Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

LondonCryptoClub

2 friends. Combined 44 years experience in central bank / macro sales and trading. Helping you navigate crypto. Check out our free newsletter, link below.

Always find it amazing how many people would rather live in this rat race that works against them at every turn, rather than try to find ways to escape it

Would rather spend 40 years in a dull job than spend 40 minutes trying to understand the greatest macro opportunity of a generation that could lead to financial freedom

As @StevenBartlett says, people would rather chose certain misery than risk the discomfort of uncertainty

Learning about Bitcoin might take you out of your comfort zone but you owe it to your future self to take that journey

Adam Livingston17 tuntia sitten

Normies think Bitcoin is risky.

While they work 40 years, get paid in a currency losing 8% a year, taxed before they touch it, stored in a bank that lends it out ten times over, while the interest you earn is less than the inflation they deny is happening.

Opt out of this absolute madness.

5,97K

This is the energy of someone who receives our Connecting the Dots newsletter free into their inbox every Sunday

naiive9.8. klo 09.35

account with .eth name right now :

4,81K

Writing the macro for this weeks Connecting the Dots newsletter

It’s amazing each week how many mega bullish idiosyncratic things are happening for Bitcoin and crypto

Trump signing an executive order to allow crypto to be included in 401k’s is HUGE

To be tariffs on gold highlighting again why “digital gold” beats a physical commodity that needs to cross borders and can be tariffed

The 53bn Harvard endowment making Bitcoin its fifth largest holding in the portfolio

Were not bullish enough

4,65K

“Harvard economists” lol

Anyone who calls themselves an economist yet doesn’t get Bitcoin, doesn’t really understand economics

That or they’re just wilfully ignorant and haven’t spent time trying to understand Bitcoin

Having started my career as an economist and worked with several economists, I can confirm it’s likely many don’t really understand economics 😂

Bitcoin Archive10.8. klo 00.41

2018: Harvard says Bitcoin is more likely to hit $100 than $100K.

2025: Harvard buys $116M Bitcoin at $116K.

Everyone gets Bitcoin at the price they deserve.

4,95K

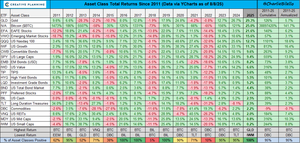

It’s great looking at these charts and putting Bitcoin performance in perspective

Over time Bitcoin outperforms everything

Being long Bitcoin and Nasdaq will likely outperform most fund managers over the next 10 years+ as they’re the biggest secular, exponential trends

Also a good reminder of how all assets are trading macro cycles and liquidity

The functioning of fiat, debt based economies requires ever expanding debt and money creation, debasing currency and pushing all assets higher in fiat currency terms

This gets periodically interrupted when central banks led by the Fed try to drain some of that liquidity and pretty much all assets go down together in those years

But the ability to drain liquidity is a small window and quickly things break and they’re back to expansion of money supply and inflating the assets which are the collateral underpinning a debt based system

This is why bears don’t make money

The corrections and down years are very infrequent and now with central banks removing the left tail risk and providing the market with a central bank put, those rare down years don’t draw down sufficiently to make up for all the gains you missed in the up years

Our aim at London Crypto Club is to try help you HODL the best performing assets in the structural bull markets without chopping yourselves up trying to trade the squiggles in those bull markets

Then signal when we’re set to enter those infrequent down years where you want to reduce position and go back to cash, ready to buy the dip!

Over time though, everything is going to be higher in fiat terms

Bitcoin will go up the most

Charlie Bilello9.8. klo 19.22

Gold (+29%) and Bitcoin (+25%) are the top performing major assets so far in 2025. We’ve never seen these two in the #1/#2 spots for any calendar year. $GLD $BTC

Video:

23,6K

No one, or at least very few, will outperform crypto by “trading” it

Just buy and HODL, at least whilst we’re in a structural bull market which likely has another year to run

Lookonchain9.8. klo 18.48

Arthur Hayes(@CryptoHayes) sold 2,373 $ETH($8.32M) a week ago when the $ETH price was ~$3,507.

4 hours ago, he moved out 10.5M $USDC to buy back $ETH at a higher price.

5,18K

Want to learn more about AI in simple language?

Give our sister account a follow 👇🏼

London AI Club9.8. klo 15.35

You’ve heard GPT-5 loads this week.

But what even is a GPT?

Here’s my breakdown in plain English 👇🏼

4,03K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin