Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

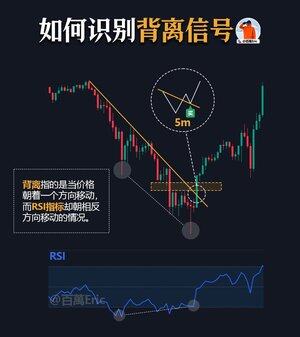

The value of divergence lies not in itself, but in the position it occurs and the accompanying changes in market structure.

The divergence in this chart appears at a low point after a continuous decline, where the price makes a new low while the RSI low point rises, which is a typical signal of selling exhaustion.

The key is that when the divergence occurs, the price just touches the support zone, accompanied by a trendline breakout and a reversal candlestick, which transforms the signal from "possible" to "highly probable."

In actual trading, these types of signals are not entered every time, but rather when the "divergence + structural turning point + confirmation candlestick" coincide, making it an opportunity for a high win-rate "bet."

37,55K

Johtavat

Rankkaus

Suosikit