Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Silo Labs

Silo Labs kirjasi uudelleen

Looks like some phresh liquidity has flooded the PT-sUSDf/USDC market.

This means that even with $500k size (e.g. $50k initial w/ 10x leverage), you're still earning 80% APY on USD.

EIGHTY PERCENTAGE POINTS ANNAULIZED PERCENTAGE YIELD ON UNITED STATES DOLLARS

IN ONE CLICK

5,51K

Silo Labs kirjasi uudelleen

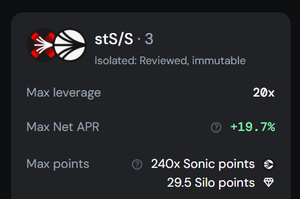

While sonic activity has been trending down, they remain one of the only proper DeFi chains I actually use.

They have good protocols, good yields, good lads.

IMO close to bottoming so I'm not too fussed earning ~20% APR to long $S while I wait 💅

Scared money don't make money

4,5K

Silo Labs kirjasi uudelleen

Gmeow Sonic frens, I come bearing fresh catmathics🐾

Been crunching numbas lately on @SiloFinance and felt like Christian Bale in "Big Short" movie knowing that $Silo is operating at institutional scale but token is valued like the biggest underdog in DeFi

Allow me to educate yall on the most asymmetric play on not just @SonicLabs but DeFi in general.

🔹Has $500M TVL across chains (on Sonic alone, roughly half of Sonic's TVL is there)

🔹Operates across 6 chains with 7th one on the way

🔹Just proved product-market fit by growing to $120M TVL on Avalanche in ONE MONTH

🔹Has a spotless security record while competitors got rekt

➠

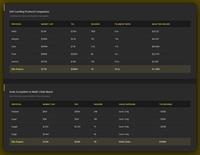

🔷How insane is this valuation gap is:

🔹 $AAVE: $3.9B mcap, 192K holders

🔹 $Morpho: $518M mcap, 12K holders

🔹 $Eul Euler: $294M mcap, 3.5K holders

🔹 $Kamino: $127M mcap, 55K holders

🔸 $Silo: $11M mcap, 1K holders 😐

GETS CRAZIER:

Even Sonic eco projects with way less, have more hodlers:

🔹 $Shadow $6M mcap, FDV 50m 24K holders

🔹 $Equal: $1M mcap, FDV 5m 10K holders

🔹 $SwapX: $1.2M mcap, FDV 5m 7K holders

➠

So we have Silo with 25x the TVL of most Sonic projects, operating on 6 chains, more MAU than any other project but similar valuations... make it make sense.

🔷 $Silo TVL/MCAP ratio is the HIGEST in DeFi Lending:

🔹 $Silo's TVL/MCap ratio: 45.5x

🔹Next best is Kamino at 14.2x

🔹AAVE sits at 6.4x

➠

Wat dis meen?

Silo manages more value per dollar of its mcap than ANY major lending protocol. By a lot.

But wait, there's more..

Even the most conservative scenario (matching Kamino's cuurent mcap) gives 11x. That's not hopium, that's just basic market comparison.

🔹 Match Kamino's $127M = 11.5x gains for $SILO

🔹 Match Euler's $294M = 26.7x gains for $SILO

🔹 Match Morpho's $518M = 47.1x gains for $SILO

🔹 Match AAVE's $3.9B = 354.5x gains for $SILO

➠

Sometimes the best opportunities are hiding in plain sight. not saying it'll flip AAVE in a week but the best investments are always backed by facts, numbas and a good maturity rate applied

If this doesn’t slap you in the face with the enticing numbers, what else could?

Join the cult of @SiloIntern and say it with me gSilo! 🫡

17,14K

Silo Labs kirjasi uudelleen

One of the things I want to see this month is @SiloFinance's auto-leverage feature.

With this, you won't have to leave the Silo front-end to leverage-loop your funds and indulge in your enthusiasm for degens strategies.

Additionally, @SiloIntern hasn't mentioned that last month they achieved a highest total volume exceeding $3.1B across the chains.

He's almost certainly being modest at this point and wants to scoop up $SILO himself before the buyback. 😎

9,78K

Silo Labs kirjasi uudelleen

Doing July DAO report and found out our dashboard underreports TVL by ~$90m

Akshual TVL = $530m (~+30% MoM)

TVB = $220m (+28% MoM)

Monthly Revenue = ~$176k (+66% MoM)

Things to look forward to in beautiful August:

- Auto-leverage

- Chain scaloooring

- More buybacks

Silo

8,36K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin