Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Rocky

Long term investor #BTC #TAO #SOL| MeMe Professional Data Player | Crypto since 2017 | Not financial advice, DYOR🙏

Recently, everyone has been discussing a new topic in the investment circle: the SEC recently launched a "crypto plan", which basically throws an olive branch to on-chain finance. In such a context, projects on the #RWA track have sprung up recently, which has also become the most high-profile #Web3 direction in the next 3-5 years. 🧐

Recently, #MyStonks announced that they have successfully completed the SEC's STO (Security Token Offering) filing. To be honest, many fans of cryptocurrency may not understand the significance of STO filing, but for me, an old leek shareholder, this matter is very important and far-reaching, and may have a big impact on the way we ordinary people invest in US stocks.

I went out of my way to do some research and read an interview with #MyStonks CMO Keaton Hu. Now I will talk to you in the vernacular about what this so-called "on-chain finance" and "STO filing" are and why they deserve our attention.

I have been in the US stock market for so many years, and the most clear thing is that the securities regulation in the United States is really strict. If you want to legally issue security tokens (STOs) in the United States, the material alone can drown you, not to mention all kinds of legal scrutiny and disclosure requirements. Therefore, #MyStonks can win the SEC's STO filing this time, which is equivalent to getting a "pass" - it can issue and trade security tokens in the United States in compliance with regulations.

Don't underestimate this license, this is not only a document, it is a credit endorsement of the platform, which means that what it does is legal and compliant, and the SEC knows it.

1️⃣What is the difference between STO and the cryptocurrency we usually play?

Most of us have the impression of the currency circle as a project issuing its own token and then trading it on the exchange, with ambiguous regulations or even a gray area.

STOs are completely different - they are essentially a combination of "securities + blockchain".

• Assets must be genuine, such as stocks, bonds, real estate shares

• There is a corresponding asset custody behind each token (#MyStonks is to find Fidelity for custody, which is a golden sign on Wall Street)

• Transactions, information disclosure, and investor qualifications are all in accordance with securities laws

To put it bluntly, this token is not just a game, it is a real digital security.

2️⃣Why do I feel that #MyStonks is stepping on the #RWA outlet?

I have seen too many overseas investors stuck in the "account opening" step - especially friends in China, Southeast Asia, and South America, who want to invest in US stocks, but the procedures are cumbersome, the cost is high, and the time difference is uncomfortable. In addition, China has recently reviewed the issue of tax payment on US stock trading (the hardest hit areas are concentrated in traditional US stock brokerages such as Futu and Tiger)

The tokenized US stocks and bonds of STO allow global investors to trade directly on the chain 7x24, without having to open a US stock account, without waiting for the US stock market to open, and directly participate with crypto assets.

This time, #MyStonks took the lead in completing the STO filing, which is equivalent to standing on the tuyere in advance, and when the supervision is further clarified and market demand explodes, it is the first batch of leading RWA projects to eat dividends.

3️⃣ Direct benefits for investors who want to play US stocks:

From my own experience of #MyStonks, there are several cool points about this kind of compliant digital securities platform:

1. Sense of security: SEC filing is in hand, at least you don't have to worry about the platform saying it's gone day.

2. Transparency: Asset custody is verifiable, transaction chain verifiable, and more transparent than traditional brokerages.

3. Liquidity: 7x24 hours trading, the concept of pre-market and after-market is gone, and you can buy and sell at any time.

4. Cross-border freedom: Geographical restrictions are broken, and global investors can participate in the allocation of U.S. stock assets.

🏷️ Join our #RWA US stock force:

Overall, the development process of #MyStonks can be described as expensive, and this STO filing is not simply "more qualifications", but a bet on a larger trend - the full tokenization of real assets. When more stocks, bonds, and ETFs can be put on the chain, the traditional brokerage set may be greatly transformed, and #MyStonks has now laid a solid foundation for compliance. In the short term, this is a plus for brand and market trust; In the medium to long term, this could be a stepping stone for it to enter the institutional market. The sooner you participate, the better your chances! 🧐

MyStonks華語8.8. klo 15.30

📢 MyStonks has completed the STO filing in the United States, solidifying the foundation of compliance!

Dear users:

MyStonks is honored to announce that it has successfully completed the filing for the Security Token Offering (STO) in the United States, officially obtaining the qualification to issue security tokens in compliance with U.S. regulations. This filing signifies that MyStonks has met strict compliance standards in all core modules, including product architecture, information disclosure, investor qualifications, and asset custody, thereby reinforcing the legal and trustworthy foundation of the platform's digital securities products.

As a compliant financing method that digitizes and securitizes real assets, STO is strictly regulated by the U.S. SEC, with high barriers to entry and complex processes. MyStonks, by investing ample resources in compliance and continuously pursuing technological innovation, has become one of the few trading platforms globally to complete this certification, establishing a first-mover advantage in the industry.

This compliance breakthrough not only enhances investment safety and transparency but also lays a solid foundation for MyStonks' future strategic layout in the global digital securities issuance, custody, and trading fields. The platform will continue to focus on compliance as its core, driven by technology, to promote the steady development of the digital securities ecosystem and lead security tokens towards large-scale application.

Thank you for your support and trust in MyStonks!

👉

#MyStonks #STO #SecurityToken #ComplianceInnovation #DigitalAssets #BlockchainFinance

57,58K

The most powerful #AI model in the universe, #GPT5 released!

Chinese still dominate the development of #AI!

Learn AI, lay out AI, and invest in AI🫡

Rocky3.8. klo 09.04

Today, I watched a demo video of #Claude AI by @AnthropicAI, and I was amazed. As a professional investor, US stock companies + #Web3 projects have to be watched hundreds every year, especially the earnings season is simply a battlefield!

For example, this kind of practical case in the video is still relatively common: as soon as the office sat down, at 2 p.m., the PM (investment director) rushed in:

"Sarah, the company we are focusing on, Velocity Athletic, has just released its earnings report, and its revenue has plummeted by 12%, but its stock price has actually risen by 17% to $71. Can you figure it out to me, is this wave of rise a positive strategy stimulus or a false rebound? Before today's close, you have to make a decision, whether to sell and take profit, or continue to hold. ”

In fact, this logic is like the non-farm payroll data + 56 employment data revised downward for two months this Friday (260,000 jobs were cut in May + June, which is equivalent to the sudden unemployment of the entire population of Miami). In this case, you have to make a judgment and decision as soon as possible, and immediately feed back to the US stocks that have not yet opened, and crypto assets to hedge, which requires immediate response and data support, which will effectively avoid this wave of killing over the weekend.

Let's take a look at the path of a normal financial analyst (expected 4-5 hours):

1️⃣Go to S&P Global to pull financial reports and meeting minutes

2️⃣ Open FactSet / Morningstar to see historical data and valuations

3️⃣ Cut Edgar to check the SEC announcement

4️⃣ Mining the history of the intranet memo and research report

5️⃣ Then make tables, draw pictures, and write memos

This operation takes at least 4~5 hours, and it takes several systems to be manually cut, and the information is inconsistent and prone to errors.

💡 At this time, #Claude appeared, it really felt like I had an extra super analyst assistant:

Directly give #Claude instructions: "Help me comprehensively analyze Velocity Athletic's financial report performance, whether the stock price change is reasonable, and issue an investment memo." ”

🔍 1️⃣Multi-platform synchronous pulling data + semantic understanding

Claude doesn't simply crawl data, it understands the context I need:

· Extract key information from S&P Global to extract key information, such as the CFO's mention in a Q&A that "margins fell by 400 basis points due to tariffs";

· Pull out historical data and opponent comparisons from Morningstar;

I found the Velocity analysis framework that I had written about in the past from our company's internal documentation (box);

· Scrape 8 quarters of financial data from Delupa to create trend charts directly;

· All content is marked with the source, and you can click in at any time for secondary confirmation, which greatly improves compliance and trust.

📊 2️⃣ Generate visual charts + core models

Q#Claude: "Help me make an annotated price chart, peer valuation comparison table, and DCF model." ”

It implements step by step:

· Stock price charts marking events (showing CFO reductions, emergency board meetings, financial report release times, etc.);

· A clear comps table: Velocity's EV/EBITDA is 21 times, the industry average is only 16 times, and the valuation is high;

· A complete DCF model: clear assumptions, freely switching scenarios, even WACC calculations are standard.

· The reasonable stock price calculated by the model: $54, far lower than the current $71, indicating that the current rise is optimistic and the bubble component is large.

📝 3️⃣ Automatically generate institutional-grade investment memos

Finally, I said, "Use our fund's internal template to make a memo for PM's reference." ”

Claude directly calls the memo template on the intranet and automatically populates with the following:

Recommended conclusion: It is recommended to sell at a high point to make a profit, and wait for the price to pull back before opening a position;

Logical support: quantitative support from financial fundamentals, market reactions, industry comparisons, valuation deviations and other dimensions;

Potential risks: For example, if tariffs are eased in the future and CFOs reduce their holdings for other reasons, it may lead to further fluctuations in stock prices;

Clear citations: All data with links to the original source for PM or legal review.

Watching the entire video demo, I think #Claude is completely the "#AI nuclear weapon" of financial report analysis, and there are still relatively few API data interfaces supported by encrypted data, which can become the killer feature of #Web3 investment research if it is improved in the later stage.

If we used to do project analysis to "fly with ten fingers + nine screens to check data + use five heads together", now with #Claude, it is like having a gold medal analyst who does not go offline 24 hours a day, and does not shout overtime, and efficiency takes off 📈!

20,49K

#AI + insurance, the transformation and explosion of this field, may have just begun! We are always looking for potential US #AI companies, especially dark horses in the segment! Be a leader in #AI+ insurance!

#LMND Q2 earnings report in 25 exceeded expectations, rising as high as 📈11% in pre-market

1️⃣ Total premiums of $1.083 billion, accelerating growth for the seventh consecutive quarter, up 29% year-on-year

2️⃣ Loss ratio reduced by 12%

3️⃣Gross profit margin increased to 39%, gross profit increased by 109%, and revenue increased by 35%

4️⃣ Vehicle loss ratio reduced by 13%

5️⃣ Automobile and European growth engines are accelerating, and the company as a whole will be profitable this year

Rocky3.6.2025

Since the introduction and recommendation of this #AI+ insurance company, it has basically risen 📈 every day! 😂

26,39K

This morning, the company just finished a relatively long investment meeting, in August, the overall strategy: defense, defense, defense, control of positions, prevention of drawdown! 🧐

Over the past 25 years (2000 to the end of 2024), the S&P 500's best and worst performing months (Figure 1):

✅ Best months: March, April, May, July, October, November and December

❌ Worst months: January, June, August and September

#BTC Market: August and September are also worse months. In August, there were 4 times higher and 8 times closed down since 2013, with an average return of 1.75% and a median return of -8.04% #BTC August.

The core is to pay attention to the Sino-US trade tariffs on August 12!

Rocky4.8. klo 12.14

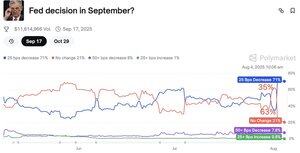

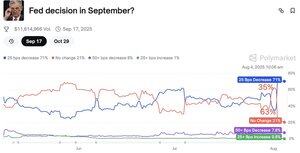

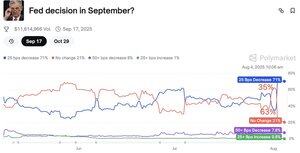

The probability of interest rate cuts is changing really fast!

Before Friday's non-farm payrolls, in September, the probability of no rate cut was 63%, and the probability of a 25 basis point rate cut was 35%

After Friday's non-farm payrolls, especially after the revision of the May-June data, the probability of no rate cut in September is 21%, and the probability of a 25 basis point rate cut is 71%

But regardless of the probability of interest rate cuts, everyone's panic about economic recession and whether there are other macro data frauds are even more worrying! 🧐

49,95K

This morning, the company just finished a relatively long investment meeting, in August, the overall strategy: defense, defense, defense, control of positions, prevention of drawdown! 🧐

Over the past 25 years (2005 to the end of 2024), the S&P 500's best and worst performing months (Figure 1):

✅ Best months: March, April, May, July, October, November and December

❌ Worst months: January, June, August and September

#BTC Market: August and September are also worse months. In August, there were 4 times higher and 8 times closed down since 2013, with an average return of 1.75% and a median return of -8.04% #BTC August.

The core is to pay attention to the Sino-US trade tariffs on August 12!

Rocky4.8. klo 12.14

The probability of interest rate cuts is changing really fast!

Before Friday's non-farm payrolls, in September, the probability of no rate cut was 63%, and the probability of a 25 basis point rate cut was 35%

After Friday's non-farm payrolls, especially after the revision of the May-June data, the probability of no rate cut in September is 21%, and the probability of a 25 basis point rate cut is 71%

But regardless of the probability of interest rate cuts, everyone's panic about economic recession and whether there are other macro data frauds are even more worrying! 🧐

4,83K

The probability of interest rate cuts is changing really fast!

Before Friday's non-farm payrolls, in September, the probability of no rate cut was 63%, and the probability of a 25 basis point rate cut was 35%

After Friday's non-farm payrolls, especially after the revision of the May-June data, the probability of no rate cut in September is 21%, and the probability of a 25 basis point rate cut is 71%

But regardless of the probability of interest rate cuts, everyone's panic about economic recession and whether there are other macro data frauds are even more worrying! 🧐

Rocky4.8. klo 09.49

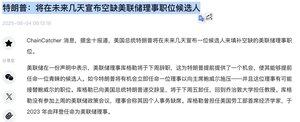

The Fed's interest rate changes are mainly voting, with 2 chairmen (chief and deputy), 5 governors, and the president of the Federal Bank of New York + 4 of the 11 local federal bank presidents, a total of 12 people.

And every personnel change in the Fed will affect the market's expectations for future interest rates. The upcoming replacement of Fed governors, and the new appointments are likely to be directly appointed by Trump, which may have an important impact on the Fed's future monetary policy direction. I guess the newly appointed person is likely to be Powell's potential successor, as Powell's term is coming to an end.

It is expected that this new director will definitely be a "big pigeon" and will cooperate with Trump to accelerate interest rate cuts. This can also be regarded as injecting certain positive expectations into the market (but expectations are expectations, and landing is landing, these are two different things)

Under this expectation, there is a high probability that U.S. Treasury yields may fall first, risk assets (especially Nasdaq constituent stocks) will rise in advance, and funds will return to the stock market 🧐

Therefore, this is Trump's bull market, although the macroeconomy is a little unsustainable, but it has been artificially giving a boost. Maintaining next year's midterm elections is also a top priority! 🧐

51,28K

The Fed's interest rate changes are mainly voting, with 2 chairmen (chief and deputy), 5 governors, and the president of the Federal Bank of New York + 4 of the 11 local federal bank presidents, a total of 12 people.

And every personnel change in the Fed will affect the market's expectations for future interest rates. The upcoming replacement of Fed governors, and the new appointments are likely to be directly appointed by Trump, which may have an important impact on the Fed's future monetary policy direction. I guess the newly appointed person is likely to be Powell's potential successor, as Powell's term is coming to an end.

It is expected that this new director will definitely be a "big pigeon" and will cooperate with Trump to accelerate interest rate cuts. This can also be regarded as injecting certain positive expectations into the market (but expectations are expectations, and landing is landing, these are two different things)

Under this expectation, there is a high probability that U.S. Treasury yields may fall first, risk assets (especially Nasdaq constituent stocks) will rise in advance, and funds will return to the stock market 🧐

Therefore, this is Trump's bull market, although the macroeconomy is a little unsustainable, but it has been artificially giving a boost. Maintaining next year's midterm elections is also a top priority! 🧐

Rocky3.8. klo 18.21

The essence of the economic cycle is the dollar tidal cycle.

The average cycle lasts 4.5 to 5 years.

2.5 years of rising phase (Kitchin expansion)

2 years of falling phase (Kitchin contraction)

From Q1 2023 to now, we are immersed in the rising phase.

The falling phase may be approaching.

Typical characteristics near the peak:

1️⃣ High-frequency wide fluctuations

2️⃣ Chaotic macro data

3️⃣ Obvious increase in trading volume

4️⃣ Public sentiment at a new high

Strategy: Liquidity first, yield second, low tolerance for errors, prevent drawdowns, and preserve the gains!

48,05K

The essence of the economic cycle is the dollar tidal cycle.

The average cycle lasts 4.5 to 5 years.

2.5 years of rising phase (Kitchin expansion)

2 years of falling phase (Kitchin contraction)

From Q1 2023 to now, we are immersed in the rising phase.

The falling phase may be approaching.

Typical characteristics near the peak:

1️⃣ High-frequency wide fluctuations

2️⃣ Chaotic macro data

3️⃣ Obvious increase in trading volume

4️⃣ Public sentiment at a new high

Strategy: Liquidity first, yield second, low tolerance for errors, prevent drawdowns, and preserve the gains!

Rocky2.8. klo 13.45

Life is only 30,000 days

I only have 11,768 days left

A hundred years later

We struggle all our lives

I can't take away a single grass or tree

We persist all our lives

I can't take away a vain love

Life is so short

We don't have time to argue

There is no time to be sad

There is no time to worry about it

We only have time to love and enjoy

Weekends are a good time to recharge

Put down the market and bring your family

Go, hit the road, feel, experience

84,8K

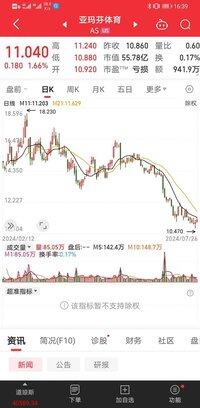

As a shareholder of Arc'teryx (Amalfen Company), the most important thing is to visit the store more and experience their services and new products!

A good company, from the inside out, you can experience a kind of cultural inheritance and value belief!

In the end, they were able to hold their shares, and Amalfen went from more than 10 yuan to $36.5 now!

But now that they are starting to keep going, you may need to pay attention ⚠️

Life is investment, investment is life! 🧐

Rocky29.7.2024

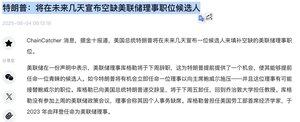

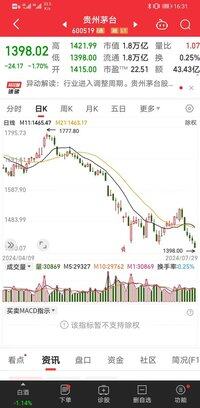

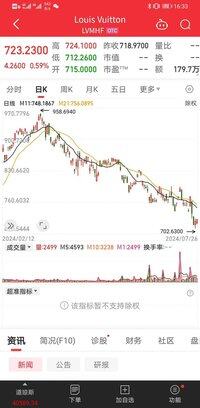

The three treasures of middle-aged men, the girl, Moutai, and Archaeopteryx!

The three treasures of the middle-aged girl, LV, lulu, and Archaeopteryx!

All of them are 📉 numb, generally depending on whether the consumption is good or not, whether the residents have money in their hands, just look at these 4 stocks! 😅

22,2K

In Yunnan, can you buy a piece of land and build such a house by yourself? 🥸

Rocky3.8. klo 09.04

Today, I watched a demo video of #Claude AI by @AnthropicAI, and I was amazed. As a professional investor, US stock companies + #Web3 projects have to be watched hundreds every year, especially the earnings season is simply a battlefield!

For example, this kind of practical case in the video is still relatively common: as soon as the office sat down, at 2 p.m., the PM (investment director) rushed in:

"Sarah, the company we are focusing on, Velocity Athletic, has just released its earnings report, and its revenue has plummeted by 12%, but its stock price has actually risen by 17% to $71. Can you figure it out to me, is this wave of rise a positive strategy stimulus or a false rebound? Before today's close, you have to make a decision, whether to sell and take profit, or continue to hold. ”

In fact, this logic is like the non-farm payroll data + 56 employment data revised downward for two months this Friday (260,000 jobs were cut in May + June, which is equivalent to the sudden unemployment of the entire population of Miami). In this case, you have to make a judgment and decision as soon as possible, and immediately feed back to the US stocks that have not yet opened, and crypto assets to hedge, which requires immediate response and data support, which will effectively avoid this wave of killing over the weekend.

Let's take a look at the path of a normal financial analyst (expected 4-5 hours):

1️⃣Go to S&P Global to pull financial reports and meeting minutes

2️⃣ Open FactSet / Morningstar to see historical data and valuations

3️⃣ Cut Edgar to check the SEC announcement

4️⃣ Mining the history of the intranet memo and research report

5️⃣ Then make tables, draw pictures, and write memos

This operation takes at least 4~5 hours, and it takes several systems to be manually cut, and the information is inconsistent and prone to errors.

💡 At this time, #Claude appeared, it really felt like I had an extra super analyst assistant:

Directly give #Claude instructions: "Help me comprehensively analyze Velocity Athletic's financial report performance, whether the stock price change is reasonable, and issue an investment memo." ”

🔍 1️⃣Multi-platform synchronous pulling data + semantic understanding

Claude doesn't simply crawl data, it understands the context I need:

· Extract key information from S&P Global to extract key information, such as the CFO's mention in a Q&A that "margins fell by 400 basis points due to tariffs";

· Pull out historical data and opponent comparisons from Morningstar;

I found the Velocity analysis framework that I had written about in the past from our company's internal documentation (box);

· Scrape 8 quarters of financial data from Delupa to create trend charts directly;

· All content is marked with the source, and you can click in at any time for secondary confirmation, which greatly improves compliance and trust.

📊 2️⃣ Generate visual charts + core models

Q#Claude: "Help me make an annotated price chart, peer valuation comparison table, and DCF model." ”

It implements step by step:

· Stock price charts marking events (showing CFO reductions, emergency board meetings, financial report release times, etc.);

· A clear comps table: Velocity's EV/EBITDA is 21 times, the industry average is only 16 times, and the valuation is high;

· A complete DCF model: clear assumptions, freely switching scenarios, even WACC calculations are standard.

· The reasonable stock price calculated by the model: $54, far lower than the current $71, indicating that the current rise is optimistic and the bubble component is large.

📝 3️⃣ Automatically generate institutional-grade investment memos

Finally, I said, "Use our fund's internal template to make a memo for PM's reference." ”

Claude directly calls the memo template on the intranet and automatically populates with the following:

Recommended conclusion: It is recommended to sell at a high point to make a profit, and wait for the price to pull back before opening a position;

Logical support: quantitative support from financial fundamentals, market reactions, industry comparisons, valuation deviations and other dimensions;

Potential risks: For example, if tariffs are eased in the future and CFOs reduce their holdings for other reasons, it may lead to further fluctuations in stock prices;

Clear citations: All data with links to the original source for PM or legal review.

Watching the entire video demo, I think #Claude is completely the "#AI nuclear weapon" of financial report analysis, and there are still relatively few API data interfaces supported by encrypted data, which can become the killer feature of #Web3 investment research if it is improved in the later stage.

If we used to do project analysis to "fly with ten fingers + nine screens to check data + use five heads together", now with #Claude, it is like having a gold medal analyst who does not go offline 24 hours a day, and does not shout overtime, and efficiency takes off 📈!

38,24K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin