Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

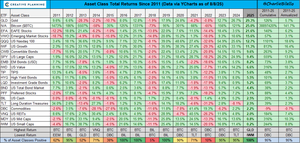

It’s great looking at these charts and putting Bitcoin performance in perspective

Over time Bitcoin outperforms everything

Being long Bitcoin and Nasdaq will likely outperform most fund managers over the next 10 years+ as they’re the biggest secular, exponential trends

Also a good reminder of how all assets are trading macro cycles and liquidity

The functioning of fiat, debt based economies requires ever expanding debt and money creation, debasing currency and pushing all assets higher in fiat currency terms

This gets periodically interrupted when central banks led by the Fed try to drain some of that liquidity and pretty much all assets go down together in those years

But the ability to drain liquidity is a small window and quickly things break and they’re back to expansion of money supply and inflating the assets which are the collateral underpinning a debt based system

This is why bears don’t make money

The corrections and down years are very infrequent and now with central banks removing the left tail risk and providing the market with a central bank put, those rare down years don’t draw down sufficiently to make up for all the gains you missed in the up years

Our aim at London Crypto Club is to try help you HODL the best performing assets in the structural bull markets without chopping yourselves up trying to trade the squiggles in those bull markets

Then signal when we’re set to enter those infrequent down years where you want to reduce position and go back to cash, ready to buy the dip!

Over time though, everything is going to be higher in fiat terms

Bitcoin will go up the most

9.8. klo 19.22

Gold (+29%) and Bitcoin (+25%) are the top performing major assets so far in 2025. We’ve never seen these two in the #1/#2 spots for any calendar year. $GLD $BTC

Video:

24,04K

Johtavat

Rankkaus

Suosikit