Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

South Korea ranks among the top crypto markets by volume, yet regulation limits access to stablecoins.

Tether has just surpassed South Korea, becoming the 18th largest holder of U.S. Treasuries, highlighting the urgency for regulation that creates accessibility to stablecoins.

South Korea has historically been slow on creating frameworks that support the digital asset ecosystem due to concerns around prior cryptocurrency collapses.

However, these concerns can be mitigated through common sense regulation like we’ve seen with the GENIUS Act.

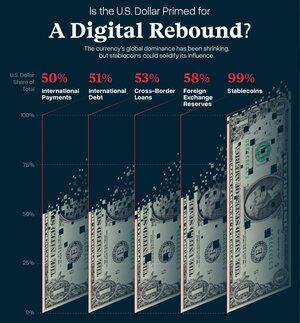

The U.S. has already set clear standards for regulating payment stablecoins. It’s only a matter of time before other jurisdictions follow suit.

Last week, two competing South Korean stablecoin bills were introduced. I spoke with policymakers in South Korea, and these bills are expected to move quickly through the legislative process in response to the growing dominance of USD‐based stablecoins.

However, one blocker to the adoption of this key legislation is whether stablecoin issuers are permitted to distribute yield to holders. This was similarly a critical point of discussion in the GENIUS Act, where the law prohibits distribution of yield.

To capture South Korea's sentiment on stablecoins, the chair of the ruling party’s Committee on Digital Assets said "stablecoins are surging like a tsunami, but we are fighting over who will run a small boat in the face of a tsunami."

Stablecoins will win and South Korea must embrace digital currencies through common sense regulation.

1,46K

Johtavat

Rankkaus

Suosikit