Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Omkar Godbole, MMS Finance, CMT

Views & Opinions are my own and not the views of my contractor/employer

Meltdown over Powell?

More tariffs and sanctions on India?

Blame India for horrible ISM non-manufacturing?

Fire ISM guys?

Tariff the Sun for sending sunlight to Russia?

First Squawk6.8. klo 10.44

PRESIDENT TRUMP TO MAKE “AN ANNOUNCEMENT” FROM OVAL OFFICE TOMORROW AT 4:30 PM ET — WHITE HOUSE

719

Omkar Godbole, MMS Finance, CMT kirjasi uudelleen

Stagflationary mix on the ISM knocking risk here

Services employment contracting, new orders and activity barely expanding, prices rising

Stagflation of course is the most toxic combination for risk IF it prevents the Fed being able to cut rates to cushion slowing growth

Given still high real rates, this not really a concern here

Rising risks to growth and employment will be sufficient for the Fed to cut in September

BTFD

5,41K

LOL

man this dude is unbelievable

*Walter Bloomberg5.8. klo 20.38

🚨 TRUMP SAYS PROBABLY WILL NOT RUN AGAIN

510

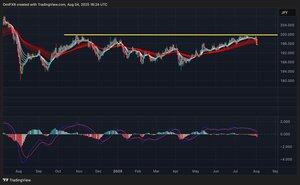

$GBPJPY short tgt 186 stop abv 200

The cross has produced a powerful confluence of bearish signals, suggesting a significant shift in trend after its recent rally.

The weekly chart has formed a large bearish outside week candle, a highly significant reversal pattern that indicates sellers have overwhelmed buyers on a longer timeframe. This sell-off was triggered by a failure to decisively break above the 200 level, a key resistance that has capped upside multiple times in the fourth quarter of 2024.

This bearish sentiment is being confirmed by momentum indicators across the board. The standard MACD (12, 26, 9) is producing deeper bars below the zero line, signaling a strong short-term downtrend. More significantly, the longer-term MACD has also flipped bearish, indicating a shift in momentum on a larger scale. The price is now trading below both the short- and long-term Guppy EMA bands, confirming that a downtrend is in place, even though the bands have yet to confirm a full bearish crossover.

The path of least resistance for GBP/JPY now appears to be lower. Traders should look for continued weakness and be prepared for a potential extended decline, with any short-term rallies likely to be corrective in nature against a stronger prevailing downtrend.

A close above 200 would flip the outlook bullish in favor of long trades.

587

Markets may be running ahead of themselves in pricing rapid Fed easing.

Friday's jobs figure of +73K, which missed expectations, while carrying biggest two-month downward revision, stoked fears about the economy, spurring traders to price in the September Fed rate cut.

But that's just one report, and according to Scotiabank, the headline figure isn't all that bad. The breakeven rate for payrolls is somewhere between 80K-120K. So more data is needed to confirm the labor market weakness.

Meanwhile, Powell's Fed has time and again stressed its dual mandate, which includes price stability. The ISM manufacturing data released last week showed price paid index well above 60 even as new orders fell below 50. Readings below 50 indicate contraction.

The ISM services will be released this week alongwith the CPI and PPI readings. Should these figures point to sticky price pressures, we could see markets dial back rate cut bets.

248

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin