Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Eli5DeFi

I've just realized I'm approaching 1,000 visual posts and threads today.

If each post takes around 3 hours to complete, that's about 3,000 hours, or roughly 125 days, spent creating over the past three years (when this account was created) and not including non-visual posts.

Yet, I still find myself lacking in many areas. I am continuously learning and experimenting even now.

There are no shortcuts to mastery; it requires everything you have to become the best in your field.

For new creators, keep experimenting, creating, and find your flow state if you want to excel.

856

Thank you to @0xAndrewMoh for featuring me alongside other prominent thought leaders here.

If you're focusing your efforts on climbing @KaitoAI leaderboard, you should definitely check this out ↴

andrew.moh14 tuntia sitten

I sat down with some top influencers ruling over 15+ Kaito LBs to discover:

+ What's their magic formula?

+ What tips would they share with fellow creators aiming for similar success?

Imagine Kaito leaderboards as intense boss battles.

These 10 CTs didn’t just beat the game, they speedran it.

If you got stuck in climbing the LBs, here’s their loadout:🧵⬇️

1,39K

➥ DeAI is Crypto Destiny

In recent months, I've been contemplating the future of crypto and AI.

Their intersection seems not only inevitable but perhaps even destined.

These fields are both connected and interdependent, and as we move into an era of superintelligence, decentralized AI could pave the way for humanity, potentially sparking the largest economic boom in history.

A thought-provoking piece by DeAI leader @MTorygreen delves into this topic in detail.

Allow me to share my perspective and add a personal, simplified Eli5 formats.

Let's dive in, 🤖

...

— The Crisis of Centralization

AI could be the "iPhone moment" for crypto. The reason is simple: AI is currently grappling with cascading crises that can only be resolved through decentralization.

These crises include:

➤ Scale Crisis ⟶ The exponential demand for AI compute power remains unmet.

➤ Access Crisis ⟶ Permissioned, closed systems that stifle innovation.

➤ Trust Crisis ⟶ AI systems are often black-box and opaque.

➤ Control Crisis ⟶ Issues of censorship and bias persist.

➤ Cost Crisis ⟶ Rising costs impede progress.

It's no coincidence that crypto, as the antithesis of these problems, emerges as the sole solution for achieving autonomous superintelligence.

...

— AI is the Civilizational Revolution

Let's return to AI for a moment.

Tory mentioned that in near-future AI will dissolve boundaries between the physical, biological, and digital realms, becoming the new operating system of civilization through three components:

➤ Cognitive Grid ⟶ Enabling the physical world to "think"

➤ Mind Legos ⟶ Cognition becomes Modular

➤ Einstein Effect ⟶ Universal genius becomes accessible

However, this system cannot rely on fragile foundations controlled by a few corporations or centralized entities.

We're constructing it on an infrastructure that destined to fail.

...

— DeAI - Path of Redemption

Simply put, DeAI leverages crypto's foundational principles to address centralized AI's flaws, making centralized AI irrelevant through and its example:

➤ Instant Scalability

- @ionet ⟶ GPU access to 138+ countries

- @AethirCloud ⟶ 400,000+ GPUs over 93 global locations

- @Filecoin ⟶ 2.1 EiB of data onboarded

..

➤ Enhanced Resilience

- @akashnet_ ⟶ 99.99% network uptime

..

➤ Open and permissionless access

- IONet ⟶ Launch GPU clusters <90s

- @opentensor ⟶ Offered 4,000+ AI Models with total of 10T parameters

- @oceanprotocol ⟶ 1.3M data-sharing nodes across 73 countries

..

➤ Censorship resistance

- @IPFS ⟶ Restoring access to Wikipedia in Turkey after it got banned

..

➤ Reduced costs

- IONet ⟶ Provides 90% cheaper GPU resources than AWS and Google Cloud

- @rendernetwork ⟶ Offer up to 80% cheaper GPU Resources

- Filecoin ⟶ 70-80% cheaper cloud storage costs

..

The shift toward the Crypto Endgame and Decentralizing Intelligence is already underway, paving the way for advancements in technology, infrastructure, and economic boom driven by DeAI.

Now is not the time to sit back.

Centralized power requires balancing, and innovation needs revitalization. We must embrace and refocus our goals on DeAI.

9,57K

➥ aPriori Order Flow Data Contributor Program

@apr_labs isn't just another MEV infrastructure; it's an advanced order flow segmentation engine powered by proprietary AI from aPriori.

In simple terms, it eliminates toxic MEV flow, harmful arbitrage, and CEX-grade defenses for traders and LPs. Imagine bringing Wall Street's fastest engine on-chain.

With @monad's TGE on the horizon, it's a great opportunity to join their Order Flow Data Contributor Program.

— How?

➢ Open the portal

➢ Connect your EVM wallet

➢ Add a new wallet cluster under your profile

➢ Complete social tasks

— What's in it for you?

➢ VIP access to high-APR Swapr pool

➢ Priority access to advanced quant execution tools

➢ Badges, points, and potential token airdrops

Also aPriori is Monad's top-funded project, backed by @keoneHD, with founders from Robinhood, Citadel, and Jump.

So I guess there is zero-risk with high upside potentials here, but ofc NFA+DYOR.

2,59K

gBabylon,

If @babylonlabs_io makes a major announcement, it’s worth your attention.

BTCFi is set to be the cornerstone of the future of finance, and Babylon is already leading the way with:

➢ Over $5B in $BTC TVL

➢ Upcoming BSN rewards

➢ More than 50 projects in the ecosystem

In short, BTCFi is Babylon.

Clear your schedule today, and join me on the stream!

Babylon6.8. klo 02.58

Big announcement. Tomorrow. Live from SBC.

🗓 August 6

🕚 11 AM PST | 2 PM EST | 6 PM UTC

📺 Watch live:

@dntse will be unveiling the latest Babylon development built from his garage. Yes, literally.

Don’t miss it. 🍿

8,34K

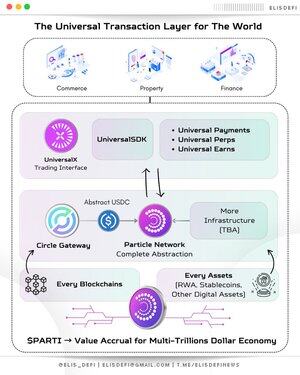

➥ The Universal Transaction Layer for The World

When I made this post, I immediately thought about the long years of regulatory hurdles and inacceptance for crypto.

But times have changed, and crypto has become one of the most coveted assets in the world.

The world is ready to embrace the revolution, yet web3 is not.

@ParticleNtwrk arrives at the perfect moment, aiming for one ambitious goal: to transcend web3 and web2 by becoming the Universal Transaction Layer.

...

— The Present

Particle is the ONLY protocol dedicated to ensuring web3 becomes a singular and cohesive ecosystem through Universal Accounts, which bundle every user experience innovation.

Notably, Particle's Universal Accounts already manage over $670M in high-frequency transactions via their consumer app, @UseUniversalX, and UniversalSDK.

Particle is also expanding its partnerships to realize this vision, starting with @circle through Circle Gateway. This collaboration abstracts $USDC transactions directly on its issuer’s chain-agnostic layer, facilitating retail-ready on-chain commerce.

...

— The Future

Particle's UA provides an application-ready, universal transaction layer that facilitates consumer interaction with on-chain assets in a retail-friendly environment.

Imagine if all our decentralized finance layer running on this.

For users, this means assets such as RWAs, stablecoins, and other digital assets can be transacted seamlessly through a unified interface or integrated platform. This eliminates the need to navigate complex blockchain processes, thereby accelerating mass adoption.

Ultimately, this will position $PARTI, the core currency of the Particle Ecosystem, accruing value by powering these multi-trillion-dollar economic opportunities.

The future of finance is unified and Universal.

9,1K

Eli5DeFi kirjasi uudelleen

The stablecoin market has skyrocketed to $267b , doubling in just a year. Talk about rapid mainstream adoption!

With game-changing moves like the GENIUS Act and insights from the USA's Project Crypto, now's the time to let your stablecoins do the heavy lifting as this sector takes off.

I've dropped 3 threads on yield-bearing stablecoins, with juicy yields as usual. Missed them?

Here's a quick summary of all the stables I covered.

You can also use the infographics as a guide.

_____________

✦ @UnitasLabs (sUSDu)

⇒ Mechanism ➝ Protocol fees from Unitas’ multi-strategy delta neutral vaults

⇒ Yield ➝ 19.68% APY

✦ @avantprotocol (savUSD)

⇒ Mechanism ➝ Delta-neutral strategies

⇒ Yield ➝ 18.36% APY

✦ @SmarDex (USDN)

⇒ Mechanism ➝ Ethereum staking and funding rates from traders using USDN protocol

⇒ Yield ➝ 15.9% APY

✦ @aegis_im (YUSD)

⇒ Mechanism ➝ Funding fees from delta-neutral spot and perpetual arbitrage

⇒ Yield ➝ 15.74% APR

✦ @CygnusFi (cgUSD)

⇒ Mechanism ➝ Short-term U.S. Treasury Bills

⇒ Yield ➝ 14.84% APY

✦ @FalconStable (sUSDf)

⇒ Mechanism ➝ Liquidity provisioning, staking, funding rate arbitrage, and cross-exchange price arbitrage

⇒ Yield ➝ 12.6% APY

✦ @HermeticaFi (sUSDh)

⇒ Mechanism ➝ Funding rates on a short Bitcoin perpetual futures position

⇒ Yield ➝ 12% APY

✦ @fraxfinance (sfrxUSD)

⇒ Mechanism ➝ U.S. Treasury Bills and DeFi strategies (staked frxUSD is dynamically allocated to the highest yield source to generate yield)

⇒ Yield ➝ 11.63% APY

@0xCoinshift (csUSDL)

⇒ Mechanism ➝ Treasury Bills and on-chain lending

⇒ Yield ➝ 11.32% APY + 5x Shift Points

✦ @Aster_DEX (asUSDF)

⇒ Mechanism ➝ Trading fees and funding rates on short synthetic stablecoin positions

⇒ Yield ➝ 11.3% APY

✦ @lista_dao (lisUSD)

⇒ Mechanism ➝ Liquidation rewards and borrowing interests

⇒ Yield ➝ 11.08% APY

✦ @ethena_labs (sUSDe)

⇒ Mechanism ➝ Delta-neutral hedging and staking rewards on its stETH collateral

⇒ Yield ➝ 11% APY

✦ @reservoir_xyz (srUSD)

⇒ Mechanism ➝ U.S. treasuries, DeFi yield, and market-neutral strategies

⇒ Yield ➝ 11% APY

✦ @parabolfi (paraUSD)

⇒ Mechanism ➝ U.S. Treasury Bills and repo reserves

⇒ Yield ➝ 11% APR

✦ @StablesLabs (sUSDX)

⇒ Mechanism ➝ Delta-neutral hedging and multi-currebcy arbitrage

⇒ Yield ➝ 10.57% APY

✦ @noon_capital (sUSN)

⇒ Mechanism ➝ Delta-neutral strategies

⇒ Yield ➝ 10.44% APY + 5x Noon Points multiplier

✦ @StandX_Official (DUSD)

⇒ Mechanism ➝ Staking and funding rates from perpetual contracts

⇒ Yield ➝ 10.06% APY

25,27K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin