Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

fiddy

Love.

strategy @lidofinance

prev @curvefinance

PFP: @wenllama

minute 43. back in the day at curve we did have an internal discussion whether we should have a 'mega vault' design like balancer. in the end my general idea here was that nobody likes their pristine assets hanging out with riff raff, and so we ditched the idea.

cool to see that aave had the same intuition (of course they did the research).

Scroll9.8. klo 01.37

.@aave just crossed $60B in TVL - and is the first DeFi protocol ever to do it.

@The3D_ walks through how the protocol works, why people borrow crypto to buy cars, and what's coming in V4.

Timestamps:

00:00 - Aave’s beginnings and ETHLend

03:53 - How collateral and borrowing work

07:48 - Lessons from the 2020 crash

08:50 - Governance and upgradability

11:32 - Why Aave launched GHO

15:03 - GHO’s peg and design trade-offs

17:47 - Facilitators and minting flexibility

23:45 - Scaling and liquidity challenges

28:01 - Yield mechanics with esGHO

31:14 - RWAs and the Horizon Initiative

39:20 - Capital efficiency vs risk

42:34 - Aave V4 architecture

5,26K

Who’s feeding them bullshit info? Blorkwerks?

Ethereum TPS also includes L2s.

Solana9.8. klo 09.00

When they say the future of markets runs at 22 TPS but NASDAQ handles 2k trades per second

1,97K

For me, this is the best outcome.

We constantly look at how we are ‘trojan horsing’ defi and crypto into tradfi, but in out tunnel vision we totally overlook the fact that we have brought in tradfi to defi as well.

Adoption comes at a cost, and in our case we’re paying with the highest cost there is: our morality and our values.

FOCIL is a symbol of hope that we haven’t yet eroded our morals for the ‘perceived’ ‘greater good’.

Oh and well ePBS seems to be included too. That’s nice. Now the war begins. My prediction on the two arenas where contentious discussions will materialise:

1. ‘Free option problem’

2. Do we really need trustless payments.

Christine D. Kim7.8. klo 23.27

EIP-7805: Fork-choice enforced Inclusion Lists (FOCIL) has been considered for inclusion (CFI'd) in the Glamsterdam fork as well

592

Does @kaiynne need another mansion? why did SNX governance rug a liquidity pool? 20m sUSD minted out of thin air, swapped for real dollars and not their garbage synth token which faced inevitable slow death to zero, and then burned all minted susd.

treasury made something like 6 million out of this rug. And well I'm pretty sure that liquidity did not belong to them.

8,83K

The first thing this reminds me of are the bid ladders in energy imbalance markets (markets active during delivery).

Angstrom6.8. klo 01.32

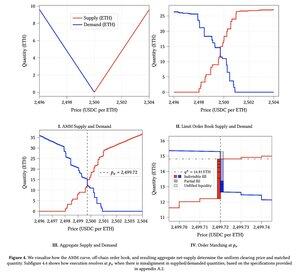

Next comes the uniform-clearing price batch auction, this auction considers all non-top-of-block limit orders (from users and market makers alike), along with the underlying AMM liquidity, and clears all possible orders at the unique price where supply intersects demand.

Swappers benefit from sandwich resistance and just-in-time limit order liquidity provided by market makers to ensure their slippage is minimized.

1,51K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin