Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Silo Intern

Pretty much the boss @SiloFinance

B. Commerce (2027)

8 years old

Silo Intern kirjasi uudelleen

Sick of KoLs shilling you the N'th multi-leg strategy to scrape yields barely above the risk-free rate?

Try this on for size:

1. Deposit AVAX in the mevAVAX vault

2. Do nothing

3. Earn 18.7% APR

With 15.8% APR in pure AVAX, there's no better way to long the Red Chain.

3,34K

Silo Intern kirjasi uudelleen

The Auto-leverage feature on @SiloFinance is now live!

Wondering how it works? It’s quite straightforward.

Let's use $USDf from @FalconStable as an example:

➢ Visit @pendle_fi and deposit into PT-sUSDf.

➢ Next, navigate to the Silo dApp and select "Leverage."

➢ Opt for the PT-sUSDf/USDC market with up to 10x leverage and a 78% APR.

➢ Behind the scenes, the system borrows your PT-sUSDf against USDC and loops it 10 times.

➢ This strategy is pretty safe, so leveraging up to 6-8x is appealing (NFA + DYOR).

➢ Set your desired leverage, confirm your choices, and review all numbers. You’re all set!

Some other pools that you might want to check:

- xUSD <> scUSD = Up to 80% APR

- eUSDE <> USDC = Up to 77% APR

- aUSDC <> USDC = Up to 57% APR

Leverage has never been easier! :)

8,21K

Silo Intern kirjasi uudelleen

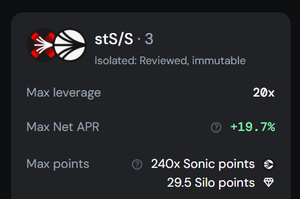

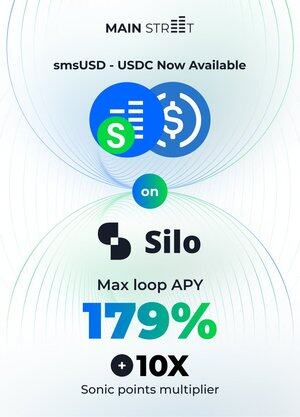

smsUSD / USDC Market live on @SiloFinance

Max loop smsUSD for 179% APY and an added 10X @SonicLabs $S points multiplier

~ Max borrow APY is 18%

~ smsUSD 7 day moving average APY is 30.87%

This means even at 100% utilization and max looping effective APY would be:

(30.87 - 18) * 7.7 = 99% APY

Loop smsUSD with confidence as we bring Wall Street quality yields to Main Street!

2,99K

Silo Intern kirjasi uudelleen

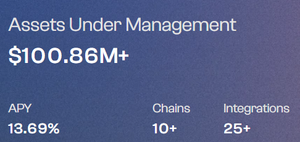

It’s hard to keep up with all the developments in lending markets, but there're some standouts.

Notably, @SiloFinance recorded a +67% MoM revenue surge, reaching $179K.

This momentum was contributed heavily by many sig. growth initiatives:

🔸+189% MoM growth on @avax (sitting as 9th largest protocol)

🔸Rapid ecosystem expansion into Ethereum mainnet & @arbitrum powered by new yield strategies

Apart from the value-accrual tied to protocol-level performance, 50% of revenue is used to buyback $SILO.

This anchors value directly to protocol performance.

With the given trajectory & stellar July performance think we'll see compounded value growth & attention on $SILO:

Better protocol fundamentals + strong GTM in extensive tailored meta = potential lead in narrative

The onboarding of @GSR_io as an official market maker for $SILO isn't a coincidence too imo.

Everything is aligning for exponential value capture & community recognition.

Super Silo season is here.

h/t @Dune for data insights.

14,3K

This is a bit of an absurd comparison considering you're valuing DeFi protocols under the same methodology as an L1

bullsnterns 🐸6.8. klo 01.11

$S trading at a 752x P/F ratio.

A $899M market cap generating only ~$1.2M in annual fees. That's kinda unsustainable imo.

For perspective:

- Uniswap: ~15x P/F ratio

- Aave: ~25x P/F ratio

- Compound: ~40x P/F ratio

- Sonic Labs: 750x P/F ratio

No institution touches anything above 100x P/F ratio.

They want:

Proven revenue streams

Sustainable business models

The real question is what this whole 'governance vote' is about. Supposedly to bring in institutions, but how exactly are they gonna do that?

Where can i find details on this proposal? HEEEEELPPP

10,67K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin