Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

How I’m cutting costs with @boros_fi (real case, not theory)

I’ve got a bot on Hyperliquid that hedges my leveraged ETH/USDC LP position on @ArcadiaFi.

The goal? Stay delta-neutral instead of bleeding because of IL.

📌 Where it hurts

On @HyperliquidX, I’m basically always long $ETH.

Right now, long funding rates there are… let’s just say, aren’t exactly giving me a warm welcome.

📌 Where Boros comes in

On Boros, I open YU long on ETH.

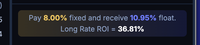

Here’s what it looks like:

- YU long earns ~11% APR

- Fixed cost is ~8%

- Net gain: ~3%.

Sure, it’s not huge, but it’s a direct cut in my carrying costs.

📌 What’s next

Boros doesn’t have Hyperliquid markets yet, so I’m pegging it to Binance, where rates are calmer.

When HL markets hit Boros, the cost reduction could get way bigger

And honestly… this is just one way to use it. The doors it opens are kind of crazy.

18,43K

Johtavat

Rankkaus

Suosikit