Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

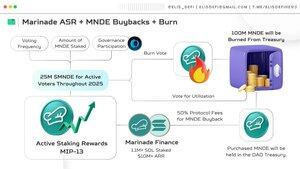

➥ Marinade Active Staking Rewards (ASR) and $MNDE Buybacks & Burn

Yesterday @MarinadeFinance's X Spaces unveils several initiatives to stregntgen alignment between protocol and $MNDE token.

Let's do some quick recap ↴

— Active Staking Rewards (ASR)

Under the proposed MIP-13, 25 million MNDE tokens will be distributed to active voters throughout 2025 that will be based on:

➢ Voting frequency

➢ Amount of MNDE staked

➢ Active participation in governance through @realmsdaos

...

— Protocol Buybacks

Starting in September, Marinade will implement a systematic buyback program where:

➢ 50% of all protocol fees ⟶ MNDE buyback

➢ All purchased token will be held in the DAO treasury

➢ The funds utilization will be will be governed through on-chain mechanisms

...

— Supply Burn Proposal

A community-driven proposal is being prepared to burn 10% of the total MNDE supply:

➢ 100,000,000 MNDE will be permanently removed from treasury

➢ This reduced max supply to 900,000,000

➢ This is one-time action to complement buyback program

...

— Wrap-Up (NFA+DYOR)

Marinade is the exclusive staking partner for @CanaryFunds' SOL staking ETF, with over 11.1 million $SOL staked and more than $10 million in ARR. This suggests that at least $5 million will be allocated annually for MNDE buybacks if revenue remains steady, with potential for more if it increases.

I believe the integration of ASR, protocol buybacks, and the supply burn proposal will enhance alignment with the protocol's growth, $MNDE tokenomics, and community participation.

► Also take a look our DeFi Strategy Series that cover @MarinadeFinance LST, $mSOL here ↴

1.8. klo 21.02

➥ Supercharge Your mSOL

If you're deep in @solana ecosystem then you know that mSOL delivers an outstanding 7.69% APY, and you can definitely explore additional opportunities to maximize your returns through proven DeFi strategies.

Discover how to optimize your $mSOL today ↴

...

— What is @MarinadeFinance?

mSOL is $SOL LST from Marinade Finance with enhanced yield that enables you to earn superior yield via Stake Auction Marketplace (SAM) to capture maximum rewards from validators including priority fees.

To date it's already achieved ↴

➤ 153k+ stakers

➤ 11.1M+ SOL staked ($2.1B+ with $195/SOL)

➤ 2.5K+ retrieved from validators downtime

➤ $10M+ in ARR

➤ Exclusive staking partner for @CanaryFunds SOL staking ETF

➤ Integrated with @BitGo for institutional-grade access

$MNDE ($42M+ Mcap/ $95.2M+ FDV) is the native token of Marinade for governance, influence validators delegation strategies, and more.

...

— The Strategies

Let's not complicate it and just use simple strategy here ↴

➤ LP Path

The easiest method is to LP your mSOL <> SOL to several DEXs such as:

- @RaydiumProtocol

- @MeteoraAG

- @orca_so

However you need some basic skills and knowledge to manage the LP even though its stable pair.

➤ Leveraged Path

There are several protocols that accept mSOL as collateral and some of them support 1-click leverage to make it more easier.

- @DriftProtocol

Deposit mSOL (7.16% APY) ⟶ borrow mSOL (0.5% APY)⟶ Loop back

- @KaminoFinance

Pick multiply ⟶ deposit mSOL, multiply your loop (max 7.3x) ⟶ with current borrow rates and utilization ration, yield around 55.5% Net APY

As this one is leveraged position, I encouraged you to understand liquidation risk and obviously smart contracts risk for each protocols, always DYOR and NFA.

— Disclaimer

7,19K

Johtavat

Rankkaus

Suosikit