And with it, the TGE!

Peeled through the posts and replies - and here’s what stood out from a user-first lens 👇

1️⃣ Signal vs Noise - Strategy Quality Filtering

Concern: Will I be flooded w low-quality or high-risk strats?

Infinit’s Agentic DeFi model promises democratised yield access - but as a user, the abundance of AI-generated strategies can quickly become overwhelming...

And w/o proper filtering, it’s hard to tell which vaults are trustworthy or tested.

So the question becomes:

➢ Is there a curation layer?

➢ Are vaults ranked by performance, risk, or adoption?

➢ Can the community downvote bad actors or spam?

2️⃣ Staker vs Non-Staker Experience

Concern: Do I miss out if I don't stake $IN?

Staking $IN unlocks access to more curated, higher-performing strategies and boosts point accumulation.

As a casual user:

➢ Will I be relegated to less optimised vaults?

➢ How visible is this difference?

➢ Is there a "try before you buy" experience before staking?

3️⃣ Longevity of Community & Incentives

Concern: Will this just be a short-term mercenary farming loop?

Most of the $IN supply is for the community. That’s a green flag.

This increases confidence in long-term alignment, but also raises questions:

➢ Will early participants be disproportionately rewarded?

➢ How does the system prevent Sybil attackers from farming and dumping?

➢ Is there a mechanism to recycle rewards or reinvest into ecosystem development?

That’s the current read from Pill’s end.

Still early, still evolving - but the foundations for an attention-based DeFi engine are here.

What do you think - are there blind spots in the token design?

6,76K

The Learning Pill 💊 kirjasi uudelleen

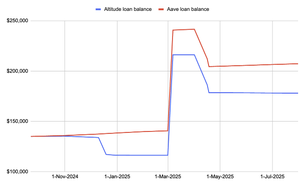

One of our users borrowed $135,000 through Altitude in September to buy a new Tesla. By March, he had borrowed an additional $62,000, bringing the total to $197,000.

Nearly a year later, his loan balance is down to $178,000.

That’s a $19,000 reduction, driven entirely by our automated system repaying the debt over time.

For comparison, the same loan on Aave would have accrued roughly $10,000 in interest. The difference? $29,000 in the user’s favor.

Proof that smart design and automation can turn debt into an advantage.

Simple. Smart.

10,16K

Why Korea’s next big export might be…stablecoins

In Korea, digital payments are everywhere - KakaoPay, Naver Pay, Toss.

And most of them run on prepaid funds.

You top up → get points → spend them in a closed loop.

Sounds efficient, right?

It is. Until you realise...

• Points can expire

• Can’t be transferred

• Are legally capped per user

• Can’t plug into global rails

Now imagine that same flow - but onchain with KRW stablecoins

⪼ Real-time settlement

⪼ Auditable & transparent

⪼ Transferable across wallets, apps, even borders

⪼ No expiry, no artificial limits

Here’s where it gets interesting: @KaiaChain is laying the groundwork to make this a reality.

$Kaia is building a modular L1 optimised for compliant Web3 infra in Korea.

That means:

➪ Hooks for local fintechs to integrate KRW stablecoins

➪ Rails for dApps, wallets, payment processors

➪ Infra that aligns with Korea’s evolving stablecoin framework

Just these should get you excited at the potential a KRW stablecoin will bring about!

It’s a shot at replacing closed-loop points w programmable digital won - globally usable, locally compliant.

And Kaia wants to be the chain that powers it all.

7,41K

Universal Accounts by @ParticleNtwrk are like Apple ID for Web3.

You don’t set up a new wallet for every dApp.

You don’t bridge funds just to try something new.

You don’t even think about chains.

UAs makes crypto feel like logging into iCloud:

→ one account, one balance, and works everywhere

You open an app, and your tokens are just... there.

Or...buy a real-world asset in 2-clicks?

Macro's showing that huge partnerships like this @ParticleNtwrk x Circle is just the beginning of many more opportunities!

We're talking TRILLIONS potentially flowing through Universal Account as tradfi moves onchain.

Particle is the only project positioned to help retail access all of these regardless of what chains the assets are deployed on, also giving dApps a massive advantage.

Let's not forget - $PARTI is designed to accrue value as their UA scales and holders are positioned to reap the fruits.

Particle Network5.8. klo 00.02

TRANSCENDING ONCHAIN: ANNOUNCING THE UNIVERSAL LAYER FOR RWAS, STABLECOINS & DIGITAL ASSETS

The stage is set for Trillions of dollars to come into Web3.

Stablecoins may hit a $3.7T supply by 2030.

Onchain RWAs are projected to be worth $30T by 2034.

Tokenized real‑estate points at a $380T TAM.

The world is ready. Is Web3? Yes, because Universal Accounts exist.

As the only solution making Web3 feel like a single ecosystem, Universal Accounts are here to stay. They’ve already cleared $670 M via @UseUniversalX, and are the only way a multi-chain, multi-Trillion asset ecosystem can find its way to the masses—whether by accelerating Web3 or upgrading Web2.

So today, we’re announcing the culmination of our tech: The Universal Transaction Layer: a retail‑ready settlement rail for RWAs, stablecoins and all other digital assets.

Through the next weeks, we’ll also progressively announce the partners that will aid us in this mission, starting with @Circle. With the integration of Circle Gateway, we’ll be setting the stage for stablecoin settlements to occur across chains for Universal Accounts, unlocking the entire world’s economy for anyone using Universal Accounts.

When every property, dollar, or asset becomes a token, Universal Accounts become the default rails for them.

Crypto is ready. Let’s transcend onchain.

📝 Read the full vision at:

6,15K

Universal Accounts by @ParticleNtwrk are like Apple ID for Web3.

You don’t set up a new wallet for every dApp.

You don’t bridge funds just to try something new.

You don’t even think about chains.

UAs makes crypto feel like logging into iCloud:

→ one account, one balance, and works everywhere

You open an app, and your tokens are just... there.

Or...buy a real-world asset in 2-clicks?

Macro's showing that huge partnerships like this @ParticleNtwrk x Circle is just the beginning of many more opportunities!

We're talking TRILLIONS potentially flowing through Universal Account as tradfi moves onchain.

Particle is the only project positioned to help retail access all of these regardless of what chains the assets are deployed on, also giving dApps a massive advantage.

Let's not forget - $PARTI is designed to accrue value as their UA scales and holders are positioned to reap the fruits.

Particle Network5.8. klo 00.02

TRANSCENDING ONCHAIN: ANNOUNCING THE UNIVERSAL LAYER FOR RWAS, STABLECOINS & DIGITAL ASSETS

The stage is set for Trillions of dollars to come into Web3.

Stablecoins may hit a $3.7T supply by 2030.

Onchain RWAs are projected to be worth $30T by 2034.

Tokenized real‑estate points at a $380T TAM.

The world is ready. Is Web3? Yes, because Universal Accounts exist.

As the only solution making Web3 feel like a single ecosystem, Universal Accounts are here to stay. They’ve already cleared $670 M via @UseUniversalX, and are the only way a multi-chain, multi-Trillion asset ecosystem can find its way to the masses—whether by accelerating Web3 or upgrading Web2.

So today, we’re announcing the culmination of our tech: The Universal Transaction Layer: a retail‑ready settlement rail for RWAs, stablecoins and all other digital assets.

Through the next weeks, we’ll also progressively announce the partners that will aid us in this mission, starting with @Circle. With the integration of Circle Gateway, we’ll be setting the stage for stablecoin settlements to occur across chains for Universal Accounts, unlocking the entire world’s economy for anyone using Universal Accounts.

When every property, dollar, or asset becomes a token, Universal Accounts become the default rails for them.

Crypto is ready. Let’s transcend onchain.

📝 Read the full vision at:

3,24K

The Learning Pill 💊 kirjasi uudelleen

The stablecoin market has skyrocketed to $267b , doubling in just a year. Talk about rapid mainstream adoption!

With game-changing moves like the GENIUS Act and insights from the USA's Project Crypto, now's the time to let your stablecoins do the heavy lifting as this sector takes off.

I've dropped 3 threads on yield-bearing stablecoins, with juicy yields as usual. Missed them?

Here's a quick summary of all the stables I covered.

You can also use the infographics as a guide.

_____________

✦ @UnitasLabs (sUSDu)

⇒ Mechanism ➝ Protocol fees from Unitas’ multi-strategy delta neutral vaults

⇒ Yield ➝ 19.68% APY

✦ @avantprotocol (savUSD)

⇒ Mechanism ➝ Delta-neutral strategies

⇒ Yield ➝ 18.36% APY

✦ @SmarDex (USDN)

⇒ Mechanism ➝ Ethereum staking and funding rates from traders using USDN protocol

⇒ Yield ➝ 15.9% APY

✦ @aegis_im (YUSD)

⇒ Mechanism ➝ Funding fees from delta-neutral spot and perpetual arbitrage

⇒ Yield ➝ 15.74% APR

✦ @CygnusFi (cgUSD)

⇒ Mechanism ➝ Short-term U.S. Treasury Bills

⇒ Yield ➝ 14.84% APY

✦ @FalconStable (sUSDf)

⇒ Mechanism ➝ Liquidity provisioning, staking, funding rate arbitrage, and cross-exchange price arbitrage

⇒ Yield ➝ 12.6% APY

✦ @HermeticaFi (sUSDh)

⇒ Mechanism ➝ Funding rates on a short Bitcoin perpetual futures position

⇒ Yield ➝ 12% APY

✦ @fraxfinance (sfrxUSD)

⇒ Mechanism ➝ U.S. Treasury Bills and DeFi strategies (staked frxUSD is dynamically allocated to the highest yield source to generate yield)

⇒ Yield ➝ 11.63% APY

@0xCoinshift (csUSDL)

⇒ Mechanism ➝ Treasury Bills and on-chain lending

⇒ Yield ➝ 11.32% APY + 5x Shift Points

✦ @Aster_DEX (asUSDF)

⇒ Mechanism ➝ Trading fees and funding rates on short synthetic stablecoin positions

⇒ Yield ➝ 11.3% APY

✦ @lista_dao (lisUSD)

⇒ Mechanism ➝ Liquidation rewards and borrowing interests

⇒ Yield ➝ 11.08% APY

✦ @ethena_labs (sUSDe)

⇒ Mechanism ➝ Delta-neutral hedging and staking rewards on its stETH collateral

⇒ Yield ➝ 11% APY

✦ @reservoir_xyz (srUSD)

⇒ Mechanism ➝ U.S. treasuries, DeFi yield, and market-neutral strategies

⇒ Yield ➝ 11% APY

✦ @parabolfi (paraUSD)

⇒ Mechanism ➝ U.S. Treasury Bills and repo reserves

⇒ Yield ➝ 11% APR

✦ @StablesLabs (sUSDX)

⇒ Mechanism ➝ Delta-neutral hedging and multi-currebcy arbitrage

⇒ Yield ➝ 10.57% APY

✦ @noon_capital (sUSN)

⇒ Mechanism ➝ Delta-neutral strategies

⇒ Yield ➝ 10.44% APY + 5x Noon Points multiplier

✦ @StandX_Official (DUSD)

⇒ Mechanism ➝ Staking and funding rates from perpetual contracts

⇒ Yield ➝ 10.06% APY

25,76K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin