Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Altitude

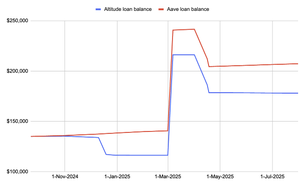

One of our users borrowed $135,000 through Altitude in September to buy a new Tesla. By March, he had borrowed an additional $62,000, bringing the total to $197,000.

Nearly a year later, his loan balance is down to $178,000.

That’s a $19,000 reduction, driven entirely by our automated system repaying the debt over time.

For comparison, the same loan on Aave would have accrued roughly $10,000 in interest. The difference? $29,000 in the user’s favor.

Proof that smart design and automation can turn debt into an advantage.

Simple. Smart.

10,11K

0% Interest Loans For Everyone

DeFi was built to open financial access. But in practice, it often feels overly complex, layered interfaces, unclear incentives, constant management. Many users spend more time figuring out how a protocol works than actually using it.

It doesn’t have to be this way.

Good design in DeFi should do what it does in any industry: make powerful systems feel simple, without hiding what matters. It’s not about dumbing things down but it’s about surfacing value and minimizing friction.

That’s our philosophy.

Under the hood, we connect with leading protocols like @aave , @MorphoLabs , and @pendle_fi to optimize borrowing, manage LTVs, and automatically repay debt using yield from idle collateral.

But the experience? It’s simple:

- Deposit your asset

- Set your borrowing parameters

- Let the system work

You stay in control. We handle the complexity.

Simplicity is not a constraint. It’s what makes real value usable. In a space filled with noise and layers, clarity is a competitive advantage.

5,33K

The Illusion of Value in DeFi

In the last few years, DeFi has become a landscape full of beautiful, complex mechanisms, many of them drawn like Dalí’s sketches on the back of a check. Tokenomics that seem mathematically elegant but rarely play out in real markets. Yield strategies that rely on layers of incentives rather than any productive use of capital. Projects that thrive more on virality than utility.

We participate. We speculate. We hold. But often, we don’t redeem.

Much of the “value” in DeFi today depends on a collective agreement not to call the bluff. To treat the dashboard numbers as truth. To let the checks hang on the wall, never cashed, because it’s better to believe in the system than stress-test it.

That is the Salvador Dali effect in DeFi.

But it is also a warning.

Redeemable Value Through Function

Altitude is designed to deliver real outcomes, not speculative narratives.

Instead of relying on attention-driven mechanics, we focus on automation, capital efficiency, and transparent performance. Deposited assets are actively put to work across established protocols like @aave , @MorphoLabs , and @pendle_fi to generate yield that helps offset or repay debt.

Borrowing rates are optimized automatically. Liquidation risk is reduced through conservative LTV targets and continuous rebalancing. Idle capital doesn’t sit, it contributes to the strategy.

It’s a straightforward approach to DeFi, practical, sustainable, and built to last.

The End of Magic

Cycles of over-financialization and narrative-heavy projects are wearing thin. Users are becoming more discerning. They want strategies that work without them. Systems that repay, not just reward.

Altitude represents this shift from spectacle to structure, from magic to mechanism.

It is, in a way, the anti-Dali. Not because it lacks creativity or elegance, but because its value is not in what it symbolizes, but in what it does. It is redeemable by design. Transparent by necessity. Productive by architecture.

And in a space long dominated by the art of illusion, that may be the most valuable thing of all.

5,3K

Borrow at 0%. Or even negative.

Most people in DeFi are overpaying to borrow, underutilizing their collateral, and managing risk manually without realizing it.

We change that.

Collateralized borrowing today is largely static: collateral is locked and unproductive, interest rates are manually selected and rarely optimal, and risk management is left entirely to the user. This architecture creates friction, suppresses capital efficiency, and introduces hidden, compounding risk.

We rethink this model from first principles.

Instead of treating loans as isolated, fixed positions, we treat them as dynamic, composable strategies. Altitude continuously redeploys idle collateral into yield-bearing opportunities without compromising solvency, automatically refinances loans across integrated markets when more favorable rates emerge, and manages loan-to-value in real time to reduce exposure and improve resilience. All of this happens on behalf of the user.

Borrowers don’t just save time. They borrow more intelligently, with less cost, less risk, and far greater capital productivity.

This is not surface-level automation. It’s integrated capital logic that optimizes every layer of the lending experience.

1,53K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin