Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

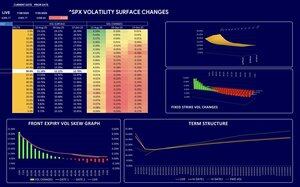

Imran Lakha | Options Insight

Imran Lakha | 20-Year Professional Options Trader | Macro | Volatility | Crypto | Learn to Trade Options Like a Pro

Interesting observation by two of the legends in the rates space. Not a risk that the market seems to be pricing much chance of with VIX down here.

Jim Bianco28.7.2025

I hope @dampedspring is wrong, but fear he might be correct.

----

The Quarterly Refunding Announcement (QRA) comes on Wednesday morning (a few hours before the FOMC announcement/Powell presser), when Treasury gives us the mix of Bills, Notes, Bonds, and TIPS they will issue next quarter.

Trump has suggested the Treasury stop issuing 10-year notes and 30-year bonds at these yields and instead borrow everything in Treasury Bills. Then, when Trump replaces Powell, and the new Fed Chairman cuts the funds rate to 1%, the Treasury can refinance all those bills at much lower rates, saving hundreds of billions in interest costs.

Doing this would be a financial disaster. The post below assumes Bessent completely understands this and fears Bessent will do what Trump tells him, regardless of how ill-advised that might be.

-----

The mix of Treasury issuance is essentially in balance with the demand for that issuance.

If the QRA on Wednesday indicates that the Treasury will issue trillions more in bills (a massive change), where will those additional bill buyers come from? They will have to be found immediately because the issuance change is coming in the next 90 days.

A supply/demand imbalance will have been created.

The solution is to adjust the price. That’s a nice way of saying Treasury Bill yields will soar to entice more buyers to step up to purchase this new, sudden supply. Remember, there are no bad bonds, only bad prices.

This will drive up repo rates in bank financing costs and throw the entire financial system’s plumbing out of whack, potentially creating a financial crisis.

4,54K

$TSLA dropped on earnings (as suspected) but it's already bouncing 2% and that's exactly why just buying straight puts to express you bearish views is very risk, especially before earnings with implied vol pumped.

This is why you need a framework that takes into account the Greeks and points you towards more effective directional trades that don't crushed by THETA and VEGA. We banked over 100% on out put fly this morning even after the stock bounced.

If you struggle to find the right trade that doesn't just buy expensive earnings vol maybe we can help.

I built this cheat sheet to give people a simple guide that helps identify the trade that reflects your view on both spot and volatility.

Like + comment “CHEATSHEET” + repost (must be following so I can DM you)

474,1K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin